While much of the Display Daily team was dealing with the overload of CES last week, there was a significant anniversary during the show, although I didn’t hear anybody talking about it. On January 9th, Apple celebrated 10 years of its smartphones.

Of course, Apple doesn’t attend CES or other trade shows, since it dropped out of Mac World where it launched the iPhone. That means it’s always slightly strange that probably the most influential consumer device of the last ten years is not at CES (although the CTA has said for several years that CES is just CES, and does not stand for the Consumer Electronics Show – and probably should be the Consumer Car Show in the future!).

At the time that Apple launched the iPhone, I heard industry observers talk about the apparently crazy decision of Apple to use PCap touch technology – my understanding is that the touch system at the time cost more than the LCD panel that was used in the phone. However, the product turned out to be a game changer, because it not only transformed the user experience of the mobile phone, because of the interface and the ecosystem that Apple developed, it has transformed the electronics business and whole industries.

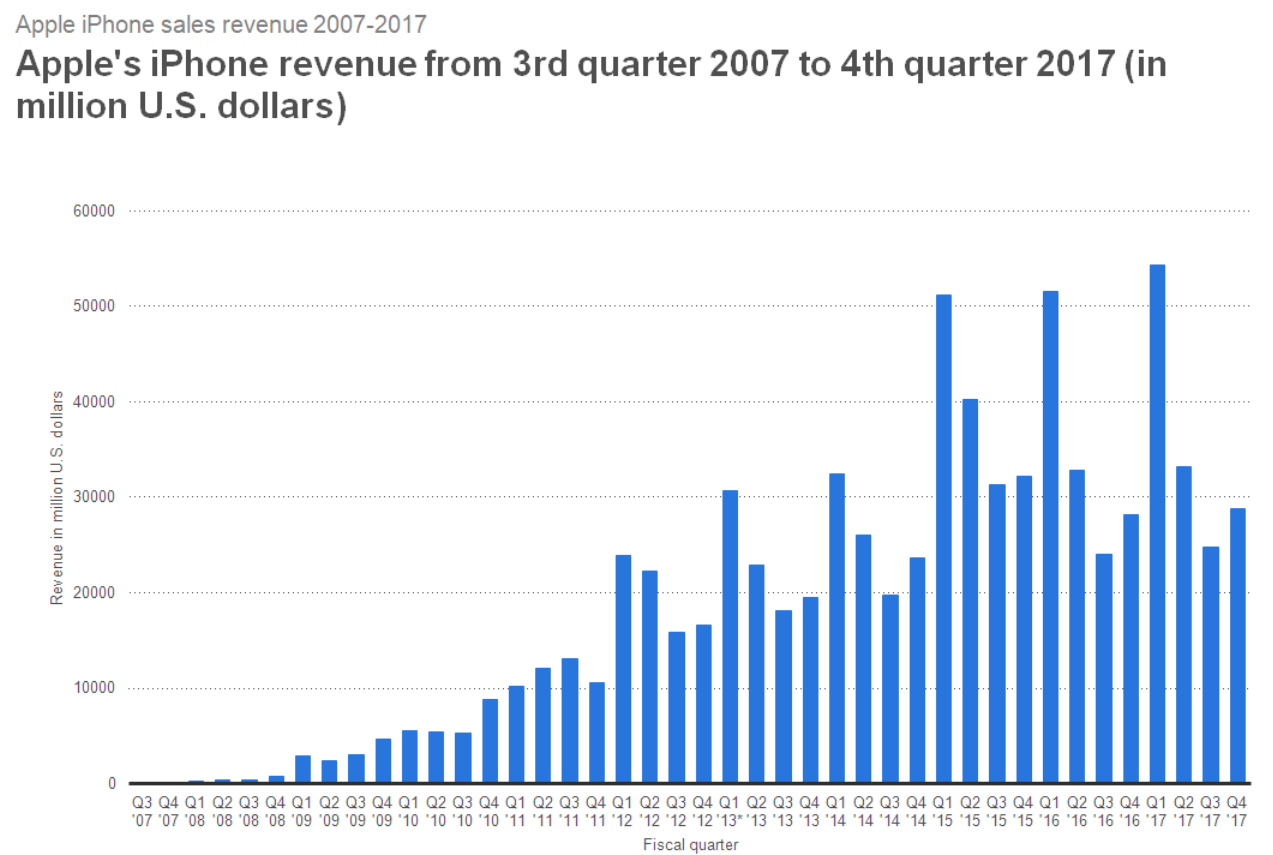

The iPhone sold quite quickly, a million in the first two and a half months, although there was a price cut for the 8GB model from the original price of $599 when it started to ship in the summer of 2007 to $399 in September 2007. Although Apple is slightly less dependent on the iPhone than a couple of years ago, the revenues are still well over $100 billion in 2017.

