A sharp drop in shipments of the Amazon Alexa drove a “correction” in the U.S. smart speaker market in 2021, with sales resuming a more normalized growth rate after record shipments in 2020, according to Omdia’s Smart Speaker Quarter Report – 4Q21.

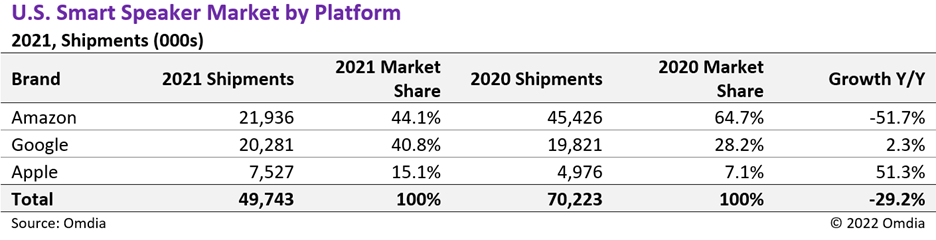

Further analysis from the report show the U.S. smart speaker market ended 2021 as down nearly 30% in terms of total shipments relative to 2020. This was predominantly due to a nearly 51% drop in Amazon Alexa smart speaker shipments in 2021 compared to the prior year.

“This sharp slowdown shouldn’t be a surprise given the altered consumer buying habits seen during the pandemic”, according to Blake Kozak, Senior Principal Analyst for smart home at Omdia. “2020 should be viewed as an extreme outlier in terms of smart speaker penetration. In fact, market size and growth from 2019 is on par with 2021, suggesting a market correction has taken place over the past year.”

Not all players in the market saw their shipments shrink last year. Although Amazon experienced a sharp slowdown in 2021 relative to 2020, Google experienced a year-on-year (YoY) increase of about 2% in the same period, while Apple’s shipments increased by about 51% YoY.

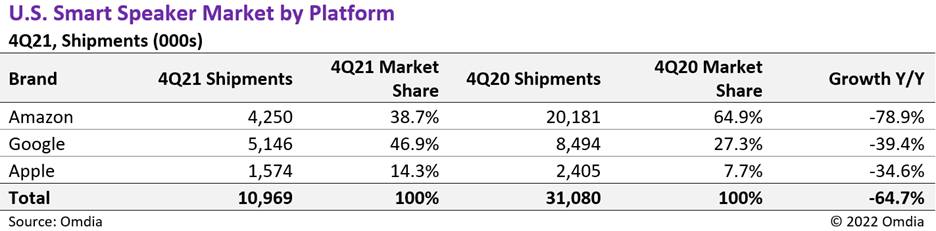

In terms of 4Q21, Amazon experienced a sharp decline of about 78% YoY, bringing its share of the smart speaker market in the US to 38% in the last quarter of the year, down from 65% in the year-ago period. Conversely, although Google and Apple fourth quarter shipments were down about 35% YoY in 4Q21, the market shares of Google and Apple increased. Google’s share of smart speaker shipments in 4Q21 was 47%, while Apple’s share doubled from the previous year to about 14%.

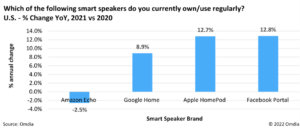

Amazon and Google continue to ship similar numbers of own-branded smart speakers. Amazon-branded smart speaker shipments in the US during the full year were 18.8 million, compared to 14.5 million for Google-branded smart speakers. The gradual increase in Google smart speakers aligns with a recent consumer survey from Omdia, which found a YoY change of regular usage favored Apple and Facebook.

In terms of smart speaker design in the U.S. market, there were about 14 million smart speakers with a display shipped in 2021, down from about 17.5 million in 2020. Although shipments of smart speakers with a display slowed YoY in 2021, the U.S. market for smart speakers with a display is nearly twice the size relative to 2019, when only 7 million speakers with a display were shipped.

Despite the slowdown last year, Omdia expects smart speakers with a display to continue to take more share of the entire smart speaker market, as the “voice as the new user interface” trend reaches its twilight. Instead, Omdia see voice being complemented by screens throughout the home.

Despite the rapid slowdown in the US smart speaker market last year compared to 2020, Kozak said that the future remains bright for this market. “We remain bullish on the use cases and adoption rates that come with smart speakers, and these devices will remain the cornerstone of smart homes in the years to come,” Kozak said.