The Europe, Middle East, and Africa (EMEA) traditional PC market (desktops, notebooks, and workstations) posted strong growth in 2020Q4 (16.6% YoY) and totaled 24.1 million units, according to International Data Corporation (IDC). The continued impact of COVID-19 and subsequent high demand for traditional PC shipments resulted in strong growth for consumer (21.3% YoY) and commercial (13.6% YoY).

The Western European PC market posted the strongest results of the regions in EMEA, growing 20.0% YoY. Despite the expected weak result of desktops (-25.0% YoY), the market was heavily offset by the continued strong performance of notebooks (39.4% YoY) which reached 12.9 million units.

“The exceptional notebook performance can once again be attributed to the massive demand in consumer and education,” said Liam Hall, senior research analyst for IDC Western European Personal Computing Devices. “Extended lockdowns and increased restrictions have translated into an even stronger urgency for devices that support entertainment and remote learning, drilling home the necessity of one device per-person rather than per-household.

“Market growth could have been even greater, but supply constraints, particularly on panel and entry level CPUs, created bottlenecks that meant the full demand could not be satiated.”

Consumer in Western Europe saw an increase of 32.1% YoY, reaching 6.9 million units in 2020Q4. On top of the strong notebook performance, desktop also enjoyed positive results, growing 12.4% YoY. Gaming continued to be an area of growth as consumers still look for ways to entertain themselves and socialize with friends during lockdowns. Beyond education, the commercial market was less buoyant, although it still grew 12.2% YoY to reach 9.2 million units.

Despite the Russian PC market underperforming and contracting by 2.8% YoY, the overall PC market in the CEE region grew by 14.3% YoY, in line with the latest forecast. The ongoing education deals across a few countries have certainly helped to maintain growth in the commercial space, which was recorded at 21.4% YoY and continuously fueled by work from home needs, while consumer increased 9.0% YoY.

“Demand for notebooks remains the market driver with QoQ backlogs coupled with ongoing lockdowns,” said Nikolina Jurisic, senior research manager IDC Europe. “The MEA region reported good overall growth driven exclusively by the commercial segments at 12.4% YoY compared to consumer declining by 2.8% YoY.”

Vendor Highlights

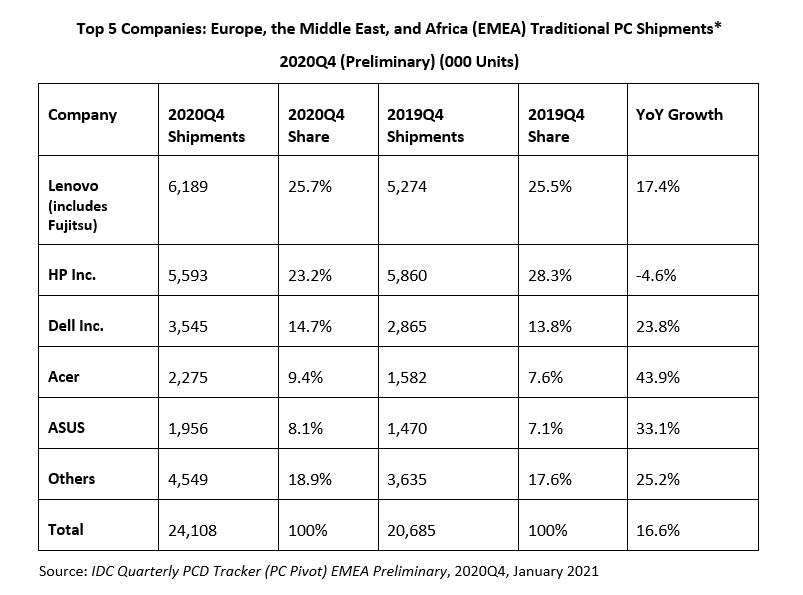

Traditional PC market consolidation slowed again, with the top 5 vendors’ share dipping in 2020Q4. The top 5 players accounted for 81.1% of total market volume, compared with 82.4% in 2019Q4.

-

Lenovo (including Fujitsu) now leads the PC market in EMEA, holding 25.7% market share (up 0.2% points YoY). The vendor grew 17.4% YoY driven by a strong double-digit performance in both segments.

-

HP inc. dropped to second position, with 23.2% market share (-5.1% points YoY). Mid-single digit declines in both segments led to a drop in ranking. A comparatively weak notebook performance stemming from supply constraints further contributed to the vendor’s decline in ranking.

-

Dell Inc. maintained third position in the PC market in EMEA with 14.7% market share (up 0.9% points YoY). The vendor enjoyed overall growth of 23.8% driven by double-digit growth in the commercial segment.

-

Acer climbed to 4th position from 5th with 9.4% market share (up 1.8% points YoY). The vendor’s strong presence in the consumer and education markets heavily supported its healthy notebook growth.

-

ASUS dropped in ranking to 5th place from 4th with 8.1% market share in EMEA (up 1.0% points YoY). A weaker performance compared to its closest competitor in the consumer segment caused a drop in ranking despite a strong performance overall in both segment groups.

Table notes:

? Some IDC estimates were made prior to financial earnings reports.

? Shipments include shipments to distribution channels or end users. OEM sales are counted under the vendor/brand under which they are sold.

? Traditional PCs include desktops, notebooks, and workstations, and do not include tablets or x86 servers. Detachable tablets and slate tablets are part of the Personal Computing Device Tracker, but are not addressed in this press release.

? Data for all vendors is reported for calendar periods.