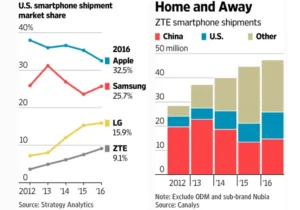

Strategy Analytics updated its smartphone US market tracking, reporting strong growth for smartphones from the China-based ZTE brand. The company is now in fourth place in the USA market, edging out domestic Chinese competitor, Huawei. Meanwhile, Apple and Samsung continue to dominate, particularly the profitable side of the business, but both top brands have shed market share of late, as competitors, LG and ZTE, continue to grow.

Relatively flat sales, a basic plateau in innovation and a huge stumble by Samsung, with its Galaxy Note 7 battery debacle resulting in a world wide recall of its flagship technology have all affected the market. It’s difficult to estimate the total effect of the three million unit recall that cost the Korean company five billion dollars, but a recent survey, reported in the WSJ, indicated that more than three in ten existing Samsung smartphone customers plan to switch to another brand when the contract that included Samsung hardware is up. “Some 37% of Samsung users in the U.S. said they were less likely to buy another Samsung smartphone after last year’s recall of the Galaxy Note 7.” The data cited comes from a survey in March 2017 by Fluent LLC, a marketing technology company, the paper said.

This loss of brand affection is unusual as the ten year old smartphone device market in the US is remarkably loyal. Of the users who bought a new smartphone in 2016, for example, 11% made the switch from Android to iPhone while 15% moved from the Apple iOS to Android, according to Consumer Intelligence Research Partners LLC. Of course not all of those 37% of Samsung users will move to iOS and that bodes well for both LG and ZTE who offer Android-based alternatives to the Samsung handsets.

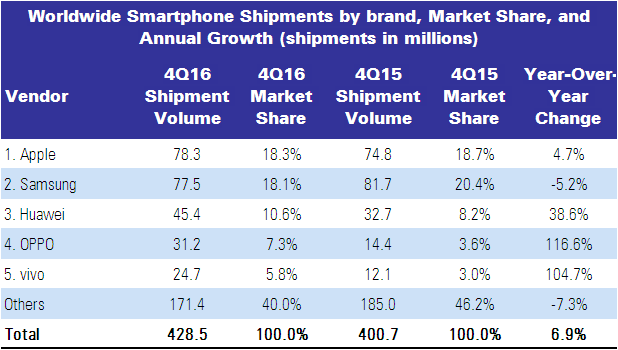

On the global front, back in February, the Framingham, MA-based market research firm, IDC, said it expects an uptick in smartphone growth in 2017. The growth in sales of devices reached a low point last year with worldwide growth at just 2.5%. International Data Corp. now forecasts worldwide growth at 4.4% for 2017, moving to 4.8% in 2018. IDC reckons we will have 3.8% CAGR over a five year period from 2016 to 2021. Device totals will reach 1.77 billion by the end of that period up from 1.53 billion last year, according to the forecast.

China based ZTE ranked 4th in US smartphone market as Apple and Samsung continue to dominate both here and worldwide Source Strategy Analytics 2017

China based ZTE ranked 4th in US smartphone market as Apple and Samsung continue to dominate both here and worldwide Source Strategy Analytics 2017

Probably less of a factor for ZTE (and LG) market growth is Apple as it plays at the more profitable higher end of the market. But Apple too has shed US smartphone market share of late, with folks holding on to existing technology longer as fewer (must have) innovations to drive new phone sales were seen in the iPhone 7 which launched last year. (A Jan 11th WSJ article said that Citigroup estimated the handset replacement rate had lengthened to 31.2 months by third quarter last year from below 24 months in 2011.) Perhaps this is in part because the iPhone 7 was very close in performance and features to the 6 series, and the wireless industry is reporting fewer subsidized phones going out to users. Many may have simply decided to wait for the highly anticipated iPhone 8 (tenth generation) device. But even here expectation is that the price of the phone will top out at over $1K creating room for much lower cost (but high value) products like the LG and ZTE products.

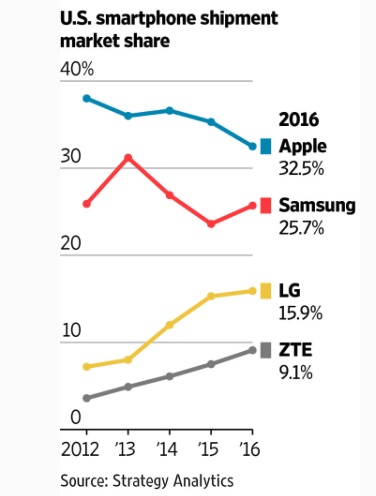

Canalys shows market share both in the US and globally for ZTE, Source Canalys as reported in the WSJ April 15, 2017

Canalys shows market share both in the US and globally for ZTE, Source Canalys as reported in the WSJ April 15, 2017

Another reason for ZTE’s growth in the US is that the company has strong partnerships in place with both AT&T and T-Mobile, key US carriers.

And while the company has enjoyed a significant growth in the USA, that growth has eluded them in other geographies. This includes its own home turf, China (see Canalys chart). But with the recent stumble of Samsung, (now on the mend with the launch of the new Galaxy S8) and Apple still months away from possibly the most expensive iPhone (Gen10) launch ever, ZTE will likely continue to find traction as a less expensive (but high value) Android substitute in the US market going forward. Stephen Sechrist

ZTE showing up in the “Other” category in world wide device sales but recently reached 4th in device shipments in the US, Source: IDC 2017

ZTE showing up in the “Other” category in world wide device sales but recently reached 4th in device shipments in the US, Source: IDC 2017

Some related stories that may require subscription (but well worth it… 🙂

T-Mobile Has Exclusive for ZTE Quartz

ZTE Launches E2E VR Live Solution

ZTE Installs Fingerprint Reader on $100 Handset

LG Starts Shipping its G6 Smartphone

The Foldable Smartphone – Coming Soon

Smartphone Shipment Volumes to Rebound This Year

ZTE Cancels Smartphone Crowd-Funding Campaign

Strategy Analytics: Apple Captures Record 91 Percent Share of Global Smartphone Profits in Q3 2016