Jeong Ho-young got his dream job in December 2019, when he became CEO of LG Display (LGD). His role would be to speed up the transition from LCDs to OLEDs, which his predecessor had started. LGD had opted to concentrate on OLED TV panels and then dabble in smartphones, while competitor Samsung Display did the opposite.

His job became more difficult when the Gen 8.5 OLED fab in Guangzhou, China, took until Q321 to reach full capacity, a one year delay. But he got a break when the pandemic hit and raised demand for TV and IT panels, faster than the Chinese large area capacity growth. Starting in early 2020, panel prices and demand more than doubled through Q421. Even Samsung Visual (it’s TV business) took an interest in OLEDs and opened up discussions to buy 2 million OLED panels from LGD. LGD’s plan to keep much of its old LCD capacity going until OLEDs could carry the burden of the large capex needed to fund the change out of LCD and to OLED and the imbedded depreciation was working. LG said it would keep some of the LCD capacity for IT.

But the display world changed in 2022, as demand contracted, prices fell, some below 2019 levels, and Chinese large area LCD capacity expanded. Samsung Visual’s TV business was shrinking so they lost interest in LGS’s OLEDs, at least for 2022. Jeong’s plan to maintain the LCD capacity as long as it was cash positive was hit by Q222’s negative free cash flow.

Speaking at an event hosted by the Korea Display Industry Association, an organization he is currently the chairman of, he said it will take some time to consider when to convert LCD lines to OLED lines. LG Display manufactures LCD TV panels at its P7 line in Paju. Sources said the company is highly likely to convert this line for OLED TV panels down the road. He must move quickly as Q222 performance resulted in a net loss, lower Y/Y revenues and an expectation that Q322 could be worse.

