In the new edition of the Middle East and North Africa Pay TV Forecasts report from Digital TV Research, Pay-TV revenues have been downgraded. They are forecast to reach $4 billion in 2021, which is down from the $5 billion forecast in the last edition of the report. The report covers 20 countries in the Middle East and North Africa.

Pay-TV revenue forecasts for 2021 for Turkey are down $361 million compared to the last edition, with Israel falling by $220 million, the UAE $174 million and Saudi Arabia $149 million. Together, these four countries account for the 90% revenue shortfall between the two editions of the forecast reports.

Simon Murray, Principal Analyst at Digital TV Research, said that along with long-running conflicts and slower economic growth, Turkey and Egypt in particular, have suffered substantial currency devaluation. Also, OTT is creating competition to traditional pay-TV operators, especially in Israel, although Kazakhstan, Kuwait, Qatar and the UAE are enjoying good growth.

According to the forecasts, legitimate pay-TV revenues will reach $4.12 billion by 2022, up by 17% from $3.52 billion in 2016.

The number of pay-TV homes will also increase by nearly 5 million between 2015 and 2022 to 19.52 million. About 18.7% of TV households paid for TV signal by the end of 2016, which will climb to 22.2% by 2022.

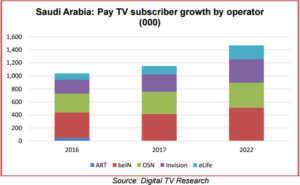

Digiturk will remain the region’s dominant pay-TV operator leader in subscriber terms, although second-placed beIN formally acquired Digiturk in September 2016.

beIN is forecast to have 1.67 million satellite TV subscribers by 2022, which is ahead of OSN’s 1.50 million. Excluding subscribers to OSN’s channels on other platforms, such as IPTV and cable, beIN will overtake OSN in 2019.

In revenue terms, OSN is the largest pay-TV operator with their packages being expensive even when compared with the most developed countries.