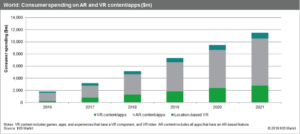

There was good progress in the combined VR/AR market in 2017, as a growing user base invested in more content, apps and out-of-home VR entertainment. The global market for consumer AR/VR content and apps grew by 72%, reaching $3.2 billion in 2017, according to IHS Markit. Research and analysis director Piers Harding-Rolls said:

“The consumer AR market is inherently better positioned than VR, because AR features are relevant to a wider cross-section of content and application categories. A smartphone-driven AR market offers a huge addressable audience but this scale will be offset to an extent by the more limited use cases for handheld and small-screen dedicated AR experiences. Even so, consumer AR’s overall market potential will significantly outweigh VR over the next five years”.

The market for consumer VR remains relatively niche but continued moderate headset adoption is expected over the next few years as hardware prices drop, technology improves and content becomes more appealing. However, with limited adoption of high-end PC and console VR headsets so far, many independent VR content companies selling content directly to consumers have found it difficult to realise a return on their investments. According to the report, market performance for AR/VR was underpinned by the following factors:

- The continued popularity of apps that include AR features across genre categories like entertainment, games, retail, social and communications. Spending on apps with AR features reached $2 billion last year.

- High-profile releases of Apple’s ARKit and Google’s ARCore SDKs that spurred interest in AR apps—the installed base of Apple’s ARKit devices alone reached 375 million in 2017.

- An increase in VR content spending, due to more high-end headsets active in the market. The installed base of all forms of VR headset reached 28 million in 2017, up from 18 million in 2016.

- The release of a limited number of big-budget console and PC games with VR modes, such as Capcom’s Resident Evil 7: Biohazard, which helped stimulate consumer interest in VR.

- A significant increase in location-based VR venues. By the end of 2017, there were 8,945 venues globally where consumers could pay for VR content and experiences, up 52% from the previous year.

Harding-Rolls continued:

“Consumer use of AR technology will be dominated by smartphones over the next few years. AR headsets are making progress but we expect to find early consumer traction within niche applications, such as training for sports and drone flying but not as devices for general use”.

The consumer VR headset market continues to grow but at a relatively sedate pace. Adoption of high-end VR headsets in 2017 was hampered by the cost of equipment and a lack of standout content, while the potential of the smartphone-based sector was undermined by limited support for Google’s new Daydream platform. Additionally, smartphone vendors spent the year pushing other features to sell their high-end phones—particularly screen and camera technologies—and not VR headsets.

The global consumer VR headset installed base reached 28 million at the end of 2017 but by 2021, that number will rise to 75.7 million. Consumer spending on VR headsets reached $2.4 billion in 2017 and is forecast to rise to $5.9 billion by 2021. Harding-Rolls concluded:

“Consumer spending will be driven by continued adoption of PC, console and standalone headsets, offset by a reduction in headset prices”.