India has set up a program to develop semiconductor and display fab ecosystem. It is in line with the India’s prime minister Narendra Modi’s vision to make India a technological hub of the world. India is new to electronic manufacturing and lacking the ecosystem for supply chain developments. It will take many years to set up manufacturing fabs. With geopolitical shifts in electronics supply chains and India government’s targeted policy for display fabs and major financial support, India has the potential to be the fifth manufacturing country for display.

India’s Vision: Position as a Global Hub for Electronics System Design and Manufacturing (ESDM)

India’s ministry of electronics and information technology (MeitY) announced a scheme for setting up of Displays Fabs in India. In their announcement in December 2021, India specified the reasons for developing ESDM hub. Growth in manufacturing for India so far has been mostly “final assembly” using imported components and sub-assemblies/parts. This is due to lack of a robust semiconductor and display manufacturing ecosystem. Display is a significant portion of the total bill of materials (BoM) of electronics products. India currently meets its display requirements exclusively through imports. The Indian government recognized that the electronics component manufacturing sector suffers varieties of issues:

- Lack of adequate infrastructure, domestic supply chain and logistics

- High cost of finance

- Inadequate availability of quality power

- Limited design capabilities

There is also need to focus on R& D and adequate skill development. The Indian government decided that given the state of the ecosystem and capital-intensive nature of display manufacturing, there is a need to incentivize the industry to set up display fab facilities in India. It will also strengthen the electronics manufacturing ecosystem in the country. Being the fifth largest economy now, India has the ambition to become a major semiconductor hub alongside US, Taiwan and South Korea. It has the vision to be the fifth country for display manufacturing along with China, Korea, Taiwan and Japan.

India’s Plan: A Modified Support Program for Display Fabs Set Up

A modified program for semiconductors and display fab ecosystem was approved in September, 2022 by Government of India with the vision of Atmanirbhar Bharat (Self-Reliant India) and positioning India as the global hub for ESDM, with an outlay of over $9.2 billion. Fiscal support from Government of India includes:

- Demand Aggregation Support: Display Fab(s) set up in India will be supported through purchase preference in procurement of electronic products by the Government under the Public Procurement (Preference to Make in India)

- Support for R&D, Skill Development and Training: Up to 2.5% of the outlay of the scheme shall be earmarked for meeting the R&D, skill development and training requirements for the development of display ecosystem in India.

- Tenure of the Scheme: Support under the scheme shall be provided for a period of six years. The tenure of the actual fiscal support outflow may be extended based on the approval of the Minister of Electronics and Information Technology.

- Capital Expenditure: Investment incurred in Building, Plant, Machinery, Clean rooms, Equipment and Associated Utilities. Investment incurred on R&D. Investment related to Transfer of Technology (ToT) Agreements. Investment incurred on Land

India has detail guidelines and notifications for this scheme: “The Modified Schemes for Setting up of Semiconductor Fabs and Display Fabs in India shall extend fiscal support of 50% of project cost on pari-passu basis to applicants who are found eligible and have the technology as well as capacity to execute such highly capital and resource intensive projects. Government of India will work closely with the State Governments to establish High-Tech Clusters with requisite infrastructure in terms of land, semiconductor grade water, high quality power, logistics and research ecosystem to approve applications for setting up at least two greenfield Semiconductor Fabs and two Display Fabs in the country”.

While central government in India is giving 50% in subsidy, some of the state governments are offering 40% to 50% of what central government is giving. Several state governments like Gujarat and Uttar Pradash have published their own semiconductor policies also. Depending on the state the applicants may get water and electricity at a highly subsidized rate and land, too. Adding it all together companies may be able to get 70% to 75% of their set up costs in subsidy from Government of India.

Vedanta’s Vision: Starting the First TFT LCD Manufacturing Fab in India

In July, 2023, Vedanta Limited, India’s leading natural resources and technology conglomerate announced the addition of semiconductors and display glass manufacturing ventures to its diversified portfolio. Earlier, in Sep 2022, the two businesses had signed Memorandums of Understanding (MoU) to set up the semiconductor and display fabs in the western Indian state of Gujarat. At that time, it was announced that the project will be taken up by Vedanta-Foxconn joint venture. Foxconn has withdrawn from semi-conductor joint venture with Vedanta in July, 2023. Vedanta is still optimistic about its vision of setting up semiconductor and display fabs and planning to start the set up after Indian government approval. MeitY has also opened up application for the support program.

Vedanta group has Avanstrate Inc manufacturing Gen 4 to Gen 8 TFT display glass in Korea. The facility also serves as the company’s R&D center, working on developing wafer glass, ultra-thin glass, next gen cover glass and AR/VR glass applications. Y.J. Chen, CEO of Vedanta’s display business, said, “This is India’s time to become only the 5th country in the world to manufacture display glass. The impact on consumers in terms of affordability of devices will be huge.” Chen has 23 years of experience in display industry, and he worked previously with HKC Corp. He said in an interview that display venture will soon begin recruiting from South Korea, Taiwan, Japan and other regions to set up LCD panel fab in India. Vedanta has signed MoUs with 20 South Korean firms to establish an electronics manufacturing hub.

