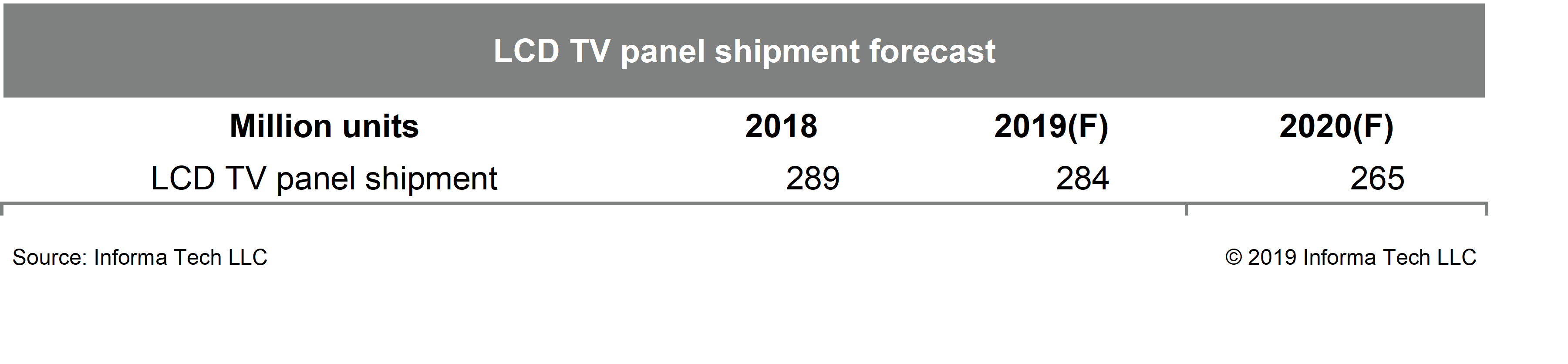

For the first time since 2011, worldwide LCD TV panel shipments are expected to decline in 2020, falling by 7 percent to total 265 million, according to IHS Markit | Technology, now a part of Informa Tech.

The 7 percent decrease represents the largest annual decline in the history of the LCD-TV industry.

The 2020 decline will come after two consecutive years of market stagnation with shipments at 289 million units in 2018 and 284 million in 2019. Market growth stopped during those years despite fab capacity expansions at Gen 10.5 and Gen 8.6 TFT-LCD facilities in China. The cessation of growth also defied the growing demand for larger LCD TV panels sized 55-inches and above.

The slower demand for LCD TV sets and the oversupply of LCD TV panels have accelerated price erosion, forcing manufacturers to curb production. Many suppliers have taken a more conservative approach by reducing fab utilization starting in mid-2019 onward and initiating more aggressive fab restructuring plans.

“Since the Chinese panel makers started their Gen 10.5 fabs in 2018, Korean and Taiwanese panel makers running Gen 7 and Gen 8 fabs have been facing tough competition in the larger-size LCD TV market,” said Peter Su, principal analyst at IHS Markit | Technology. “Due to the fast-declining prices of 65-inch and 75-inch LCD TV panels produced by Gen 10.5 fabs, they are now in a critical situation. As a result, Korean LCD TV panel makers have resorted to restructuring their LCD TV fabs, while their Taiwanese competitors have reduced LCD TV panel production and channelled resources to the production of monitors and notebook PC panels instead. This scenario is expected to lead to the big drop in 2020 LCD TV panel shipment.”

