During the COVID-19 pandemic, many Indian consumers purchased their first smart TVs, particularly at 32-inches. Now, they are opting for larger screen sizes, especially 43-inch and 55-inch models. In the first half of 2023, the demand for larger smart TVs (55 inches and above) surged by 18% YoY even as the total market declined 5%. According to Counterpoint, those looking to upgrade their smart TVs are increasingly seeking premium products with enhanced features.

The share of smart TVs in overall shipments reached a record high of 91% in the first half of 2023, a trend expected to continue due to increased broadband penetration and the growing popularity of OTT (over-the-top) platforms. OTT services have played a significant role in driving smart TV growth, offering popular sports events, TV series, and movies, thereby creating consumer loyalty. Both OTT services and smart TVs provide an improved viewing experience, thanks to advanced display technologies and features like Dolby Atmos and Dolby Vision.

Dolby Audio surround sound has become a standard feature for smart TVs, and an increasing number of models now support both Dolby Atmos and Dolby Vision. These TVs are available at prices starting from INR 20,000 ($240). With the upcoming festive season and the broadcast of major sporting events on OTT platforms, Dolby’s penetration is expected to grow in the smart TV segment.

QLED TVs are gaining popularity in the mid-segment (INR 30,000-INR 50,000 or $360-600) as more brands introduce affordable QLED models with smaller screen sizes. QLED TV shipments grew by over 21% year-on-year in the first half of 2023, and their contribution to overall smart TV sales is projected to rise further.

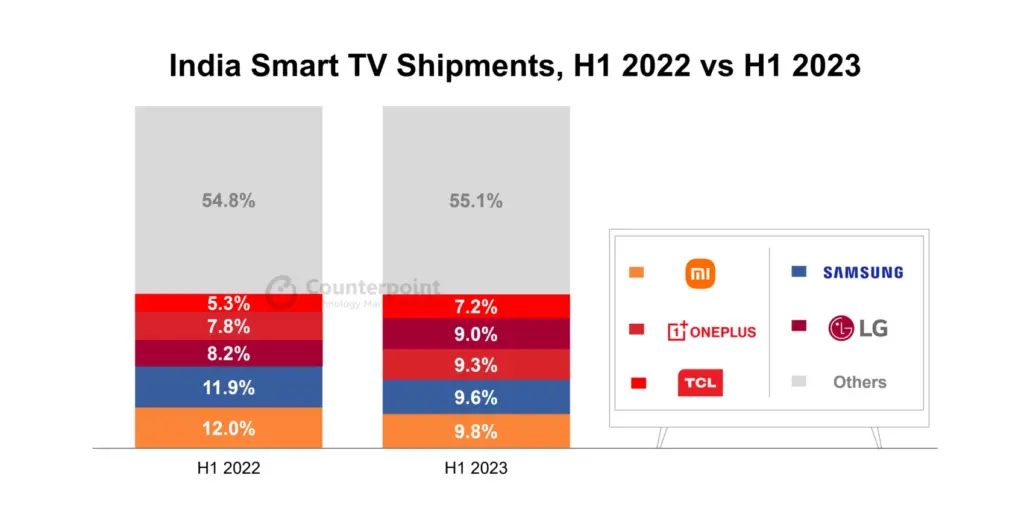

Xiaomi continued to lead the smart TV market with a 10% share, introducing various series during this period. Samsung secured the second spot by launching new models in its QLED and Crystal 4K series, along with attractive promotions. OnePlus ranked third, experiencing rapid growth, and launching the QLED TV Q2 Pro. LG took the fourth position, introducing multiple OLED models and promotions. TCL ranked fifth and experienced significant growth by launching new models and hosting contests.

Established players like Xiaomi and Samsung face increasing competition as other brands expand their reach, especially in offline markets, offering products at various price points with enhanced features. The Indian TV manufacturing industry is on the rise, with OEMs investing in manufacturing capacity. Newer OEMs are also entering the market, partnering with leading brands to produce TVs.

Consumer preferences are shifting towards premium TVs with larger screens and better features. However, the INR 10,000-INR 20,000 ($120-240) price range continued to dominate with a 37% share of the overall smart TV market in the first half of 2023. Shipments for entry-level budget TVs (below INR 10,000) more than doubled, catering primarily to first-time buyers.

It is estimated that India’s smart TV market will witness a 7% YoY decline for the whole of 2023, with the second half of the year showing increased shipments due to the festive season. The market is expected to return to normal growth in 2024, with an estimated 10% YoY increase. The increasing preference for premium TVs is anticipated to drive the overall market’s average selling price higher.