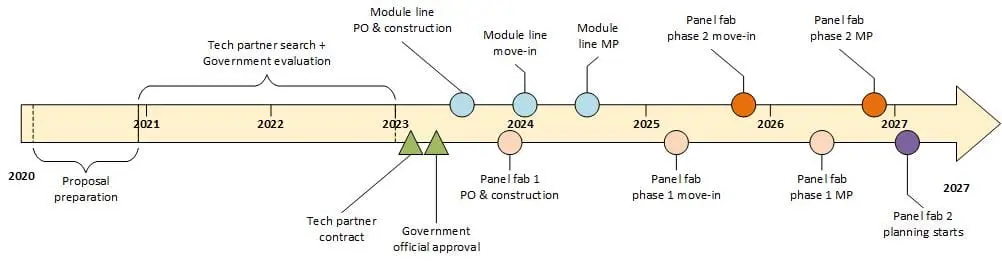

Innolux: TFT LCD Technology Transfer Partner for Vedanta’s Fab

On February 2023, Innolux, the display supplier from Taiwan made a public discloser that it has reached an agreement to transfer TFT LCD panel and module technology to Vedanta. Omdia’s blog in February, 2023 written by Charles Annis said, “The factory will be India’s first integrated flat panel display factory including both TFT, color filter, and cell frontplane processes as well as module assembly. The fab is likely to adopt Gen 8.6 or 2250 x 2600 mm substrates. A capacity of 60,000 substrates per month is currently assumed. Vedanta engineers are already involved in on-site training in Taiwan. Innolux presumably will receive a one-time technical transfer payment and then collect ongoing royalty payments per display when mass production begins”.

As per July 12, 2023 DigiTimes article, “Innolux has said its plan to join hands with the Vedanta Group to establish the first TFT LCD production line in India with mass production capacity remains unchanged”.

Implication: For India and Display Market

Sudarshan Kundu consultant to government of India MeitY, said in an interview, “For India it will benefit in terms of lowering the import of LCDs. It will generate tens of thousands of direct and indirect employments. Technological research quality will improve and innovation will improve”. With geopolitical shift of supply chains where many of the top brands diversifying and shifting away from China, India can provide huge advantage by being in the center of the globe, geographically. It can also help to import raw materials from Asian countries. In the global market LCD is losing shares to OLED. Top display suppliers such as Samsung and LG Display have shifted away from LCD with fab closures. Published news in India in June 2022, said that a 6th Gen AMOLED fab will be set up under India Semiconductor Mission (ISM) in state of Telangana. There has been no update on this project recently. An OLED fab in India will be possible with appropriate technology transfer partners.

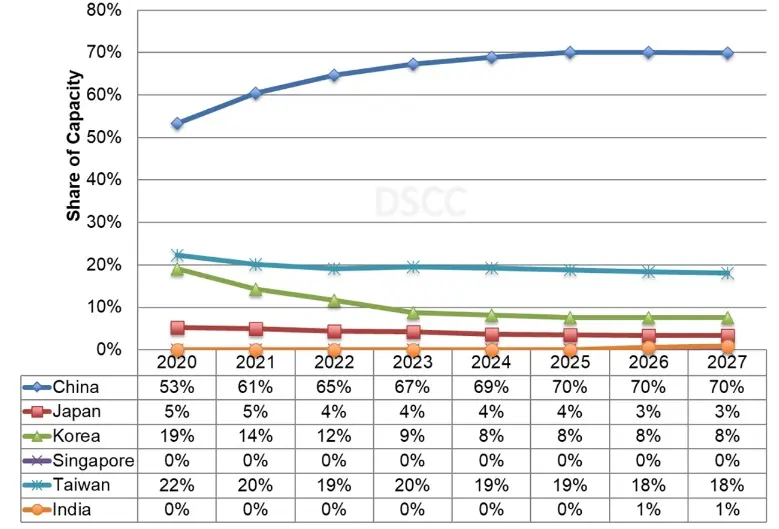

A blog post from DSCC’s Ross Young in June, 2023 pointed out that as per frontplane technology:

- LCD capacity will remain significantly higher than OLED capacity throughout the forecast period despite significantly faster growth for OLED, 6.3% CAGR from 2021 to 2026 vs. LCD at a 1.6% CAGR.

- OLED capacity is projected to reach a 10.1% share in 2027, gaining share every year

- China is expected to dominate display capacity, growing from a 61% share in 2021 to a 70% from 2025-2027.

- India is expected to invest from 2025 through Vedanta and reach a 1% share in 2027.

Development of display ecosystem will need capital, commitment, cooperation and partnership of many companies as well as strong support from central and state governments of India. It will also take many years to make it successful. India can also consider new technology such as MicroLED to make it a hub for next gen display technology.

Sweta Dash is the founding president of Dash-Insights, a market research and consulting company specializing in the display industry. For more information, contact [email protected] or visit www.dash-insights.com