The IFA organisers and the GFU trade association always holds a pre-IFA press event when they talk about the ‘big picture’ developments in the market and highlight changes in the show organisation.

Hans-Joachim Kamp of the GFU started by saying that when it was first suggested, there was a lot of scepticism about including domestic appliances in the products presented at IFA, but now iFA is the biggest home appliance event in the world and the organisers want the show to continually develop.

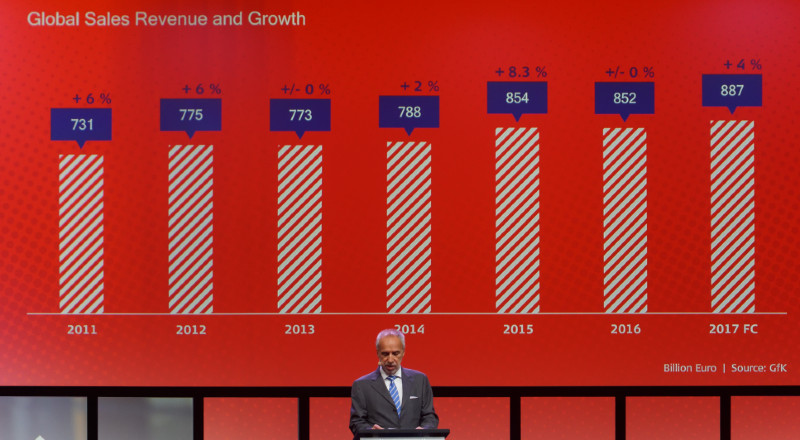

Consumer electronics is seeing 4% growth globally to €887 billion this year and companies are making some profit again after a difficult period.

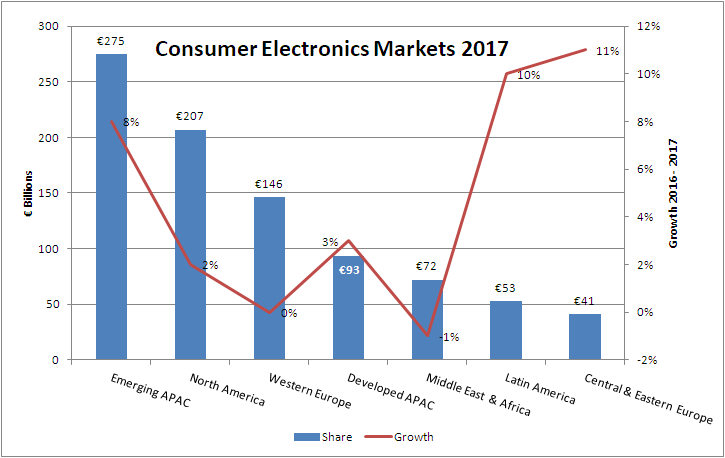

Regionally, Asia is in the lead followed by North America and Europe. The growth is highest in Eastern Europe and then Apac.

CE Markets Forecast 2017 – Data GFU/GfK – Image:Meko

CE Markets Forecast 2017 – Data GFU/GfK – Image:Meko

The GFU is optimistic about the development of UHD TVs and sales are growing by 40% this year with sales of 75 million globally and 29% of all sets in the first half of 2017 having the high resolution. OLED is growing with 1.2 million sets this year, up 122%.

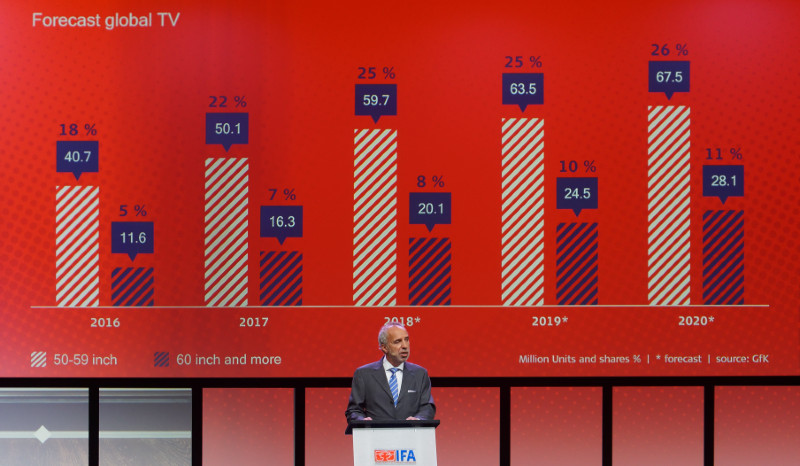

Large sets are taking an increasing share (see our report on the IHS event at the show for more on this topic IHS Updates on UltraHD). The GFU expects to see 66% growth to 2020 in the largest sizes of TVs and average screen sizes to keep increasing to 46.7″ over the forecast period to 2020 from 42.2% in 2016 and 43.7% this year. 2018 will see an average size of 45.2″.

