The economic downturn and popularity of tablet devices are causing notebook and panel makers to increasingly adopt higher display resolutions to keep consumer attention, says IHS. Worldwide notebook panel demand was down 12% YoY in 2015, to 176 million units.

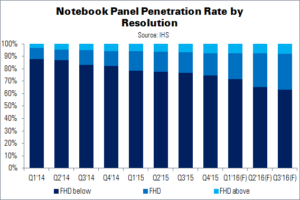

Notebook inventory continues to climb, and brands and panel makers hope that upgrading resolution will boost demand. IHS expects 1920 x 1080 panels to represent 20% of the notebook market in Q1 this year, growing to 30% by Q3.

Linda Lin, senior analyst at IHS, says that raising resolution is one of the ways for notebook brands to increase sales and reduce backlogged inventory. “After panel prices crashed to the break-even point in the fourth quarter of 2015, lowering prices to increase panel demand is no longer an option, so upgrading features is the only option left”, she added.

Resolution upgrades are easy for consumers to understand. Additionally, with lower panel prices, upgrades can be made more easily and affordably. The panel cost gap between HD and Full HD displays was down to $10 in 2015. The next trend to watch for is increasing resolutions above Full HD.

Both Samsung Display and LG Display are leaders in promoting Full HD IPS panels.