For while now, it has been clear that ‘the Chinese are coming’ to the LCD business. Recently, we hit one of those ‘inflection points’ that analysts like me are so keen on.

Our friends at IHS recently reported that BOE of China was the biggest supplier of large LCDs in the market in Q4 2016, at least if you count on a volume basis. On other measures, such as by square metres, or by revenues, they are still well behind LG and Samsung (who make more of the big TV displays, while BOE makes a lot of monitor and smaller TV panels) but still, it’s a notable point.

Looking back over the history of the TFT LCD industry, it started in Japan and that development was picked up in Korea. The Koreans started to get very strong and after Taiwanese notebook and monitor makers got into difficulty during the Asian financial crisis, because they couldn’t easily buy the panels that they needed, the Taiwanese government supported the industry in that country to establish a supply chain.

There are a Lot of TV Buyers in China

China has a lot of TV viewers and buyers, so it has a strong TV set business, with Changhong, Haier, Hisense, Konka, Skyworth and TCL representing about a third of the global TV set business. As a result, China has had to import a lot of LCD panels from Taiwan and Korea. There were two effects of this. First, LCDs became a huge import item and they were one of the largest value items for China to bring into the country. Further, much of the value of a TV is from the panel, so much of the value in the TV business was flowing out of China.

China had already seen a very negative feature of its success in assembly. When Foxconn was making early smartphones for Apple, the US company was taking a lot of the value for the design and marketing. Japanese and other suppliers were taking a lot for the displays and touch panels. US and Taiwanese companies were taking a lot of money for the chips. Companies all over the world were collecting money for patents. As a result, very little got left in China. As China wants to build more jobs and high technology, it wasn’t keen on this arrangement.

So, the Chinese government has been encouraging huge investments in the building of LCD fabs to supply the local TV makers. Much of the support has also come through local government direct investments and ‘soft loans’ to help the industry to invest. The cost of capital is a big factor when you are investing in multiple billions, so very cheap capital has made a big difference.

Chinese Companies Exploit the Support

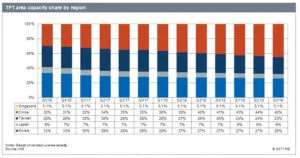

Consequently, companies such as BOE, CEC and CSOT have been able to start in the LCD business and develop to the point that by the end of 2016, as we’ve seen, BOE had risen to the top by volume. Chinese capacity is now the biggest on a regional basis, at 31% compared to 29% for Korea according to IHS in Q4 2016. However, as the song says “you ain’t seen nuthin’ yet”.

There is a shortage in the market at the moment, because Korean and Taiwanese companies have changed or delayed investments, but the Chinese investments haven’t yet come to fruition. They will come into operation in 2018 when huge new fabs from BOE, CSOT and HKC will come on stream. These are based on Gen 10 and 11 technology which, so far, has been the exclusive province of Sharp. Although Samsung and LG have talked about the possibility of building such fabs, they haven’t, so far done it (and Samsung never will, in my view). LG and Sharp/Foxconn might also invest in big new plants in China.

As a result of the confirmed investments so far, 40% of the capacity of the TFT industry will be in China by 2018 and IHS believes that by 2020 there will be 15 fabs at Gen 8 or above. At around that time, China could have half the LCD capacity in the world.

So when anybody says to you that ‘the Chinese are coming’ you can tell them that they are behind the times. The Chinese are here!

Bob