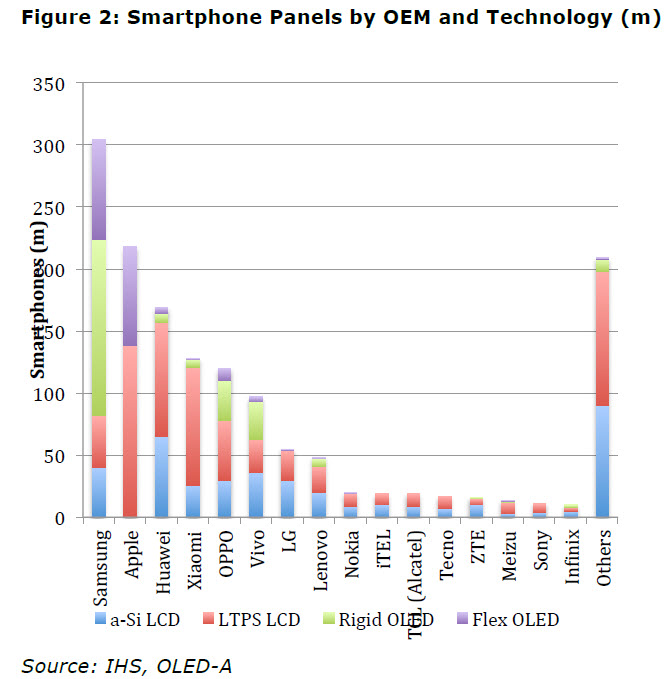

According to the OLED Association, quoting data from IHS, smartphone shipments are expected to reach 1.475 billion in 2018, while smartphone display shipments are forecast to reach 1.665 billion, as panel makers generally sell 10-12% more displays than OEMs sell phones to make up for breakages, etc. The chart below shows the mix of smartphone displays by technology and OEM.

Samsung and Apple will ship 87% of all flexible display-based smartphones and no other OEM has more than a 5% share. Oppo and Vivo have the highest share of shipments of smartphones that use OLEDs in China, at 35% each.

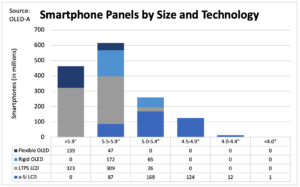

Samsung has the highest use of OLEDs at 73%, with Apple in second at 37%. In terms of panel size, the panels are divided into six categories, with 5.5-5.9” having the most displays at 614 million, followed by over 5.9” at 462 million and 5.0-5.4”at 260 million.

In terms of technology, LTPS LCDs occupy the number-one position at 45%, followed by a-Si LCD at 27%, rigid OLEDs at 16% and flexible OLEDs at 13%.

OLED panel-makers are looking to take share from LTPS LCD in the 5.0”-and-larger category to take advantage of comparable costs for rigid OLEDs, the unique form factor of flexible displays and the upcoming introduction of foldable displays. It is also quite unlikely that OLEDs will target the low end of the market currently held by a-Si LCDs, which are built in older fabs and carry very low prices but cannot support high pixel densities.

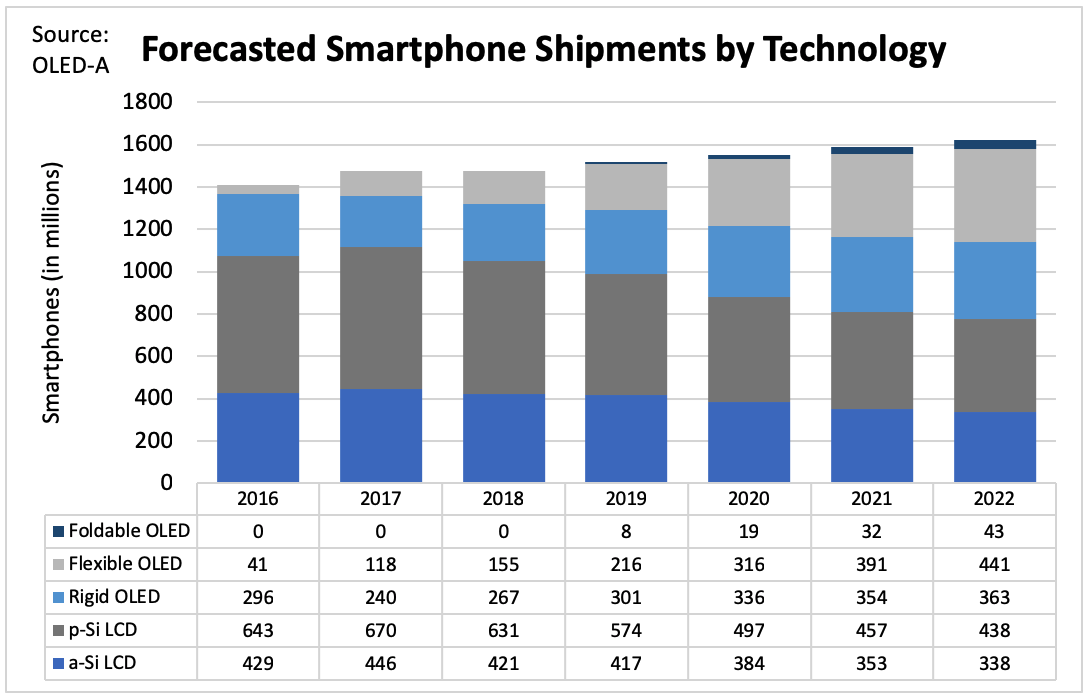

Should the industry experience an oversupply, which is highly likely if Chinese OLED panel-makers carry out their plans and achieve reasonable yields, LTPS LCDs made by JDI, LG and Sharp would be targeted, rather than a-Si LCDs. The chart below shows a forecast of panel shipments by technology, with OLEDs replacing LTPS LCDs. Total OLED smartphones could reach 800 million in 2022, up from 420 million in 2018.