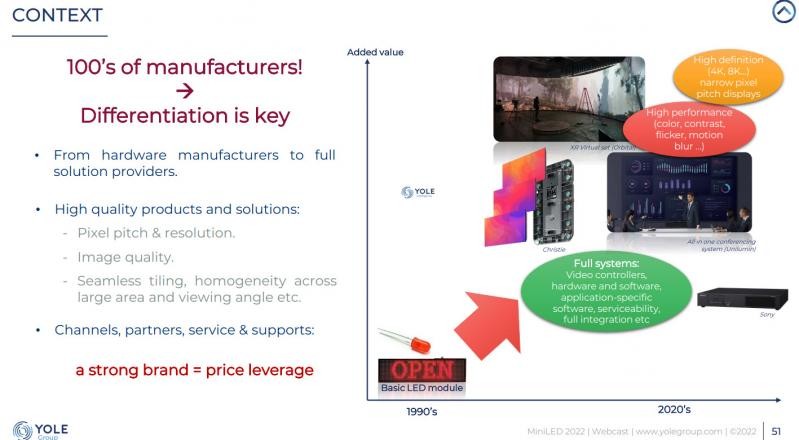

The second part of the Yole webinar looked at the development of miniLED in direct view displays rather than in backlights. The market developed because there were hundreds of companies that could put together the displays with chassis’s, drivers and controllers, said Eric Virey of Yole.

To survive, the companies have a number of different strategies:

- They are moving from supplying just displays to starting to develop complete systems and support (a trend that was clear at IBC as firms showed virtual production systems with controllers, camera trackers and software) (LEDs for Virtual Production at IBC)

- Some are working on superior quality with HDR, better colour and contrast, reduced motion blur etc

- Smaller pitch is also a target for higher definition narrow pixel pitch displays for 4K and 8K

Firms are also developing their channels and partnerships for system and long term support – these are key points for buyers. (and from what I have heard, relying simply on a ‘big name’ may not be enough – Editor)

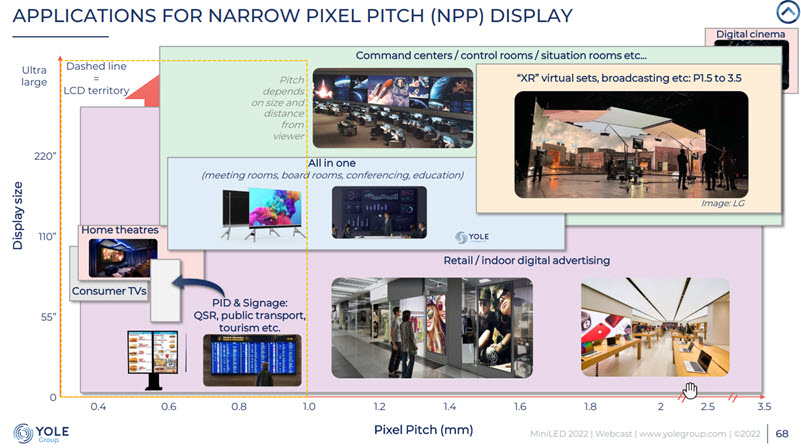

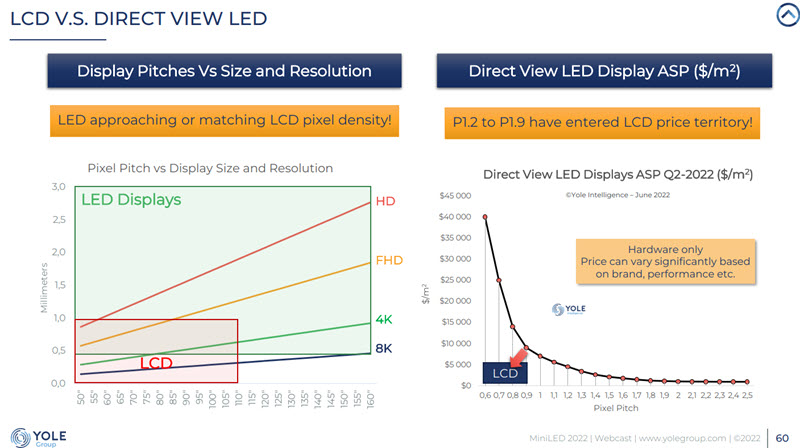

Direct view LED has to compete with LCD and one of the key advantages is the lack of bezels compared to LCD video walls. At the moment, LCD has an advantage of smaller pixel pitch, although Virey said that 0.7mm is in the market and he knows of developments down to 0.4mm.

