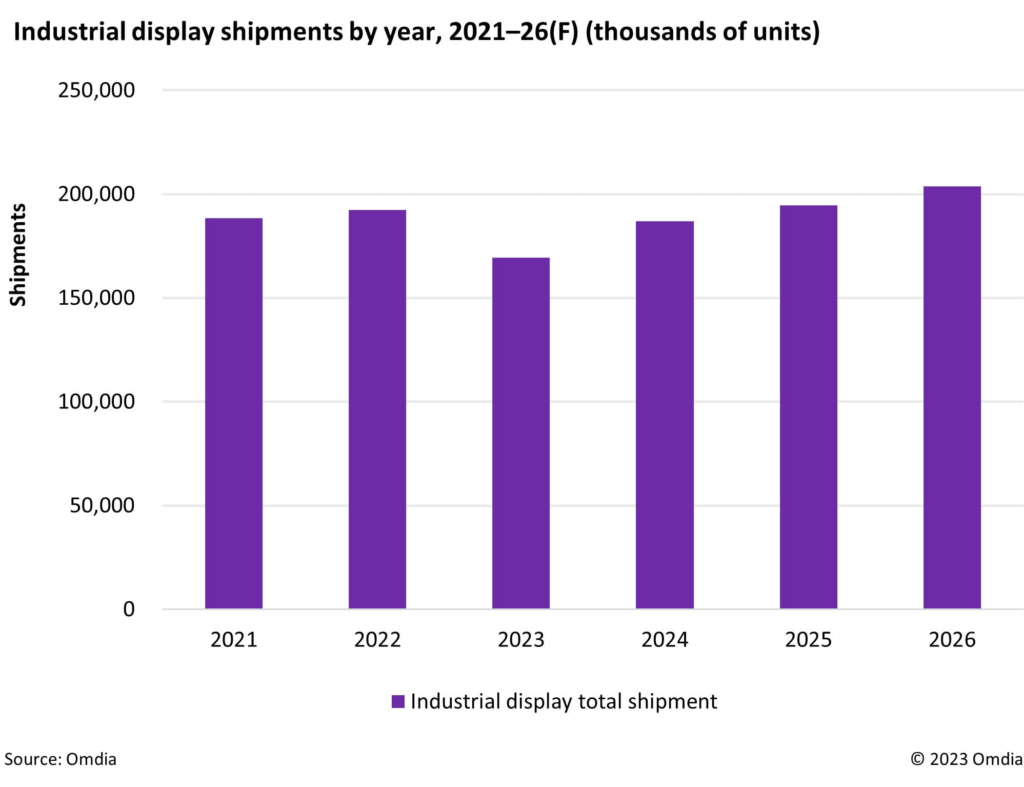

Shipments of industrial displays are expected to fall 8.8% year-over-year (YoY) to 355 million units in 2023 due to issues like overbooking, inflation, and high inventory levels, according to the latest research from analyst firm Omdia. However, a rebound is likely from 2024 onwards. Omdia forecasts 10% YoY shipment growth for the market in 2024 as demand starts to recover more steadily in the second half of this year.

Thin-film transistor liquid crystal display (TFT LCD) remains the dominant display technology for industrial applications, expected to account for 48% of total shipments in 2023. The rest is made up by technologies like passive-matrix OLED (PMOLED), PMLCD, active-matrix OLED (AMOLED), and EPD.

TFT LCD industrial panels still mainly range from 1-inch to 27-inches in size, with over 50% being 10.1-inches or smaller. Customization is extremely high to meet different environmental needs.

Chinese display makers are forecast to lead global market share with 59% of industrial display shipments in 2023. Major players include Tianma, BOE, Innolux, AUO Display Plus (ADP), and Truly.

“Korean and Chinese panel makers have been actively investing into AMOLED, eyeing opportunities not just in consumer IT but also industrial displays for applications like home appliances, gaming, translation pens, and in-flight entertainment,” noted Omdia Principal Analyst TzuYu Huang.

While TFT LCD remains dominant for now, the firm sees potential for AMOLED penetration into more industrial segments over time. Still, ongoing TFT LCD innovation for verticals will stay important to drive business, Huang concluded.