I had an online meeting with Luke Chen, Sr. Business Line Manager, European Region at ViewSonic, and he had done a lot of preparation to respond to some questions I had sent through, which was appreciated.

I had an online meeting with Luke Chen, Sr. Business Line Manager, European Region at ViewSonic, and he had done a lot of preparation to respond to some questions I had sent through, which was appreciated.

-

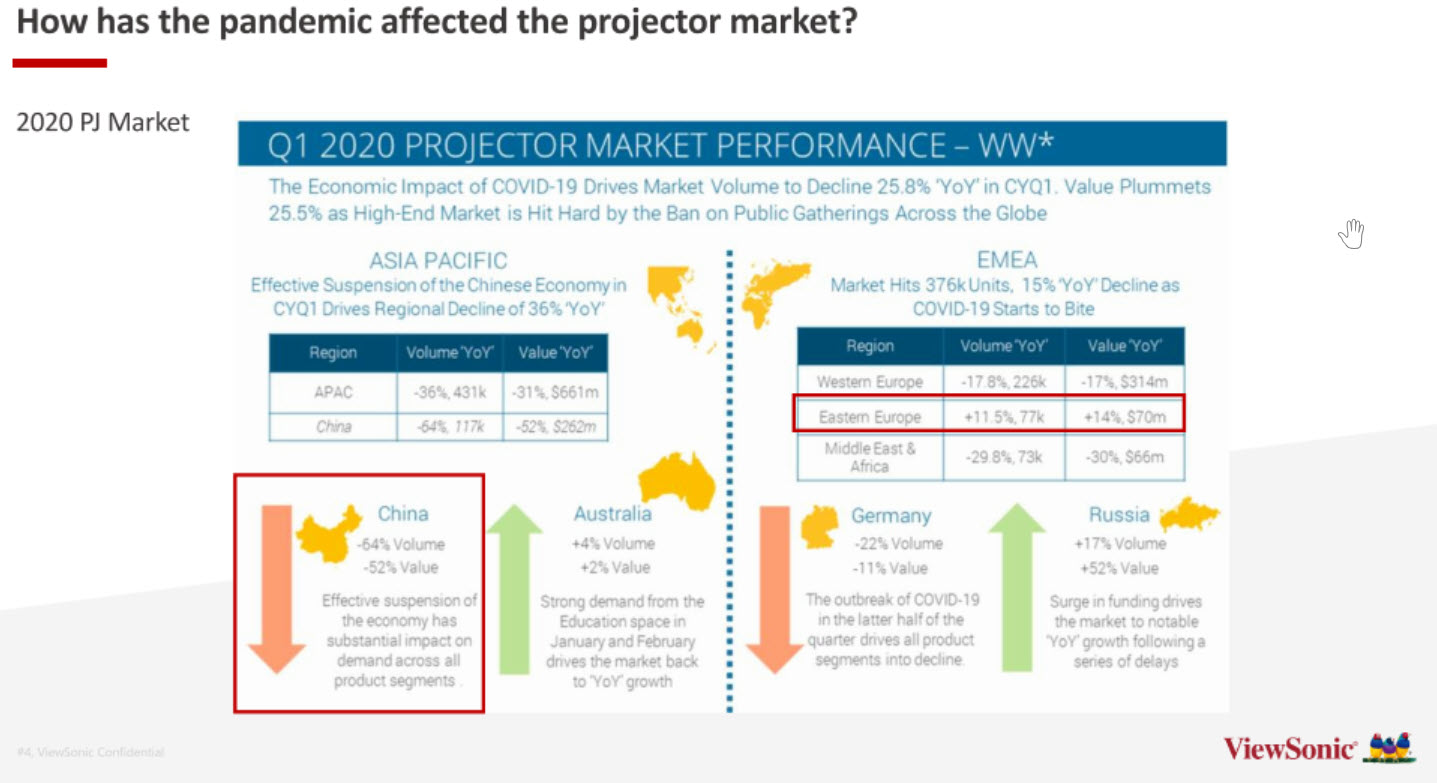

How has the pandemic affected the projector market?

