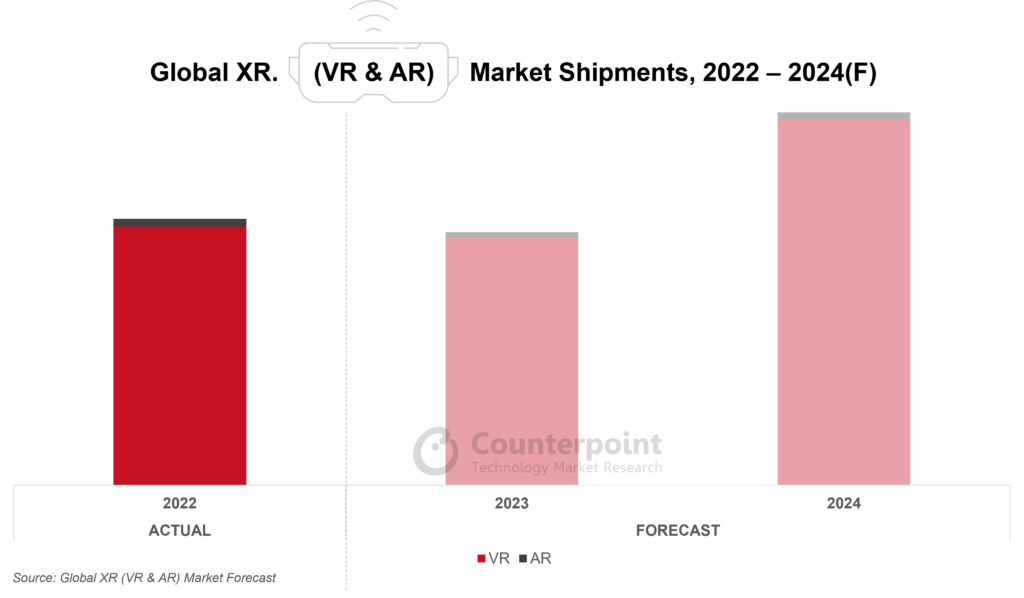

In a remarkable forecast for 2024, Counterpoint is saying the global extended reality (XR) market is expected to witness a significant surge in headset shipments, reaching a record 3.9 million units. This marks a substantial YoY increase and a growth trajectory that is being attributed to several key factors and major product launches slated for the year, including Apple’s Vision Pro.

Apple’s Vision Pro is set to hit the US market on February 2, with pre-orders beginning January 19. Counterpoint analysts are bullish on a very mspecific consumer base comprising avid Apple fans, developers, early adopters, and enterprise users driving the market. They anticipate Apple to sell about half a million units of Vision Pro in 2024, capturing a modest but significant segment of the XR market. The momentum in the XR market is also being attributed to a carry-forward from 2023, which saw releases from Meta and Sony with their Quest 3 and PlayStation VR2, respectively.

So, 2024 is expected to witness a shift from pure virtual reality (VR) to mixed reality (MR), with major players in the industry rushing to launch MR products or incorporate passthrough capabilities in their new headsets. Standalone headsets continue to be the preferred choice, although Apple’s Vision Pro will require a wired connection with an external battery case.

In terms of regional market dynamics, North America is forecasted to maintain its lead as the largest XR market, particularly with the exclusive availability of Apple’s Vision Pro in the region for most of the year. While Europe and China are significant markets, their growth is expected to be slower compared to North America.

Augmented reality (AR) is also projected to grow by 54% YoY in 2024, reversing a trend of decline observed over the past three years. This growth is primarily driven by the success of Xreal’s Air 2 and Air 2 Pro AR glasses in China. Despite this, AR is expected to contribute only about 2% to the overall XR shipments.

Counterpoint analysts also mention Samsung’s anticipated re-entry into the XR market with an MR headset in 2024. However, despite the potential traction it may generate, Samsung’s contribution to global shipment growth is expected to be less than Apple’s, owing to a later launch in the year. Pico, owned by TikTok’s parent ByteDance, is unlikely to fully recover from the setbacks of its Pico 4 in 2023. Similarly, DPVR, another significant player in the Chinese market, may struggle to emerge as a major global player despite launching its gaming PC VR headset, E4.