MICROOLED, a leading provider of low power high resolution OLED microdisplays, announces an €8 million growth investment provided by two pan European high-tech investors, Cipio Partners and Ventech. These investors will join the company’s Board of Directors along with the historical investor Supernova Invest through CEA Investissement.

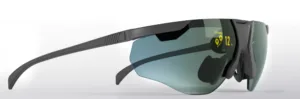

MICROOLED offers cutting edge OLED microdisplays to a broad and global customer base for diverse of applications, from consumer electronics to highly demanding professional use cases. By combining its 13-year expertise in display, manufacturing and system integration with a strong knowledge of the market, MICROOLED recently introduced ActiveLook, the lightest and most compact optical module for smart glass applications, which is being adopted by eyewear companies such as Julbo, UVEX and others.

The company was established by Eric Marcellin-Dibon, CEO, and Gunther Haas, CTO, in 2007 and employs over 75 highly skilled team members in Grenoble. It had been able to rely on a investment by Supernova Invest, through CEA Investissement. The company has experienced record growth in 2019 with a net profitable result. The team will use the funding to further push the development of integrated AR modules while strengthening manufacturing capacities to support increasing global demand for OLED microdisplays across all type of use cases.

“We are ready to innovate with our customers, developing unique solutions based on our high efficiency OLED technology”, said Eric Marcellin-Dibon MICROOLED CEO. “Augmented reality represents a huge market opportunity. Connected eyewear is everything about style and comfort and a successful product can only be achieved with a highly integrated system and by mastering the key technologies down to the pixel. This is our core expertise and with this strong investor pool, we have the resources to enable our customers entering these new markets with our ActiveLook platform”.

Christian Claussen, General Partner with Ventech states: “I have closely followed MICROOLED’s growth path over the past years and am impressed with management’s ability to develop cutting-edge world class technology with a strong focus on real customer needs. MICROOLED will now open a completely new chapter in consumer-AR thanks to their ready-to-market Active Look platform. We are more than happy to support management with funding and advice during the next growth phase of the company.”

About MICROOLED

MICROOLED is leading provider of highly power-efficient microdisplays with superior image quality for mobile near-to-eye viewing devices used by consumers, medical professionals, and security industry. Founded in 2007, MICROOLED headquarters, R&D and a production facility are located in Grenoble, a renowned center of excellence in France for chipset and nanotechnology development.

About Cipio Partners

Founded in 2003, Cipio Partners is a leading investment management and advisory firm for European Growth Capital & Minority Buy-Outs for Technology Companies. Cipio Partners targets European growth stage technology businesses with €10-100 million in revenue and makes initial investments ranging from €3-10 million. Cipio Partners operates from offices in Luxembourg and Munich.

About Ventech

Ventech is a leading Seed & Series A-focused global venture capital firm. Founded in 1998, Ventech backs the most innovative and globally ambitious digital technology entrepreneurs with 200+ investments (Believe, Botify, Freespee, Ogury, Picanova, Speexx, & Vestiaire Collective) and 80+ exits (Webedia, Curse, StickyADS.tv and Withings) to date. With its dual structure platform, Ventech has dedicated funds for Europe (from Paris, Munich & Helsinki) and Asia (from Shanghai and Hong Kong).

About Supernova Invest

Supernova Invest is a cutting-edge venture capital firm with a leading position in the French deeptech investment market. It manages and advises five capital funds for a total of €260 million AUM. Supernova Invest specializes in breakthrough technologies, developing start-ups in Industry, Health, Energy& Environment and Digital Technology sectors. The team has 20 years of technology investment experience and has provided more than 100 of the most innovative companies in their segments with support and guidance from creation until full maturity. Supernova Invest has a strong partnership with both the CEA (the French Alternative Energies and Atomic Energy Commission) and Amundi (the European leader in asset management).