Apple’s iPhone revenues. Source:Statista

Apple’s iPhone revenues. Source:Statista

The iPhone has also transformed Apple and its suppliers. Foxconn has gone from a $38 billion company to $145 billion and the firm is currently the owner of more LCD production capacity than any other firm, as it owns both Innolux and Sharp. The company has probably had a significant impact on the shape of the Taiwanese electronics industry as, according to Nikkei and based on reported data from Nikkei, 25.8% of Apple’s suppliers are from Taiwan. Korea supplies 5.9% of the total number of suppliers, but, of course, the huge companies in Korea mean that although the number of suppliers may be small, the revenues will be large. It has been estimated that Samsung is getting a lot of revenue from the Apple iPhone X – around $110 to $120 per handset according to some estimates for every iPhoneX, as Samsung is supplying the OLEDs as well as flash memory and DRAM, according to the Wall Street Journal.

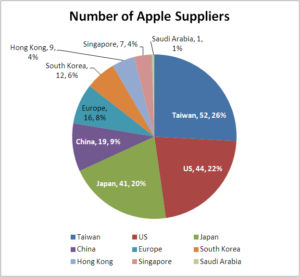

Apple’s supplier count (source Apple, compiled by Nikkei. Image:Meko)

Of course, Apple only had to move to OLED because Samsung, as a competitor, had a clear advantage in its smartphones because of the size and performance of its flexible OLED technology. It must be very irritating for Apple to feel it has been forced to go to the very company that caused it the competitive pressure, in order that it could buy the solution to that pressure.

Looking ahead, though, it’s hard to see exactly where the smartphone goes and how Apple keeps the interest in its devices. Both Apple and Samsung are being squeezed up to the premium segments only, by Chinese suppliers that are steadily taking share. My personal view is that a change in form factor to exploit fully the next generation of flexible displays could be what ignites the market. However, it is three years or so since I first saw the ‘tri-fold tablet’ and flip smartphone concepts in a suite at CES, and we don’t seem to be much nearer commercialisation. There are lots of rumours of something from Samsung at the end of this year, but the company has been damping speculation, so it could take significantly longer.

What Follows the Smartphone?

Of course, in the very long view, the change has to move from a device that we carry all the time to a device that we can access all the time, using a combination of voice control and AR. However, we have a long way to go, although I spoke to a MicroLED supplier that was showing a 20,000 cd/m² microLED in a suite at CES and the company had hoped to show 100,000 cd/m², but didn’t quite make it in time for the show. That could solve the display device challenge, but there are still a lot of optical issues to be handled. Don’t hold your breath, but that increasingly seems to me the next disruptive change.

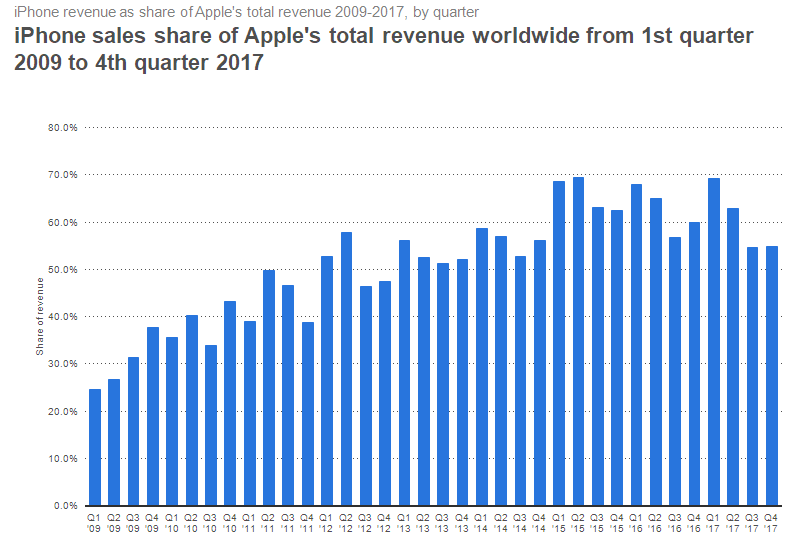

If the iPhone and the premium segment does falter before the next generation arrives, Apple may have to go through a tougher patch. Although Apple depends less on the iPhone than it did a couple of years ago, it still represents more than 50% of Apple’s revenues. – Bob Raikes

iPhone share of Apple revenue – source: Statista.

iPhone share of Apple revenue – source: Statista.