While in recent years OLED TV has seen its share of the premium TV market deteriorate, OLED TVs and the brands that sell them regained much of that lost ground in the fourth quarter of 2020, according to the new DSCC Quarterly Advanced TV Shipment and Forecast Report, now available to subscribers.

This report covers the worldwide premium TV market, including the most advanced TV technologies: WOLED, QD Display, QDEF, Dual Cell LCD and MiniLED with 4K and 8K resolution.

The report’s pivot tables allow an analysis of brand share by screen size, region, technology, resolution and other variables. In Q4 2020, among all Advanced TV products, Samsung increased unit shipments by 26% Y/Y and maintained its leading position but lost some share. LGE increased shipments by 47% and share increased from 14% in Q3 2020 to 17% in Q4 2020, and Sony shipments increased by 41% Y/Y and Sony’s unit share recovered to 7%. TCL Advanced LCD TV shipments increased by 146% Y/Y and TCL took the #4 position in Advanced TV units with 4%.

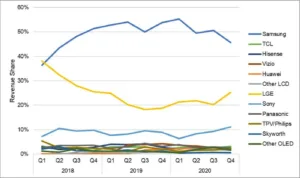

Samsung also leads the industry in revenue share for Advanced TV, as shown in the first chart here, but Samsung’s revenue share declined below 50% in Q4 2020 after peaking at 55% in Q1 2020. LG and Sony gained revenue share at Samsung’s expense; LG’s share increased to 25% in Q4, its highest share since Q1 2019, while Sony took the #3 spot with 11% share, its highest share back to 2018.

