The global smartphone market continues its recovery, with the top three Chinese OEMs posting impressive gains according to IHS Markit. Samsung continued to lead the pack in smartphone shipments during the first quarter of 2017, shipping 79.1 million units. That is an increase of 0.1% year-over-year. Apple is in the second spot, shipping 50.8 million phones, down 0.8% from a year ago.

Chinese manufacturers captured seven of the eight remaining spots in the top ten. Three Chinese OEMs also posted the biggest year-over-year gains including Oppo, which shipped 28.1 million phones, up 67.3%; Vivo, with 22.5 million units for a gain of 56.3%; and Huawei, with 34.6 million units, up 21.7%. Device manufactures shipped 338.9 million units in the first quarter of 2017, up 5.6 percent from 320.9 million units in Q1 2016.

Demand for Older Smartphone Models Remains Strong

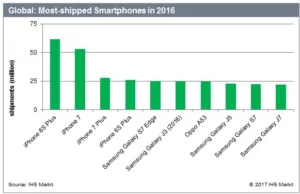

Looking at the fourth quarter alone, the new iPhone 7 was the 2016 best-seller, followed by iPhone 7 Plus, based on research from the IHS Markit Smartphone Shipment Database, which tracks quarterly shipment data for more than 350 smartphone models.

Apple again has demonstrated that its new iPhones integrate enough innovations and new features to drive sales and remain successful in the market. The company also is capable of selling older devices for an extended period; for instance, the year-old iPhone 6s and 6s Plus both were among the most-shipped models in 2016.

The Samsung Galaxy S7 Edge and S7 ranked fifth and ninth, respectively. The two devices have outperformed their immediate predecessors, S6 and S6 Edge: the combined shipments of S7 and S7 Edge in 2016 were 10 million higher than S6 and S6 Edge over the same period.

The Note 7 recall forced Samsung to keep the S7 and S7 Edge, released in March 2016, as the company’s premium flagship devices for much longer than usual – competing with other rival flagship devices released since March. Samsung’s ability to drive sales of older premium devices was impressive. Aggressive promotions, which included bundling with Gear VR, helped sales of S7 and S7 Edge.

Samsung Ships Five Of The Top Ten Smartphones

Samsung claimed five spots out of the top 10 most-shipped smartphones in 2016. Excluding the aforementioned S7 and S7 Edge, the remaining three models all belong to its mid-tier J series. The company has seen shipment unit gains in the mid to low-tier segment, relative to 2015, due to growth in emerging markets.

Huawei, the third largest smartphone maker after Apple and Samsung, did not have any models in the top 10 most-shipped smartphones in 2016. Similar to Samsung, Huawei continues to address multiple smartphone pricing segments – either with its own Huawei-branded handsets or with those of its sub-brand, Honor. In the premium segment, Huawei’s P9 was among its own top-five most-shipped smartphone models in 2016, performing better than previous flagships.

Chinese manufacturer Oppo had one model in the top ten ranking. In 2016, Oppo posted growth of 109 percent in smartphone shipments to become the fourth largest smartphone maker in terms of unit shipment, up from the seventh spot in 2015. Unlike Huawei, Oppo has a smaller product portfolio and operates in fewer markets, with more than 80 percent of the company’s 2016 shipments within its home market of China.

Analyst Comment

It wasn’t just Samsung that had a lot of models in the top 10 in 2016 – Apple had four in there as well, and the top four, so only Oppo had one model that crept into the chart at #7. As I have mentioned before, one of Apple’s core strengths is not just that it has successful products, it also has very, very few products and in smartphones, they are all top sellers. (BR)