The Notebook PC market is starting to see a new normal as pandemic demand and priorities shift from digitization while inflation limits household budgets and economic challenges do the same for businesses. As a result, global volumes were down -15% year-on-year in the second quarter, according to a new report by Strategy Analytics .

Despite these new challenges, notebook PC sales and ASPs are much better for all vendors compared to pre-COVID times and this trend will continue as customers are purchasing more premium products.

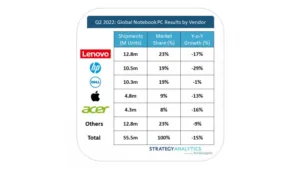

Q2 2022: Global Notebook PC Results by Vendor, Source: Strategy Analytics, Inc.

Chirag Upadhyay, Industry Analyst said:

Consumer spending is now taking other priorities such as holiday, new clothes, and home improvement, while some are also taking financial precautions due to inflation and recession fears. The commercial business still looks solid compared to pre-pandemic level as SMB business continues to improve and provide the best hybrid working solutions, while some large enterprises are still leaning towards desktop PCs, including popular workstations, as people return to offices. We will see consumer spending improve a little bit in education in Q3 as shoppers want to get their hands on the latest laptops and huge Back-to-School discounts.

Eric Smith, Director – Connected Computing added:

The Chromebook shipments decline continued from pandemic highs, falling by -53% year-over-year, as educational demand is lower in 2022, though shipments were 11% higher sequentially during the traditional quarter for purchases by educational institutions. HP felt the sting of these poor annual comparisons, with global HP shipments falling -29%. Currently, education spending is on hold over other priorities in many countries, and we are confident that the Chromebook market will grow as soon as governments re-start spending on digitization.

- Lenovo barely under-performed the total market and remains the #1 Notebook PC vendor, as shipments (sell-in) fell to 12.8 million units in Q2 2022 (calendar year); this represented -17% decline from the 15.5 million shipped the year prior and down -11% compared to previous quarter

- HP took another large hit during the second quarter of 2022 as notebook PC shipments were down -29% year-over-year to 10.5 million units; market share is below 20% for the second straight quarter, a rarity in their results since Q1 2016

- Dell nearly matched its shipment level from a year ago at 10.3 million units, falling only -1%, and nearly taking the #2 spot from HP; market share increased 3 percentage points to 19% as a result of outperforming the market

- Apple MacOS barely outperformed the total market as it faced supply constraints during the quarter; shipments reached 4.8 million MacBooks during the second quarter, a -13% loss from Q2 2021 and -21% from Q1 2022

- Acer maintained the 5th spot globally in Q2 2022 with 4.4 million notebook PCs shipped, a -16% decline year-over-year; essentially breaking even with the total market, Acer held steady at 8% market share