The barriers to entry of the market have come down and that has meant a very competitive landscape for the technology and the market has seen dramatic price reductions over recent years. Virey showed a very interesting chart of cost/m² for LEDs with different pitch (as of Q2 2022) and said that P1.2 to P1.9 is now getting to ‘LCD price territory’. 0.9mm pitch could be next. However, as always, cost tends to be related to the number of pixels rather than the area.

LED Display cost – but as Virey highlighted, the actual cost can be dramatically different from this for different brands.

LED Display cost – but as Virey highlighted, the actual cost can be dramatically different from this for different brands.

LCD can do well in smaller sizes but in retail and indoor digital advertising, it can be under threat from LED. Digital cinema is still in the early stages and pitch is not so critical. Command centres and control rooms are a great market because of the long life and reliability of LED.

In conference room and meeting room markets, LCD has a cost advantage up to around 98″ (I was recently at an event where the cost of a 110″ was described as around double that of an LCD rather than, as it would have been at one time, five to ten times the cost).

Virtual production has been a good market for direct view LED to grow.

Monolithic displays are going to remain a niche market only really for high income consumers. There need to be substantial changes in architecture to get costs of microLED down to become a volume market.

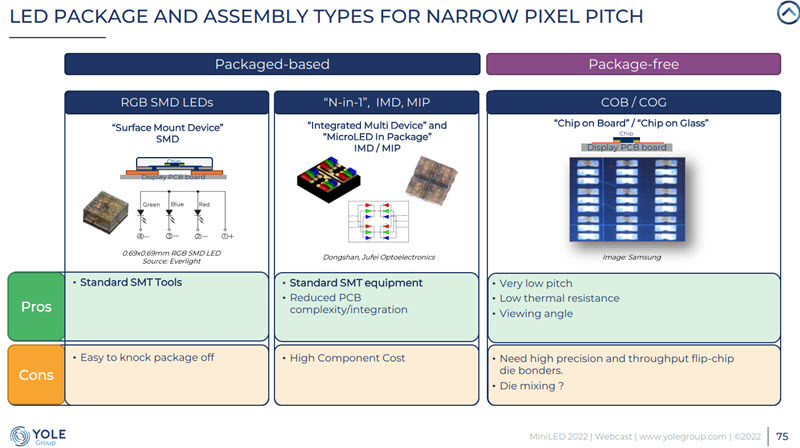

Virey then turned to different architectures for LEDs and he explained the differences between SMD and COB/COG architectures. He also described how LED makers have developed multi-die packages (“N-in-1, “IMD”, “MIP” packages) that can be placed with standard SMT equipment, but can get to finer pitches, like COB/COG. In the longer term, COB/COG could lead to cost reductions but at the moment there remain a lot of challenges that need to be overcome and that means a slower rate of cost drop.

He used the developments from NationStar which has moved from 4-in-1 at 0.9mm pitch to 0.7 and 0.5 mm and now has 20-in-1 IMD technology with 0.4mm pitch allowing the creation of 81″ 4K and 163″ 8K sets. The next step could be to P0.3 which would mean 4K at 55″ and 8K at 110″. However, Yole does not see realistic use cases below 0.5mm. LED chip sizes are coming down and there is talk about the use of glass instead of circuit boards as pitch goes down below 0.5mm.

There has been around $15 billion of investment in LED, mainly from China over the last three years – Yole estimates it has made 91% of the investments, with Japan at 4%, the US at 3% and Taiwan at 2%. (BR)