A few weeks back I wrote an article in the Display Daily, titled, “Can the magic of OLED display bring strong growth to smart phones?”. I said in the article that OLED display is hitting its ‘shining moment’ this year with introduction of Samsung Galaxy 8 and 8+ smartphones.

Flexible AMOLED display technology has received rave reviews for its performance and the bezel-free ‘infinity display’ in Galaxy 8 products. There is great expectation also over the upcoming Apple iPhone 8 products with OLED displays. Even with rave reviews and the expected popularity of the OLED-based iPhone 8, these products will mostly serve high-end markets with device-price ranging from $750 to $1000. The shining moments of OLED in 2017 will bring excitement and high demand, but tight supply and higher cost will prevent makers from offering low end products with OLEDs for the emerging market to drive strong unit shipments growth for the smartphone market this year. OLED’s supply pains could be a real gain for LTPS LCD displays in 2017.

Samsung’s Galaxy S8 Family

Samsung’s Galaxy S8 Family

Higher OLED Adoption Rates Creating Fear and Uncertainties

LCD was the dominant display technology for the smartphone market in 2016 where a-Si TFT LCD served mostly the low-end and mid range segment and LTPS-LCD served generally the high-end segments. But now, not just Samsung and Apple, but many top Chinese brands are either planning to adopt OLED display or have already started using OLED display in their smartphone products. The display industry expects Apple to have OLED iPhone models this year and expects all iPhone models to shift to OLED in future, although LTPS LCD has been the display of choice for all iPhone models in recent years.

The intense interest in OLED display, especially flexible displays, the rave reviews and expected iPhone shift to OLED and higher adoption rates are creating real fear and uncertainties for LTPS LCD’s future in the smart phone market.

LTPS LCD Capacity is Coming When Industry Interest is Shifting

Apple’s iPhone success, and the strong performance of LTPS LCD in areas such as higher resolutions, lower power consumption and other features led to strong growth and higher market shares for the display panel in recent years. That led many display companies to invest aggressively in Gen 6 LTPS LCD fab capacities in the last few years. The expected adoption of OLED technology by Apple away from LTPS LCD changed all that. By the end of 2016, some display suppliers had delayed their expansion plans and started to focus more on OLED displays. The rise of OLED has created challenges for LTPS LCD in the high-end smartphone market. Still, substantial growth of LTPS LCD capacities is expected in 2017 just when industry interest is shifting to AMOLED.

More LTPS Capacity With Aggressive Pricing And Better Performance

High production capacities during this transition time will lead to lower prices as display suppliers battle for more market share. Price reduction will help LTPS adoption both in high-end and mid-range markets. The prices of low-end and mid-range HD smartphone panels increased in 2016, reducing the gap between a-Si and LTPS, enabling more of a shift towards LTPS. JDI, LG, and Sharp were the dominant suppliers in the high-end LTPS market whereas AUO BOE, CPT, Innolux, Tianma, Truly and others focused on a-Si LCD for smartphones. But JDI, AUO, Tianma and others are also developing new LTPS capacity in 2017. New sixth gen fabs will increase efficiency and reduce costs. Suppliers such as JDI and AUO are focusing more on thinner form factor, slim bezel and in-cell touch technology, bringing higher performance and better features to LTPS-based products.

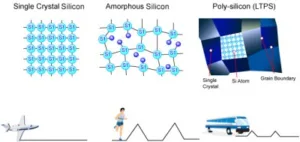

![]() Polysilicon is a form of silicon that sits between the amorphous silicon of low cost LCDs and the single crystal silicon of semiconductor chips. Image:AUO

Polysilicon is a form of silicon that sits between the amorphous silicon of low cost LCDs and the single crystal silicon of semiconductor chips. Image:AUO

Window of Opportunity for LTPS LCD

There has been already some increase in LTPS LCD demand this year from Chinese brands due to the supply shortage of AMOLED panels. Samsung Display is increasing production of AMOLED, but supply will not be sufficient to serve increased demand from many other brands after providing Samsung and Apple. Many display suppliers, especially from China, are planning to bring higher AMOLED capacity. New AMOLED capacity from other suppliers will not be ready this year. Chinese smartphone brands will have to rely on LTPS LCD this year. Lower prices and better performance may actually enable them to offer higher performance smartphones at a more competitive price, which is needed for emerging market growth.

Hurdles For Flexible Display

The biggest differentiator between LTPS LCD and AMOLED display is flexibility. The shift from glass-based to plastic displays enables thinner, lighter, and flexible form factors with more design differentiation options. As smartphone market growth slows down, especially in mature markets, top brands need design differentiation to drive replacement demand. Samsung Display and LG Display started making their first OLED flexible displays for smartphones from 2013.

After the success of Galaxy Edge products with flexible displays, Samsung is shifting even more towards flexible OLED with the introduction of Galaxy 8 and Galaxy 8+ products, as the flexibility enables innovative design. In future, foldable smartphones are also expected. In spite of its great advantages, there are still many challenges for flexible display, especially manufacturing difficulties. Up to now, Samsung is the only maker with successful high volume manufacturing capabilities for flexible smartphone displays. Even though many other suppliers are planning to come in, it will take time and the process is challenging.

OLED Shines While LCD struggles as a Flexible Display

In the current market while the flexibility of OLED shines, LCD struggles. Up to now there has been no volume production of plastic LTPS LCDs. Some suppliers are trying to produce plastic LCDs, but it will be challenging due to LCD’s inherent structure.

JDI’s Full Active Flex Display. Image:JDI

JDI’s Full Active Flex Display. Image:JDI

In January 2017, JDI announced the development of an LTPS-based “Full Active Flex” 5.5″ FullHD smartphone display which uses a plastic substrate for both sides of the liquid crystal cell. The company said with the Full Active Flex display, it is possible to form curved shapes by using the flexibility, which can expand the degree of freedom in smartphone design. JDI is planning to start mass production of this display in 2018. The company is also planning to showcase the product at the upcoming SID Display Week 2017.

OLED Supply Issues Opening Up Opportunity For LTPS LCD

Can LCD fight back by reinventing itself? Can plastic flexible LCD compete with plastic flexible OLED? Will OLED supply challenges provide better and longer opportunities for LTPS LCD in future? These questions need further analysis and discussion. At least for 2017, OLED’s supply pains will be a real gain for LTPS LCD display in the smartphone market.

Sweta Dash is the founding president of Dash-Insights, a market research and consulting company specializing in the display industry. For more information, contact [email protected] or visit www.dash-insight.com