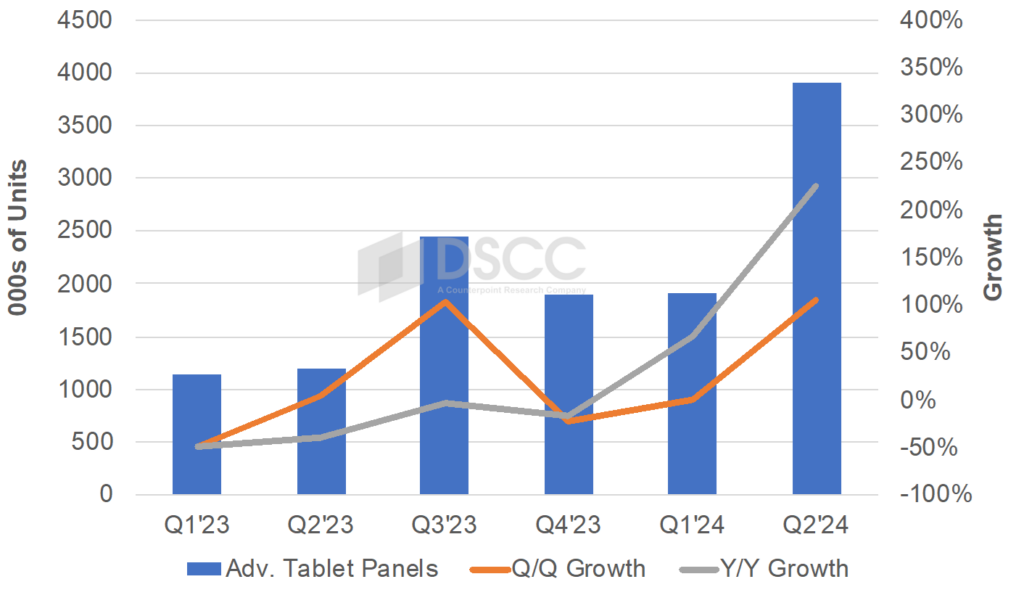

OLED tablet panel shipments jumped by 131% year-over-year (YoY) in the first quarter of 2024, reaching a record high. The trend is expected to continue in the second quarter, with projections indicating a 127% quarter-over-quarter (QoQ) and 333% Y/Y increase, setting another record as Apple ramps up production and shipments of its OLED iPad Pro.

According to DSCC, Apple emerged as the leader in OLED tablet panel procurement during Q1’24, securing a 47% market share. The tech giant is expected to expand its dominance to 72% in Q2’24. The 13-inch M4 iPad Pro is anticipated to lead procurement volumes in both quarters.

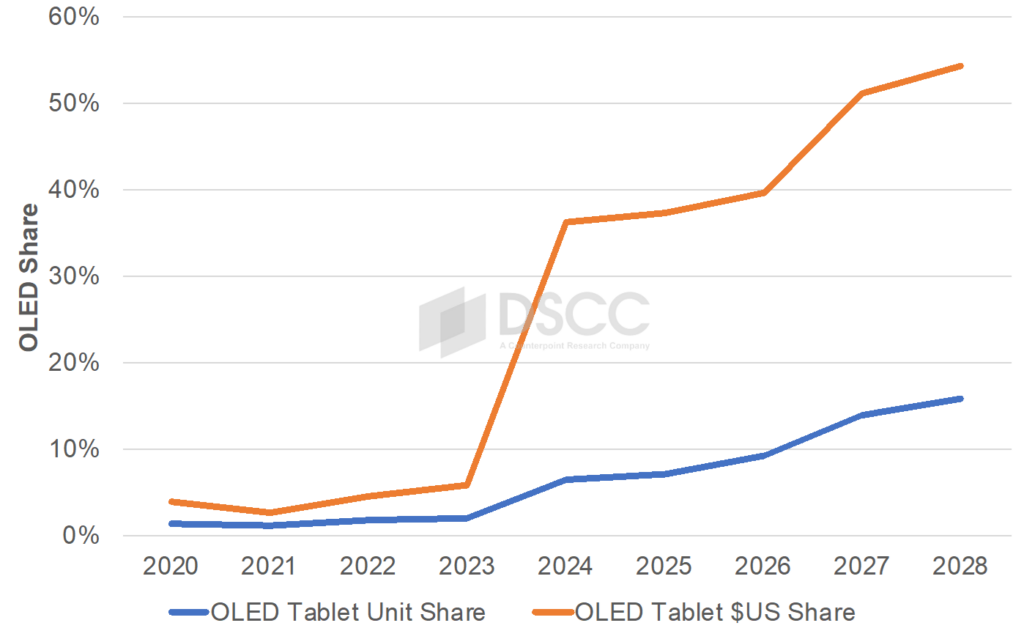

OLED tablets are poised to gain market share through 2028 and beyond as the price gap with LCDs continues to narrow. DSCC projects OLED tablets will achieve a 16% unit share and a 55% revenue share by 2028, driven by more brands offering OLED tablets.

In Q1’24, OLED tablet panel shipments rose to a new high of 1.72 million units. Huawei followed Apple with a 25% share, and Samsung held 17%. Microsoft also saw QoQ growth as it prepared to launch its Surface Pro Copilot+ 11th edition tablet. The quarter saw 15 OLED tablet models procuring panels, an increase from 13 in Q4’23. The 13-inch M4 iPad Pro led procurement with a 35% share, followed by the 11.1-inch M4 iPad Pro at 12.5%, and the Mate Pad Pro 11 at 11%.

The second quarter of 2024 is projected to be the peak for panel procurement this year, with shipments expected to exceed 3.9 million units. Apple’s volumes are anticipated to rise by 246% QoQ, with Huawei, Microsoft, and Samsung also experiencing growth. Apple’s market share expectation of 72% should be followed by Huawei at 13%. The 13-inch M4 iPad Pro is predicted to maintain its lead with a 38% share, trailed by the 11.1-inch iPad Pro with a 34% share, and the Huawei Mate Pad Pro 13.2-inch with a 5% share.

DSCC’s forecasting OLED penetration to reach 16% of the global tablet market on a unit basis and 55% on a revenue basis by 2028. As prices decline and consumers increasingly recognize the visual performance benefits of OLEDs, DSCC expects OLED tablet display revenues to grow at a compound annual growth rate (CAGR) of 72%, compared to 10% for the overall market. OLED tablet unit volumes are projected to grow at a 51% CAGR, in stark contrast to the 2% CAGR for the broader market.