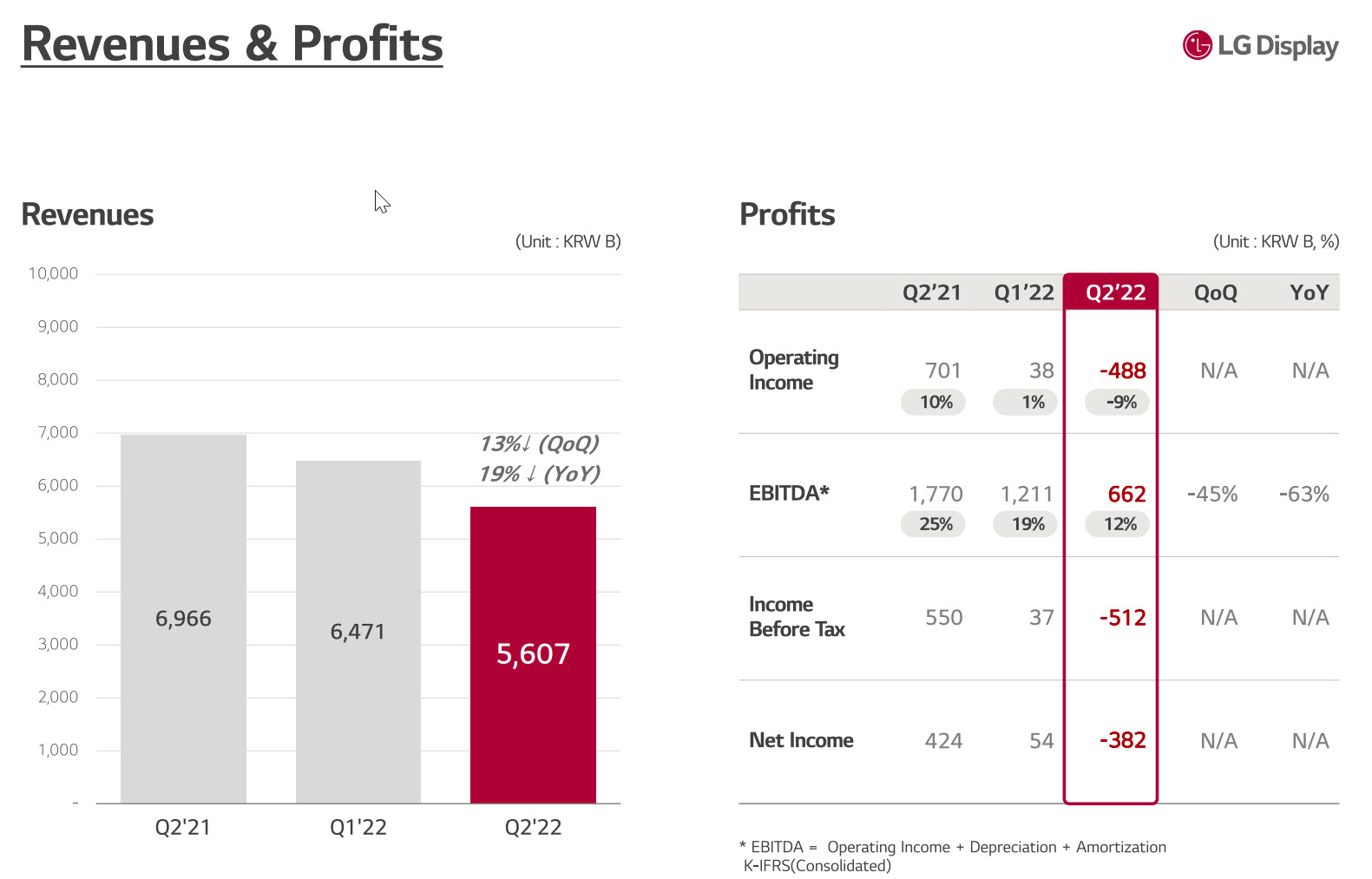

LG Display reported Q222 sales of KRW5.607t (down 20% Y/Y and down 13% sequentially), an operating loss of KRW488b (swinging to a loss on a Y/Y and sequential basis), and a net loss of KWR382b (swinging to a loss on a Y/Y and sequential basis). The company issued guidance for 3Q calling for:

- sequentially growth in shipments in surface area terms to be around 5%; and

- blended ASP to improve by around 20% sequentially.

As LCD prices deteriorate for IT applications and demand slumps for TV OLED panels, the company booked operating losses in Q222, though the losses were in line with expectations. Performance is expected to rebound at least to some extent in 3Q on the back of an improvement in sales. However, the company appears likely to continue to book operating losses, largely on factors related to the business environment. LGD’s near term actions appear limited to lowering its own inventories through capacity utilization adjustments.

Minimize LCD – Maximize OLED

Management is faced with minimizing its small, medium, and large LCD operations (its timeline and how much of these operations will it keep for the IT industry) and how quickly to expand its small, medium, and large OLED business, which is basically a choice between making new investments or repurposing LCD lines, considering providing tech to other companies, increasing sales and development of products for the IT industry, and increasing sales to Samsung Visual Display).

- Management has already spoken on minimizing its P7 operations and enacting a partial repurposing of the Guangzhou plant to IT products. The company’s OLED panels are produced using different methods for different IT applications, namely the RGB deposition method for notebook PCs and the white deposition method for monitors.

- Given the likelihood of strong OLED demand beginning 2025, but also the company’s strengths in high-value-added LCD products such as IPS curved panels.

- LCD panel production capacity for IT applications is still increasing as demand moves away from TVs and the new plants of Chinese manufacturers, including CSoT’s t9 plant, move into operation.

- Attention focused on how long the company will be able to differentiate itself based on its technological leadership. LGD will likely invest in G8 RGB deposition lines for IT applications in order to accommodate iPad and MacBook demand.