Smartphone sales are 1.5 billion and is the largest category with 5% growth expected. 347 million pieces were sold in Q2 and that was up on last year. Wearables are now 161 million units globally, an increase of 38%. Wearables will become important not only for fitness, but also for medicine. the GFU believes.

Digital Still Cameras (DSCs) on the other hand continue to decline, while action cameras are growing with 9% this year to 11 million units – not far off 50% of the DSC market.

Domestic Appliance Market is Going Connected

Reinhard Zinkann Jr. is the CEO of Miele and is the head of the ZVEI and came on to talk about appliances which are celebrating ten years at IFA as the first appliance appearance was in 2008. Curiosity was great on both sides in the early days, but it has turned out well, for Zinkann. 66 appliance makers started by exhibiting in 2008. Since then, space and exhibitors have increased a lot and this has made the event more attractive to buyers and to brands. Appliances have become more technologically capable and have reduced their energy consumption over the years

Reinhard Zinkann Jr. is the CEO of Miele and is the head of the ZVEI and came on to talk about appliances which are celebrating ten years at IFA as the first appliance appearance was in 2008. Curiosity was great on both sides in the early days, but it has turned out well, for Zinkann. 66 appliance makers started by exhibiting in 2008. Since then, space and exhibitors have increased a lot and this has made the event more attractive to buyers and to brands. Appliances have become more technologically capable and have reduced their energy consumption over the years

Connectrivity has also improved and become a big factor in sales and there is cooperation to develop interoperability between the different brands to optimise the use of energy, for example.

Asia is well ahead of the rest of the world in buying connected appliances, and the market is doing well in Europe, although from a low base. There is month by month growth in the sale of connected domestic appliances in the European market.

IFA is ‘Bursting at the Seams’

Christian Göke is from the IFA organisers and, of course, was bullish about the event. There are 1800 exhibitors in 2017 with 159,000 m² of space and the show is ‘bursting at the seams’, with all halls fully booked, again. Göke said that no other show has been ‘brands only’ on the show floor, although it wasn’t entirely clear what he meant by that. IFA is also looking to the future and will continue to develop its format. IFA is for now, he said, and really helps with sales to the end of the year. Many orders are placed by resellers at the show for delivery during Q4.

Christian Göke is from the IFA organisers and, of course, was bullish about the event. There are 1800 exhibitors in 2017 with 159,000 m² of space and the show is ‘bursting at the seams’, with all halls fully booked, again. Göke said that no other show has been ‘brands only’ on the show floor, although it wasn’t entirely clear what he meant by that. IFA is also looking to the future and will continue to develop its format. IFA is for now, he said, and really helps with sales to the end of the year. Many orders are placed by resellers at the show for delivery during Q4.

A change this year was that the organisers moved all the keynotes to a new area, IFA Next, which was focused on innovation. IFA Next is a new segment that is intended to show what is going to happen in the next two to five years while the IFA+ Summit is looking out ten years or more (So ‘IFA Next’ is like the MWC 4YFN (four years from now) event that runs in Barcelona. We visited the area and it was a good area for technology and startups, although it was smaller than the Barcelona or CES equivalents).

The IFA Next hall has 120 startups as well as big brands such as Amazon and IBM along with some technology associations. There are keynotes from Philips, Microsoft, FitBit and Huawei (although Foxconn cancelled its keynote – Man. Ed.)

All the innovation depends on the Supply Chain and IFA Global Markets is outside the main fair, but there were three shuttle lines to get there. GfK, IEEE and Google/Android (droidconBerlin) all ran conference events during the show.

In response to a question, Kamp said that in the recent GfU survey, it was clear that getting better image quality was driving the market to buy bigger TVs. Responding to another questioner that suggested that Germany is behind in digitalisation. This was not accepted. but Zincan said that although the government was behind progress, consumers could not be made to replace old products or adopt the best products. German appliances last 12 years on average, Miele lasts 20 years and that reduces the speed that new appliances can arrive.