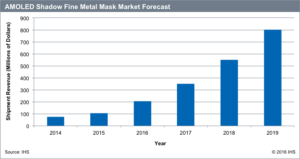

As display panel makers ramp up active-matrix organic light-emitting-diode (AMOLED) panel production, supplying fine-metal shadow masking is a critical point in the manufacture of small and medium-sized panels according to Jerry Kang, principal analyst, IHS Markit. As many display panel makers are planning to add more AMOLED production fabs in the next few years, the fine-metal shadow mask market is expected to grow 400% from $205 million in 2016 to $802 million in 2019.

Dai Nippon Printing (DNP) and Toppan Mask have been the main suppliers for AMOLED shadow masks since 2010, but their current capacity was expected to be too tight to supply new production fabs. However, DNP recently announced it would invest $54.6 million to triple its shadow-mask production capacity through 2020.

DNP is currently dominating the high-resolution shadow-mask market, with its proprietary etching technology, but they have contracted with Samsung Display to supply high-resolution masks exclusively. Many panel makers and mask suppliers are now trying to overcome limited supply and develop their own mask manufacturing technology to compete with DNP’s.

According to the IHS Markit OLED Display Market Tracker, while Samsung Display contributes the majority of shadow-mask revenue globally, through the end of this year, many other panel suppliers are expected to increase their share of the market by more than one-third (35%) in 2019. These competitors will focus on sixth-generation (Gen6) manufacturing in 2018, which would increase Gen6 shadow mask revenue tremendously.