- Large OLED: Shipment volume for TV OLED panels rose by more than 70% Y/Y to 7.7m units in 2021. Production capacity will be around 10m–10.5m units in 2022. However, due to sluggish demand for OLEDTVs and the impact from the Shanghai lockdowns on brand-name product sales, 1H shipment volume was sluggish at around 3 million units, and the company has been forced to adjust capacity utilization since May to around 70%. With a slow H122 and no Samsung Electronics OLED purchases before the end of the year, full-year shipment volume is likely to be below 8 million, or flat to slightly higher than last year’s level. LG Display will be dependent on a recovery in 2023 to capture demand from existing customers (though it will be difficult as the company faces lowering prices on OLED panels where achieving profitability is already a struggle), win orders from Samsung Electronics, and develop demand for new apps, including gaming monitors and mid-sized TVs with screens under 32 inches. The company needs to create 4K panels sized below 32 inches using the current bottom emission structures. The company is expected to push back its decision on expanding production by 30,000 at the Guangzhou plant, as well as enacting a P7 OLED repurposing and resuming G10.5 investment, to the end of this year or 1Q FY12/23. In line with the goal of reducing its investment burden, the company may consider boosting production capacity by transferring technology to competitors to create WOLED partners.

- Small and medium-sized OLED (possible investment in G8 RGB OLED): LG Display shipped around 22 million panels for the 6.06” iPhone 12 in 2020 from the E6-1 and E6-2 plants (30,000 substrates per month), which are essentially Apple-dedicated plants. By supplying panels for the new iPhone 13 (6.06”) and 13 Mini (5.4”) models, as well as existing models, the company shipments in 2021 rose to an estimated 48 million. Earnings have been improving significantly for E6, as production capacity rises, and yield improves. In Q222, volume reached an estimated 6.7 million units (an estimated 9.3 million units in 1Q). For the iPhone 14 in 2022, as Apple does away with the Mini, two 6.7” models and two 6.1” models are expected and the iPhone 14 Pro models (6.7”/6.1”) will use LTPO-OLED and that iPhone 14 models (6.7”/6.1”) will use conventional LTPS-OLED. LG Display is expected to supply panels for the 6.7” LTPO model and the 6.1” LTPS model. However, full-scale mass production at the E6-3 plant, which is believed to be in test production now, may be carried over to next year rather than this year, with a focus on yield and when mass production begins for LTPO devices since these factors should help widen the tech gap with BOE, which is trying to catch up to LG Display.

- The company is also investing in the E6-4 plant (P10) to make panels for the IT sector (tablet and laptop sectors). Preparations for mass production should be completed in 2Q23 and the company could supply all the panels for two new iPads (11.0” and 12.9”) likely to launch in 2024. A tandem structure with two light-emitting layers is likely to be adopted at E6-4. Substrate size will likely be the same as the size for G6, and deposition will likely be G6 Half, the same as for E6-1/2. It has become increasingly likely that rival Samsung Display will invest in the world’s first G8 RGB OLED (vapor deposition: G8 Full) for use in IT devices such as tablets and laptops. Against this backdrop, LG Display will likely invest in test lines to mass production lines and consider truly investing in G8 RGB OLED (oxide-based substrate, G8 Half vapor deposition) within its P10 factory. Clearly, business conditions have been worse than initially expected in 2022. Since operating cash flow (free cash was negative in Q222) is below the company’s target, the company needs to focus on core competencies even more. LG Display will likely give more priority to G8 RGB OLED than large OLED or the same priority and are focused on what management decides to do.

- Gen 8.5 production is continuing to improve in Guangzhou, China. Compared to Paju operations in Korea, China has lower costs for personnel, indirect and SG&A, but higher costs for depreciation compared to Korea’s fully depreciated lines. So total costs for the two fabs are comparable, but cash costs are lower for production in China. The big change has been an increase in the range of screen sizes for WOLED products, including

- 27” FHD, 31” QHD and 42” UHD panels and a 45” WQHD panel with an ultra-wide (21.5:9) aspect ratio. This size panel and the ultra-wide aspect ratio allows an efficient 10-cut on a single Gen 8.5 substrate.

- The 45” WQHD panel will be targeted at the high-end gaming monitor market, where its deep contrast and fast response time are key features compared to LCD-based displays. The addition of this 45” panel and additional monitor sizes like 27”, 31”, 42” can allow LGD to generate more revenue from its Gen 8.5 capacity. (BY)

We will continue this article in tomorrow’s Display Daily. The two articles will count as just one free one if you are not a paying subscriber.

Barry Young is CEO of the OLED Association.