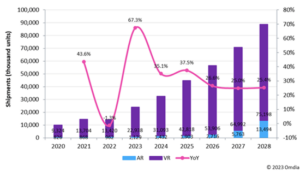

Near-eye display shipments for XR applications, including AR, VR and MR will be 24 million in 2023 with 67% YoY growth according to new research from Omdia.

Because of global inflation, lockdowns in some Chinese cities, and weak demand, all consumer electronic devices performed poorly in 2022, and XR products were no exception. XR applications consist of AR (Augmented Reality), VR (Virtual Reality) and MR (Mix Reality). The XR device is represented in both amount device and smart glasses forms.

Commenting on the new data, Senior Research Analyst, Kimi Lin said:

Shipments of near-eye terminal devices declined in 2022 to 14,382 thousand units, a 1.3% decline year-over-year (YoY) and under expectations. While Omdia has significantly revised long-term forecasts, we are optimistic for 2023 due to key products such as the Sony PSVR 2, Apple’s mixed reality (MR) headset, and Meta Quest 3 as well new product launches expected from HTC, that will all bring a new round of growth.

In terms of the revenues, the near eye display for XR application revenues reached $620 million in 2022 and will increase to $1.15 billion in 2023 – the first year near eye display for XR application will break through the $1 billion revenues mark.

Displays for VR applications still form the bulk of shipments. Considering the complexity of AR displays and optical engines, Omdia believes the maturity of AR display technology still needs three to five years for development.

TFT LCD and AMOLED are still mainstream in VR applications. TFT LCD and AMOLED are also the most mature display technologies for the near eye displays. OLEDoS (also known as Micro OLED) has better visual performance than TFT LCD and AMOLED, but its market share remains limited because of high costs. So far, only a few XR devices have adopted OLEDoS, but shipments are very small due to its high-end positioning. Apple will allegedly adopt OLEDoS on its commercial-oriented MR device that will be released in 2023. Apple’s adoption should increase the OLEDoS display shipment substantially in 2023 and 2024. However, Omdia believes the share growth of OLEDoS will slow down after 2024 unless OLEDoS cost and prices can be reduced significantly to a level most brands can afford, especially in the high resolution OLEDoS.

As for AR applications such as the smart glasses, displays for AR devices are silicon-based. OLEDoS is the mainstream now, but the brightness of OLEDoS does not meet the requirements for outdoor use of AR devices. This gives great chance to Micro LED on Silicon or known as LEDoS. Omdia projects that the LEDoS technology matures in three to five years, LEDoS will finally become mainstream in the AR application market.