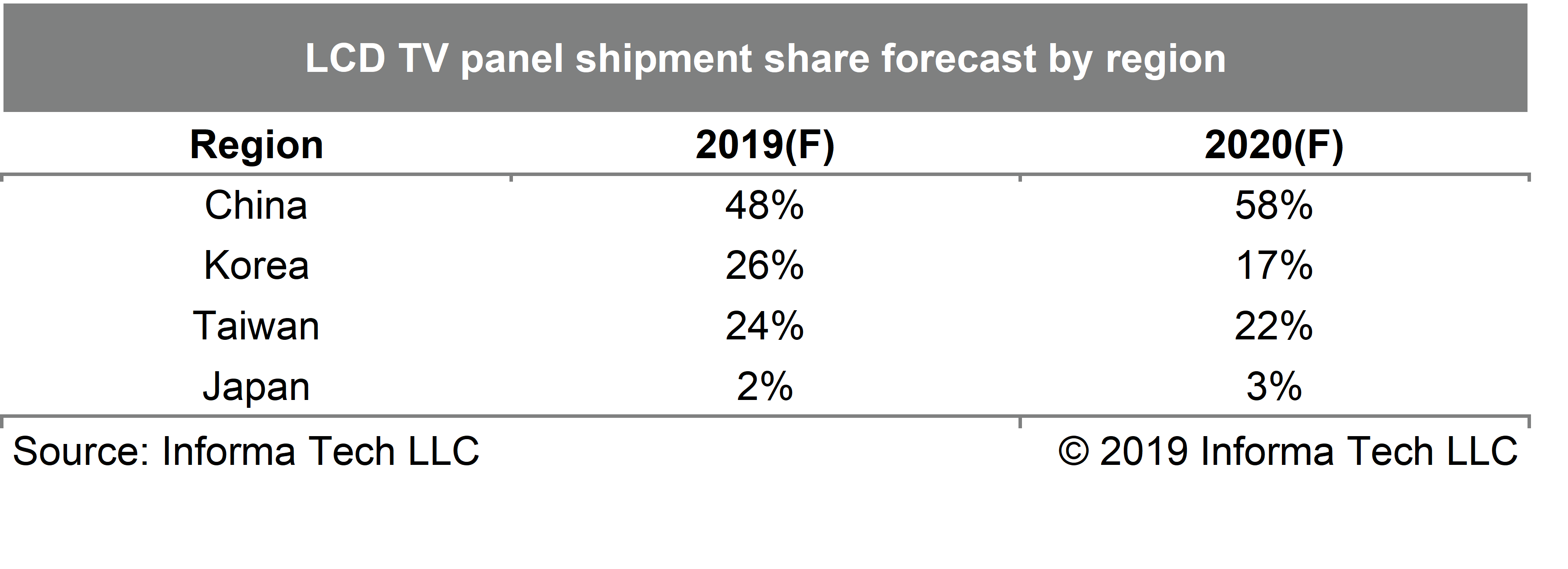

The Korean share of LCD TV panel shipments in 2020 is forecasted to decrease by about 9 percentage points compared to 2019, while the Chinese share is set to increase by 10 points. Looking at current trends, Korean LCD TV panel makers may eventually exit the LCD TV panel business, relinquishing their market share to their Chinese rivals.

???

???

“Even though the volume of the LCD-TV panel shipments has eroded, demand for larger-size panels will continue to grow,” Su added. “IHS Markit | Technology expects that 65-inch and larger LCD TV panel shipments will reach 37 million units in 2020, up from 30.6 million in 2019. However, there is a possibility of supply tightness of some panel sizes due to the shuttering of Gen 8.5 fabs that produce 49-inch and 55-inch LCD TV panels.”

Chinese electronic components producer BOE is expected to take the lion’s share of 2019 LCD TV panel shipments, at 19 percent, followed by Korea’s LG Display with 15.4 percent, and Taiwan’s Innolux, at 15.3 percent.

Chinese panel makers are likely to claim an even bigger slice of the pie in 2020. BOE next year is forecasted to extend its lead, with 21 percent of the market, while CSOT is expected to account for 16 percent of the market share. Innolux is forecasted to retain its 15 percent market share next year.

Globally, the three Chinese panel makers that are expected to rank among the top five LCD TV panel shippers in 2020 are BOE (21 percent), CSOT (16 percent) and HKC (12 percent).

The Large Area Display Market Tracker

The Large Area Display Market Tracker from IHS Markit | Technology provides information about the entire range of large display panels shipped worldwide and regionally, including monthly and quarterly revenues and shipments by display area, application, size, and aspect ratio for each supplier.