Worldwide, the impact has been really tough, with volumes down 25.8% and value down 25.5% because of Covid in Q1. Part of that was the impact on supply chains which often involve China. EMEA was not quite so bad at 15% down (and Eastern Europe actually up because of a surge in funding in Russia.

Q2 saw the worst performance in the market, with volumes down by nearly half (47.6%) and values down 44.3% worldwide. EMEA was also down 46% with Eastern Europe and MEA at less than half the year-on-year volume.

Q3 sees the market recovering somewhat globally, at 29.1% down in volume to 1.1 million units. EMEA was down 22.6% in volume to 316K units. Value was down 28.8%. The UK was particularly down by 42.5% on volume and 49% in value, while the decline in Germany was 11.4% and 22.4% respectively.

Higher end product sales have been particularly hit by the bans on public events.

-

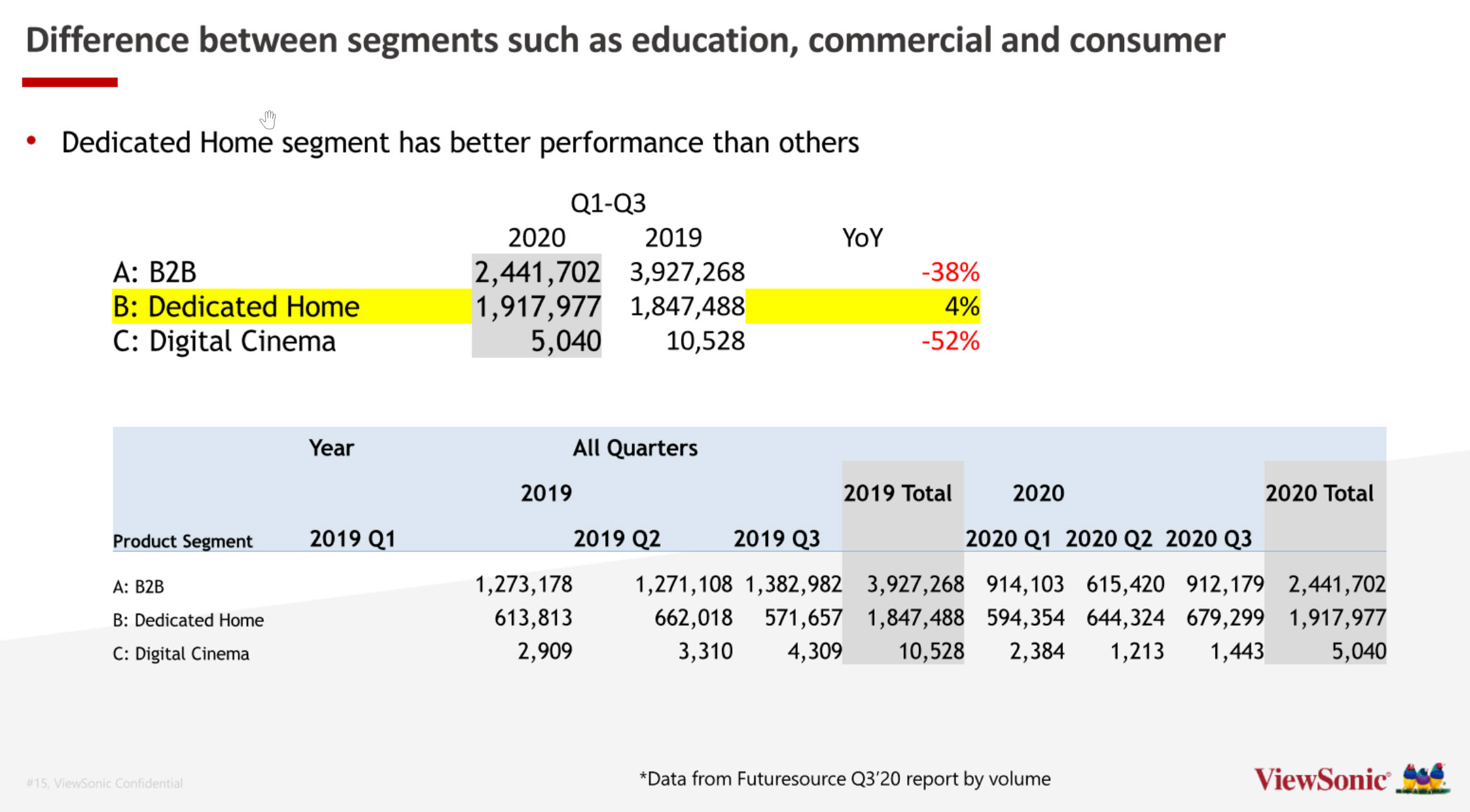

Is there a significant difference between segments such as education, commercial and consumer?

This is the big subject, Chen told us. Corporate, meeting room and education sales were down along with other B2B applications including museums and events. Education (at least in terms of the volume classroom market) is now switched to buying flat panels and demand is very weak. However, consumer sales are relatively strong, for reasons that we discussed a bit later in this article.

-

Are there significant regional differences?

Chen had done some interesting analysis of the effects on GDP caused by Covid based on data from Futuresource. This shows that markets that have quite strong B2C markets have been less impacted than those that depend on B2B, especially where the impact of Covid has been high. Comparing, for example, Germany and India, the B2B market in Germany was down 14%, but the dedicated home market was up over Q1-Q3, by 29% to nearly 70K units. India, on the other hand, where the B2B market was nearly double that of Germany in 2019, saw a drop to less than Germany, down by 60% year on year. In Germany, ViewSonic saw its sales grow by 93% year on year. In the UK, BeB sales were down 48% to 44K, while home projectors were down by just 13% for Q1 to Q3.

