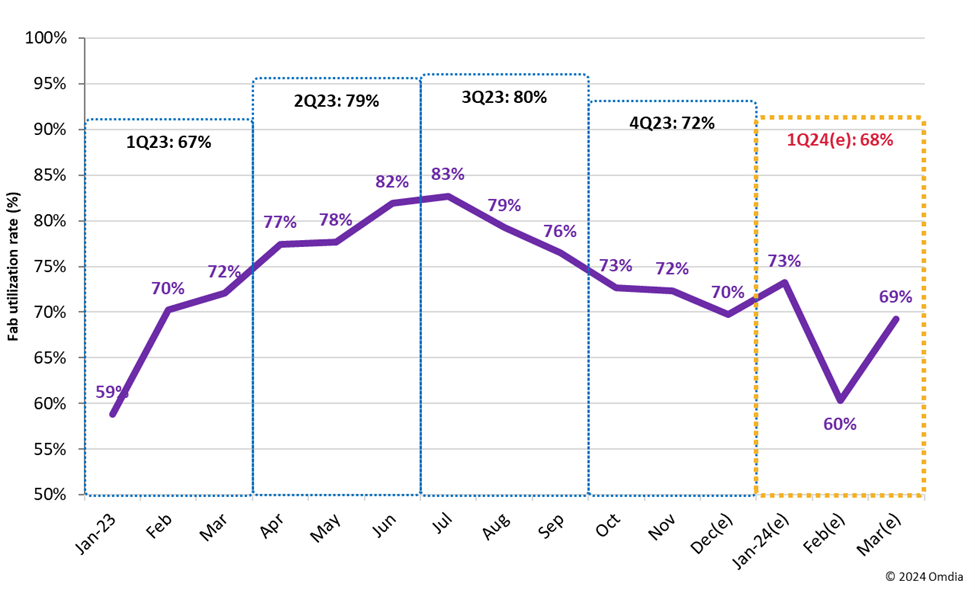

Omdia says a significant decrease in display fab utilization to below 68% is expected for the first quarter of 2024. This downturn is attributed to reduced demand at the beginning of the year and strategic measures by panel makers to protect LCD panel prices. Overall, the developments in the coming months are crucial in determining the pace of recovery in LCD TV display prices, particularly for Chinese panel makers.

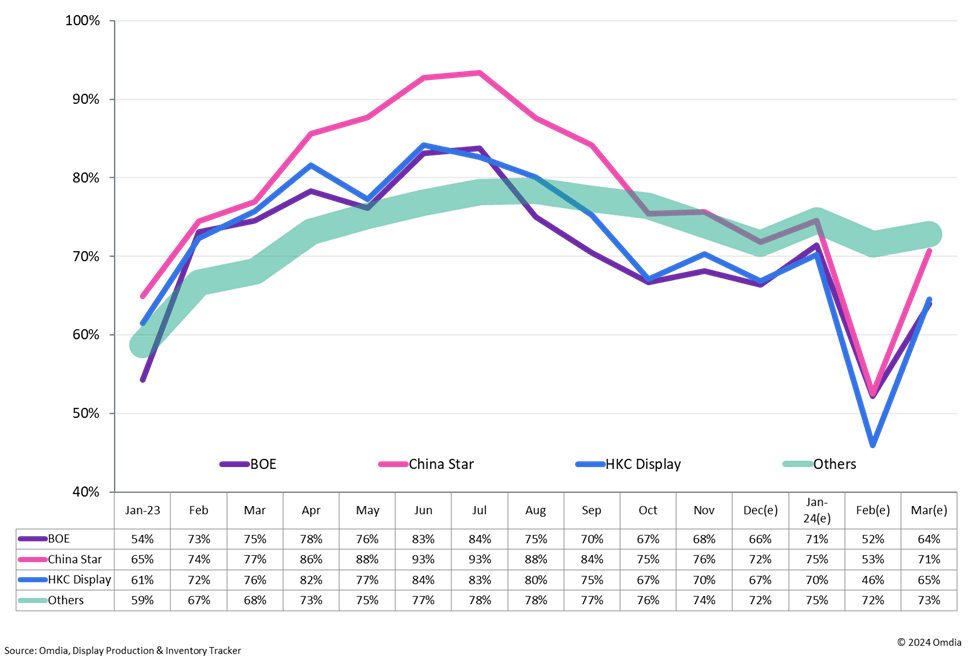

The slowdown in North American TV sales during Black Friday and Chinese Double 11 promotions in 2023 has led to an excess of TV inventories being carried into 2024. To counteract the price pressures from TV brands and retailers, panel makers, particularly Chinese firms who accounted for 67.5% of LCD TV display shipments in 2023, are planning to cut utilization further in the first quarter of 2024. Notably, China’s top three panel makers, BOE, TCL CSOT, and HKC, are leading these efforts, especially during February, which coincides with the Chinese New Year holidays. They have extended their holiday period, resulting in an average fab utilization of just 51% in February, compared to 72% for other makers.

Omdia identifies three key reasons for the confidence of Chinese panel makers in halting the decline in LCD TV display prices sooner than the industry expects. Firstly, their previous experience in managing prices through production-to-order policies in early 2023. Secondly, an anticipated increase in TV display demand from the second quarter of 2024 due to major sporting events such as Euro 2024, the Paris 2024 Olympics, and the 2024 Copa América. Lastly, the increase in shipping costs and times from Asia to Europe, influenced by geopolitical tensions impacting Red Sea routes, is also a factor considered in their strategy.