Advanced TV Revenue Share by Brand, Q1 2018 to Q4 2020

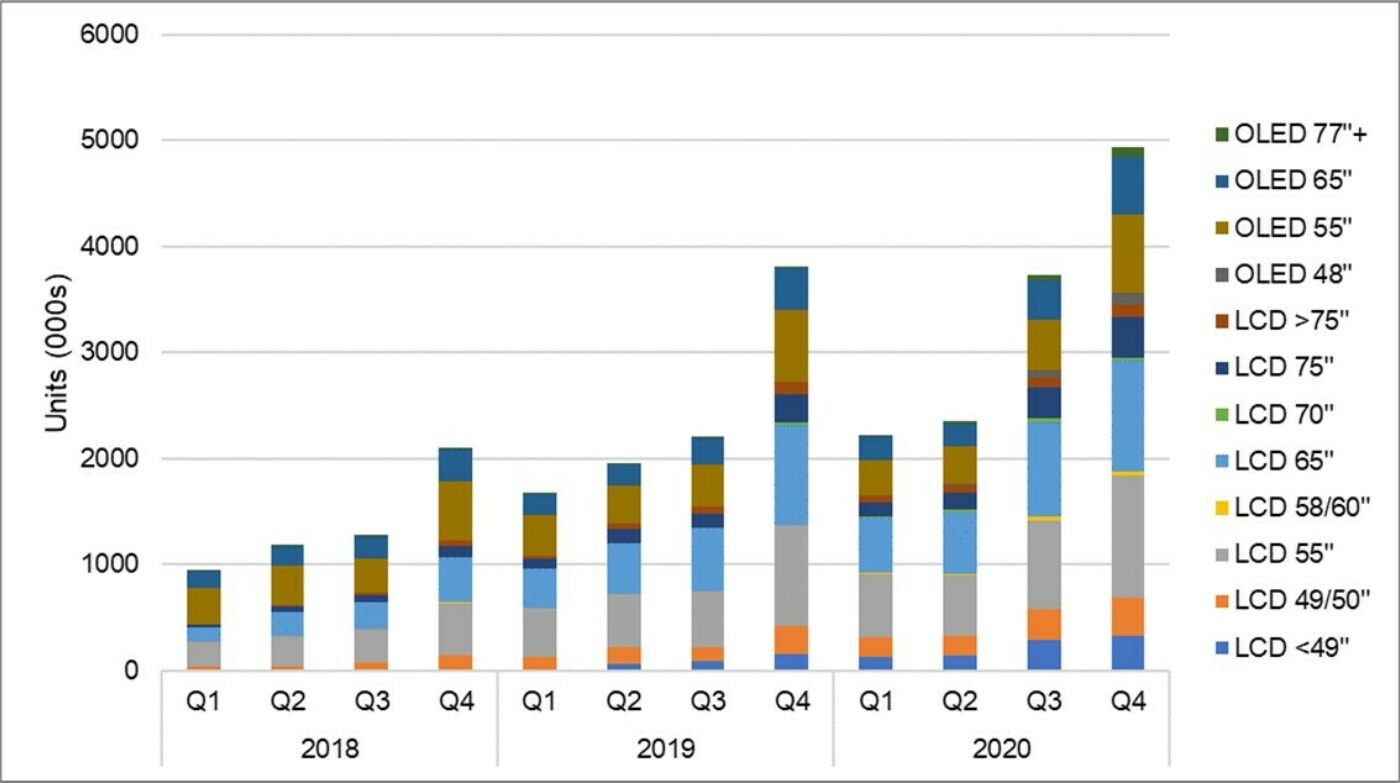

Advanced TV shipments in Q4 2020 jumped by 32% Q/Q and by 29% Y/Y to 4.9M units, as shown in the next chart here. While in general, the trend in TVs is toward larger sizes, in 2020, the smaller screen sizes of Advanced TVs recorded the biggest gains, as Advanced TV technologies in both LCD and OLED are offered at smaller screen sizes to reach lower price points. Advanced LCD TVs smaller than 49” saw a 99% Y/Y increase in Q4 2020, while in OLED the first shipments of 48” have been recorded in 2020. In the largest screen sizes, OLED gained at LCD’s expense, as shipments for 77”+ OLED TVs increased 395% Y/Y while shipments of >75” LCD TVs declined by 2% Y/Y.

Advanced TV Shipments by Size and Display Technology, Q1 2018 to Q4 2020

“As the pandemic kept people locked up, consumers around the world upgraded their homes with Advanced TVs in 2020,” said Bob O’Brien, Co-Founder and Principal Analyst at DSCC. “An increasing share of those consumers chose OLED TVs in Q4 2020. The introduction of 48” OLED TV in 2020 helped broaden the choices available to consumers, and this puts OLED TV makers in a great position for continued growth in 2021.”

Advanced TV revenues increased by only 3% Y/Y as price declines combined with a smaller product mix meant that the average price of an advanced TV declined from $1424 in Q4 2019 to $1139 in Q4 2020. Revenues for the most common sizes of Advanced LCD TV, 55” and 65”, declined by 13% and 18%, respectively. Revenues for 77”+ OLED increased by 259% Y/Y, and revenues from 48” OLED TV increased from $0 in Q4 2019 to $118M in Q4 2020, 5% of all OLED TV revenues.

Overall, OLED TV revenues increased by 29% Y/Y on the strength of increased 77” OLED TV sales as well as volume increases as the average price of an OLED TV declined by only 5% Y/Y to $1639. In contrast, Advanced LCD TV revenues declined by 10% Y/Y as the average price of TVs in this category declined by 29% Y/Y to $925. As a result, OLED TV revenue share of Advanced TV increased from 35% in Q4 2019 and 37% in Q3 2020 to 43% in Q4 2020.

DSCC’s Quarterly Advanced TV Shipment and Forecast Report includes technical descriptions of all major advanced TV display technologies, plus quarterly shipment results from Q1 2018 through Q4 2020, sortable by technology, region, brand, resolution and size, and includes pivot tables for analysis of units, revenues, ASPs and other metrics. The report includes DSCC’s quarterly forecast for five years across technology, region, resolution and size.

Readers interested in subscribing to the DSCC Advanced TV Shipment Report should contact [email protected]. For media inquiries please contact Ashton Reagin at [email protected].

About DSCC

Display Supply Chain Consultants (DSCC) was formed by experienced display market analysts from throughout the display supply chain and delivers valuable insights through consulting, syndicated reports and events. The company has offices in the US, Europe, Japan, Korea and China.