Overall, the global dedicated home projector market is actually up from Q1 to Q3, by 4% to 1.92 million, while B2B was down by 38% and digital cinema down by 52%.

-

Given the high performance and low cost of LCDs and OLEDs, is there still a market for consumer projectors?

This was the topic of much of the discussion in our webinar. Chen said that the kind of ‘cocooning’ (my word – editor) of consumers’ spending time at home has helped to drive demand for projectors. Furthermore, a lot of consumers have saved real money with the lockdown because of savings in entertainment and sport spending. Given the good value of projectors, especially LED projectors which have great performance and get over the historic disadvantages of lamp-based products, spending on a projector can seem like a good investment. The projector can be the second or third display in the home.

Consumers are also starved of cinema attendance. A projector can be a good alternative if you regularly take the family to the cinema. It can also be used for gaming, video conferencing and other applications. The LED architecture tends to be smaller and quieter (because of the reduced power consumption and heat) than traditional units, Chen said, which makes them easier to set up, especially with short or ultra-short throw lenses.

I had to admit to Chen that although I traded up to a 65″ OLED TV this summer, (My PDP Finally Gets Re-assigned to Guests), when watching the movie “Interstellar” at the weekend, although I was impressed with the quality, the letter boxing meant that at one point I did think ‘the image could be bigger’.

LED projectors have no problem to create 100″ images and that is really difficult and expensive with any direct view technology. As Chen said

“Eyes are very greedy”

– viewers always want more resolution and brightness and colour.

Chen believes that ‘smart’ projectors are essential so that content and apps can be accessed easily on devices or the projector itself and I wouldn’t disagree. This facility, especially good ‘casting’, with a short throw lens makes a projector much more practical in the typical living room.

