TV – Analysts are always looking for inflection points – moments when lines on charts start to move in different directions.I spotted a couple in the last week.

The Asus NX500 uses QDs to deliver a wide colour gamut

A small one, probably, was the first notebook to use Quantum Dots, the Asus NX500. A prototype of the unit was shown by 3M at the SID Display Week event in June of this year and the UltraHD resolution, quantum dots and optical bonding on the unit made it, without question, the best notebook display I have ever seen, by some distance. The product is a high end one and it’s unlikely to have an impact in terms of volume on the market, but to see a notebook (that I’d be happy to carry) without a compromised display was a pleasure. The enhanced efficiency of the QD technology helps Asus to avoid limiting the gamut of its display to minimise power consumption.

I hope this is an inflection point that signals that improved colour and visual performance will be a feature for notebook makers. I bought my last notebook “sight unseen”, and trusted to its IPS display, but while better than any previous notebook I’ve had, it’s the worst IPS display I’ve seen for a long time.

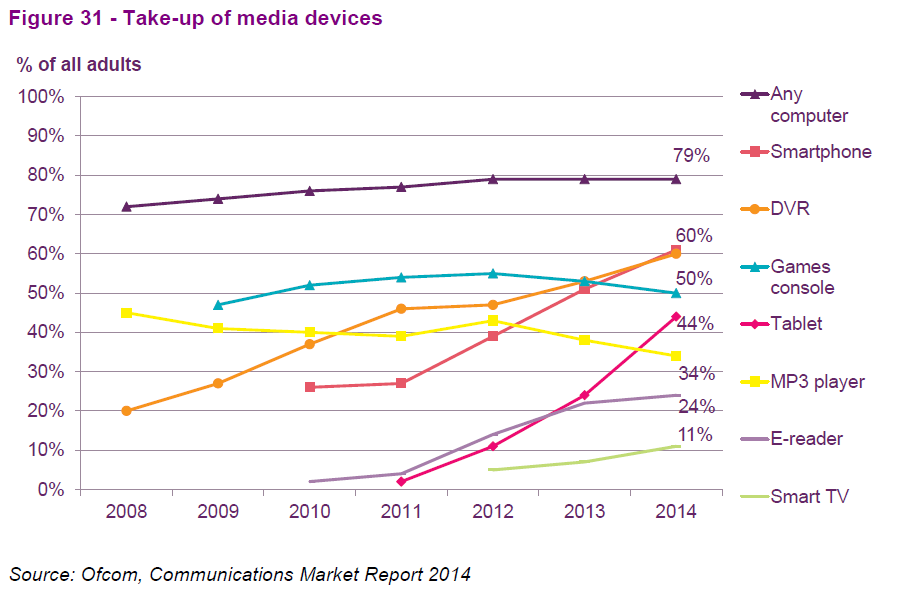

The second one is one that is local to me. The UK telecoms and broadcast regulator, Ofcom, said that according to its latest

Infrastructure Report 2014, the number of households in the UK with TVs has declined for the first time, albeit only very slightly at 26.02 million, down from 26.33 million at the end of 2012.

Several years ago, I was part of the team that prepared the DisplayCast ATV forecasts for Display Central’s publisher, Meko. In all of Europe, TVs had reached saturation, so people only bought TVs to replace old or failed sets (as Paul Gray of IHS memorably said to me once “When your TV breaks, you don’t take up reading”). Growth in the market for sets was only coming from either an increase in households (which was happening in many countries because of demographic and social issues), an increase in the number of sets per household, or a reduction in the length of time between set renewals. We had a detailed model based on these parameters to estimate market growth.

A couple of years before the arrival of tablets, we were forecasting set market growth based on a combination of household growth, shorter refresh times (driven by price reductions and the switch to digital and flat panel technology) and an increase in the number of sets per household.

The number of sets per household varied a lot across the region, with the UK in the top spot, if I remember correctly. We expected that more countries would move to become multi-set households as sets became cheaper, people got wealthier and there was more and more consumption of “Multi-channel” TV.

The last assumption was the first to come under pressure when the iPad started the move to tablets for video consumption. The TV market was first hit by a drop in small set sales. However, we were confident that while mobile devices might well displace second TVs, they wouldn’t displace the main set in the home. That now seems to be under question, with Ofcom reporting that “There are now nearly one million homes with broadband but no TV. Catch-up content in particular is growing in importance and being consumed on devices such as tablets, smartphones, computers and games consoles”.

The big question, then, is where this leaves TV set makers as they look for market growth. With a slowdown in population and household growth, the only real variable left to play seems to be refresh frequency. That suggests that we can expect an even more frenzied bombardment of consumers with reasons to upgrade their TVs, with UltraHD only the start. On the other hand, if wide colour gamut, high dynamic range and high frame rates are the result, you won’t find me complaining! – Bob Raikes

Ofcom in the UK published this useful data

The Ofcom report is an interesting document, although I haven’t worked my way through all 192 pages of it!