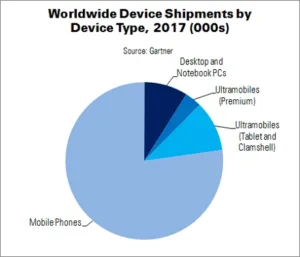

Worldwide device (PCs, tablets, ultramobiles (ultrabooks of various form factors) and mobile phones) shipments will rise 2.8% this year, to 2.5 billion units according to Gartner. However, the computing devices (PCs and ultramobiles) category will fall 7.2% in value terms, to $226 billion (down 3.1% while accounting for exchange rate movements). 306 million units will be shipped, a 2.4% YoY fall.

Local currency depreciation against the dollar in Europe is expected to cause PC price rises by vendors in the region, said Gartner analyst Ranjit Atwal. These rises will be the primary reason for falling PC purchases. “We expect businesses will delay purchases of new PCs, and consumers will delay or ‘de-feature’ their purchases. However, this reduction in purchasing is not a downturn, it is a reshaping of the market driven by currency”, Atwal said.

| Worldwide Device Shipments by Device Type, 2014-2017 (000s) | ||||

|---|---|---|---|---|

| Device Type | 2014 | 2015 | 2016 | 2017 |

| Desktop and Notebook PCs | 277,118 | 252,881 | 243,628 | 236,341 |

| Ultramobiles (Premium) | 36,699 | 53,452 | 74,134 | 90,945 |

| PC Market | 313,817 | 306,333 | 317,762 | 327,285 |

| Ultramobiles (Tablet and Clamshell) | 227,080 | 236,778 | 257,985 | 276,026 |

| Computing Devices Market | 540,897 | 543,111 | 575,747 | 603,311 |

| Mobile Phones | 1,878,698 | 1,943,952 | 2,017,861 | 2,055,954 |

| Total Devices Market | 2,419,864 | 2,487,062 | 2,593,608 | 2,659,265 |

| Source: Gartner | ||||

Mobile phones are both the largest and most profitable sector of the device global market. Gartner expects this sector to equal 1.9 billion units, up 3.5%, in 2015. Cheaper smartphones will continue to appeal to consumers, countering the need to raise prices. Although mobile phone prices have been rising slowly in recent years, Gartner expects prices in 2015 to remain flat or fall slightly, as smartphones reach saturation over the next few years.

Ultramobiles, meanwhile, will reach 237 million units in 2015: a 4.3% YoY rise. They will compete directly with tablets (the market for tablets is mature, and “comparable to notebooks”, says research director Roberta Cozza).

Gartner expects an increasing percentage of Android tablet users to switch to iOS, as high-end Android vendors are having difficulty with differentiation. These vendors are also struggling to capture value beyond technology and features.

“We also estimate that, despite Apple’s premium price tags, the iOS base replacement cycle that started in the fourth quarter of 2014 with the larger iPhones will carry on into 2015”, said Cozza.

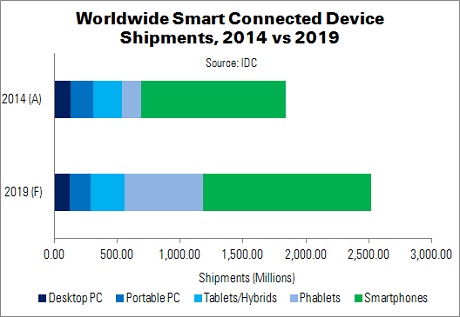

IDC released its own smart connected device (SCD) data at the same time as Gartner – the difference being that IDC excludes feature phones. The firm estimates a total volume of 1.8 billion units last year, with a forecast growth to 2.5 billion in 2019. Smartphones will dwarf both tablets and PCs in terms of shipment volumes by that point.

PCs represented the ‘lion’s share’ of the SCD market (52.5%) up until 2010, compared to 44.7% for smartphones and 2.8% for tablets. The market has shifted dramatically since that point; last year, smartphones had grown to 73.4% of the market, while PCs had slipped to 16.8% and tablets had grown to 12.5%. By 2019, IDC expects the distribution to be 77.8% smartphones, 11.6% PCs and 10.7% tablets.

There are some bright spots in the PC and tablet markets – mainly around hybrid devices. Detachable two-in-one tablets and convertible notebooks are both showing strong growth. However, the smartphone is the clear choice for people owning one connected device. Growth will slow later in the forecast, but smartphone volumes will still be dominant. In the words of Tom Mainelli, programme VP for devices at IDC, “[I]t’s not likely that anything -including wearables – will unseat [smartphones] from this dominant position anytime soon”.

There are some bright spots in the PC and tablet markets – mainly around hybrid devices. Detachable two-in-one tablets and convertible notebooks are both showing strong growth. However, the smartphone is the clear choice for people owning one connected device. Growth will slow later in the forecast, but smartphone volumes will still be dominant. In the words of Tom Mainelli, programme VP for devices at IDC, “[I]t’s not likely that anything -including wearables – will unseat [smartphones] from this dominant position anytime soon”.

Delving deeper into the smartphone market, the future for these products is in emerging economies, sub-$100 price points and phablets. Last year, 73% of smartphones were shipped to emerging markets; 21% were priced below $100; and 12% were sized between 5.5″ and <7″. IDC expects these categories to increase to $80, 35% and 32%, respectively, by 2019.

Comment

While Gartner forecasts that Android-to-iPad conversions will grow, researcher Cowen & Co. predicted a similar movement in the smartphone space, worldwide. The company surveyed 3,000 smartphone users in the USA, Japan, China and the UK, half of whom were iPhone 6 owners and half that planned to purchase one in the next 12 months.

Almost 20% of the current iPhone owners said that their new phone replaced one from a competitor – of which around 83% were Android handsets. Another 5% said that their current phone was their first smartphone. The indication here is that around 25% of iPhone 6 purchases have been by new or returning Apple customers. The Android-to-iPhone conversion was highest in China (30%), and lower in Japan (14%), the UK (9%) and USA (8%). Cowen also found that there are more hardships to come for Android vendors. 42% of the respondents intending to purchase an iPhone 6 own a competitors’ handset, and 85% are Android users.

In other words, even though a significant number of iPhone 6 buyers have switched from Android, this may only be the ‘tip of the iceberg’. (TA)