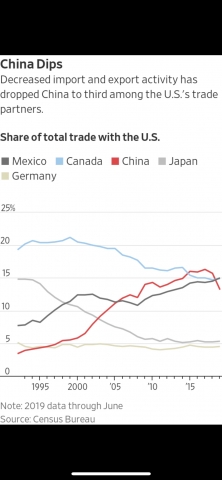

In case you missed it, the ongoing trade spat between the US and China, the world’s largest communist nation (yep – wonder why we don’t often see this in print?) has resulted in a 12% drop in overall US imports and removed China from top US trading partner status, a position that country has held since 2005. Meanwhile, both Mexico and Canada imports overtook Chinese products shipped to the USA, so China is now relegated to number 3.

US exports to China have also dropped by 19% as (arguably) two of the three largest global egos (ummm that would be Xi and Trump) jockey for position as trade negotiators from both nations grind on. (As an aside, that has got to be one of the least desirable jobs on the planet right now, as rumors circulated in May that the N. Korean trade negotiators working for the only ego bigger than Xi or Trump, were actually shot – Dang, hard day at the office, honey.)

So what will be the affect of all this tariff positioning for LCD panels (TVs et al) here in the US?

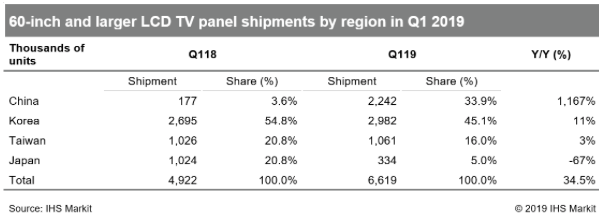

For one IHS is reporting Chinese panel makers are accelerating the mass production of large TFT liquid crystal display (LCD) TV panels faster than expected, and have already grown to almost 34% (33.9) of the plus 60-inch panel shipments in Q1-19 and growing. That’s a whopping 10X expansion in just one year according to IHS data. The firm was quick to point out that South Korean fabs are still dominant in the large panel category, with a market share of 45.1% in Q1-19.

Source: US Census BureauThis rapid growth may have even taken China by surprise, according to principal analyst at IHS Markit Robin Wu,

Source: US Census BureauThis rapid growth may have even taken China by surprise, according to principal analyst at IHS Markit Robin Wu,

“When BOE’s B9 10.5G fab started its mass production in the first quarter of 2018, the industry expected that its full ramp-up would take quite a time due to a learning curve. However, it did not take as long and BOE has become the largest supplier of 60-inch and larger LCD TV panels since the end of 2018.”

Just as Large China Fabs come on line

In large LCD TV panel shipments, IHS reported Beijing, China based BOE gained a 29% market share of the total 60-inch + size in Q1-19 with its 10.5G fab running at maximum capacity (that’s 120K sheets in Q1.)

CSOT (China Star) also started mass producing at its 10.5 G fab in the first quarter and CEC-Panda, and CHOT cranked up their two 8.5G fabs.

Next up is the Foxconn/Sharp China fab in Guangzhou, scheduled to ramp their 10.5G scale fab sometime in the second half of this year, assuming no disruptions due to demand shifts resulting from the trade tariffs.

Even before US China trade became an issue, IHS saw the coming competition between China and Korea for the large TV market heating up. “As both Chinese and South Korean panel suppliers are focusing on large LCD TV panels, competition between them will become more intense, pressuring the price of large LCD TV panels even further throughout 2019,” IHS analyst Wu said.

The IHS Market report said BOE led the unit shipments of large (9-inch and above) TFT-LCD panels with a 24.6% share in the first quarter of 2019, followed by LG Display (18.8%) and Innolux (16%). That’s a total of 178.3M units in Q1-19 tacking down by about 1% year over year (from 2018 Q1 numbers.)

By area shipments, LG Display accounted for the largest share of 20%, followed by BOE (19.9%) and Samsung Display (14.1%). That represents an area shipment increase of 6.7% year over year, to 49.1M square meters during the same period (2018 Q1 numbers.)

So careful what you wish for, just as large fabs and billions of Chinese Yuan has been invested in making outstanding AM LCD panels demand for those TV sets may be affected by a new round of tariffs. At this point, it appears that at least in TVs, the biggest (short-term) winner in the trade battle between US and China is going to AMLCD fab rivals in Korea, that would be LG and Samsung. Stephen Sechrist

Chinese Panel Makers Starting to Dominate Large LCD TV Panel Market, IHS Markit Says

Large Flat Panel Display Supply and Demand Expected to Tighten by Q3 2019, IHS Markit Says

Gartner Says Global Device Shipments Will Decline 3% in 2019