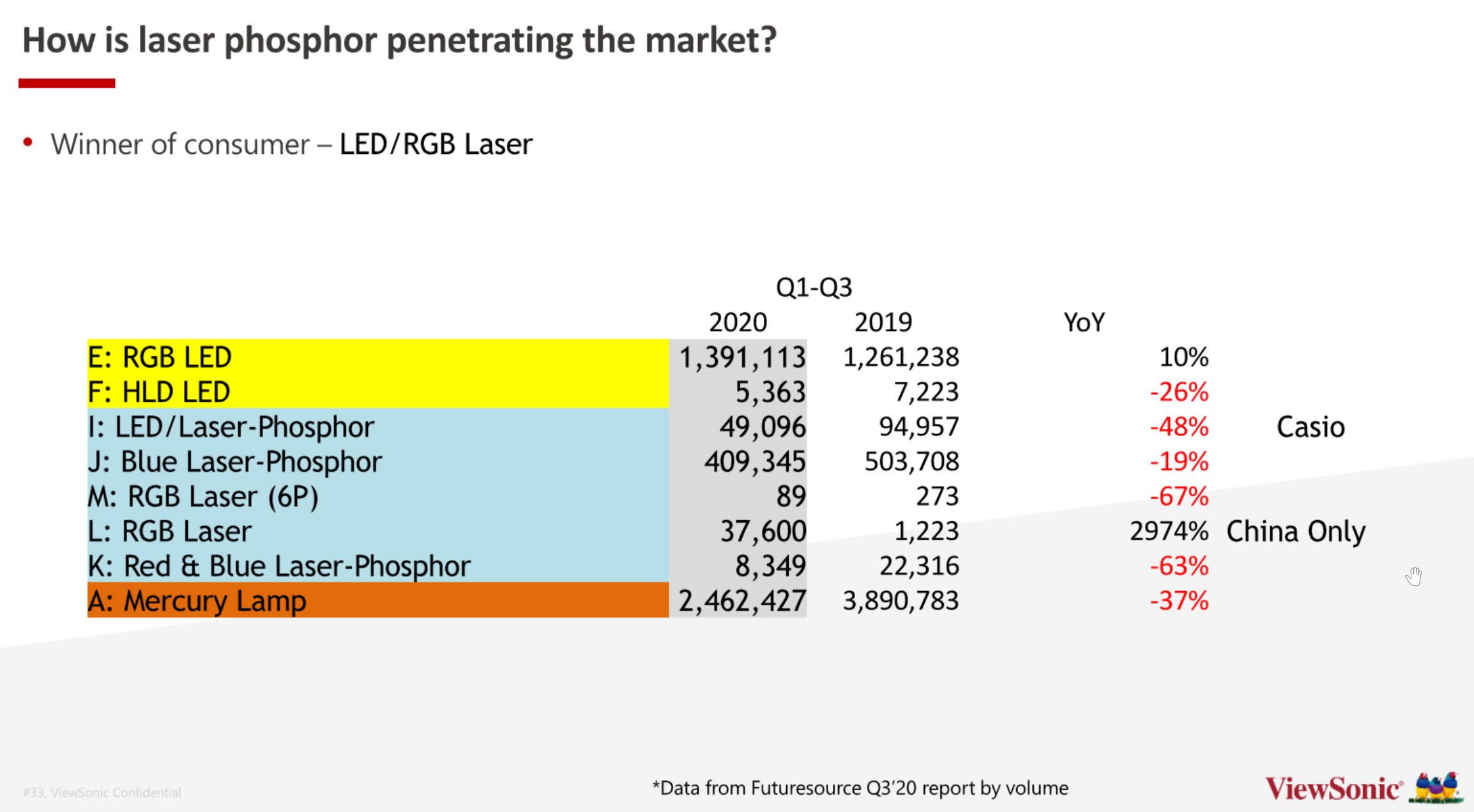

Looking at the numbers, RGB LED is up so far in 2020, by 12% to 1.367 million globally, and is the only lightsource that is growing in dedicated home (apart from RGB laser in China).

-

How is laser phosphor penetrating the market?

We have reported a lot over the years on laser phosphor projectors, but the relatively high prices make them less attractive than LED projectors, although the higher brightness than LED makes them attractive to B2C buyers. Laser phosphor is continuing to take share from other technologies in the installation market, but if LED can continue the trend to higher brightness, which means a significant increase every six months, this may change in the future, Chen believes. ViewSonic believes it will hit key performance and price breakthrough levels next year with its next range of models. (BR)