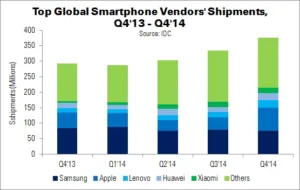

Apple closed the gap with Samsung in the worldwide smartphone market in Q4’14, while the products themselves set a new record for both the quarter and the year, according to IDC’s preliminary data.

Vendors shipped 375.2 million smartphones in Q4’14, representing 28.2% growth from the 292.7 million units shipped in Q4’13. For 2014 as a whole, 1.3 billion smartphones were shipped: a 27.6% increase from 2013’s 1.02 billion.

Apple remained the number two smartphone vendor in Q4’14, remaining in the same spot it has held for 11 consecutive quarters; however, the gap closed significantly. The iPhone 6 and 6 Plus pushed the volume gap to just 600,000 units, from 33 million in Q4’13. IDC believes that Apple could overtake Samsung this year if the company’s success continues. Samsung, for its part, is being challenged by both Apple and the rising number of low-cost Android OEMs. Samsung must either accept lower margins or change its premium strategy to regain its share, IDC said.

IDC programme director Ryan Reith commented, “Beyond the record-setting quarter, a few impressive things stand out with regard to Apple. First, at a time when ASPs for smartphone are rapidly declining, Apple managed to increase its reported ASPs in the fourth quarter due to higher-cost new models. Second, the growth of iPhone sales in both the U.S., which is considered a saturated market, and China, which presents the dual challenges of strong local competitors and serious price sensitivity, were remarkable. Sustaining this growth and higher ASPs a year from now could prove challenging, but right now there is no question that Apple is leading the way.

| Top Smartphone Vendors’ Shipments, Market Share and YoY Growth (Millions) | |||||

| Vendor | Q4’14 Units | Q4’13 Units | Q4’14 Market Share (%) | Q4’13 Market Share (%) | YoY Change (%) |

| Samsung | 75.1 | 84.4 | 20.01 | 28.83 | -11 |

| Apple | 74.5 | 51 | 19.85 | 17.43 | 46 |

| Lenovo | 24.7 | 13.9 | 6.59 | 4.75 | 77.9 |

| Huawei | 23.5 | 16.6 | 6.25 | 5.66 | 41.7 |

| Xiaomi | 16.6 | 5.9 | 4.42 | 2.03 | 178.6 |

| Others | 160.9 | 120.9 | 42.9 | 41.31 | 33.1 |

| Total | 375.2 | 292.7 | 100 | 100 | 28.2 |

| Source: IHS | |||||

Smartphone growth fell from 40.5% in 2013 to 27.6% in 2014, and is expected to slow further to the mid-teens in 2015. However, there are still growth opportunities in emerging markets. IDC expects competitive pressure in the market to come from below, in the form of companies such as Lenovo and Xiaomi.

In vendor terms, Samsung led for both the quarter and the year, but was continuously faced by rising competition at the low- and high-end. The company has streamlined its product portfolio to compensate.

Apple hit a new shipment record in Q4. iPhone sales rose 44% in the USA and 97% in the BRIC countries, doubling YoY in China, Brazil and Singapore.

Lenovo was a ‘distant’ third, edging out Huawei thanks to its Motorola acquisition. The company continued to dominate the sub-$150 market in China and will bring the Motorola brand back to the country in February. For its part, Huawei returned to the top five list in Q4, with a renewed focus on mid-range and high-end models.

The final spot was taken by Xiaomi (down from third). Volumes were slightly down QoQ, but the company enjoyed the highest YoY growth of all leading vendors. However, Xiaomi’s grip on the fifth-place spot is challenged by LG and ZTE.

| Top Smartphone Vendors’ Shipments, Market Share and YoY Growth (Millions) | |||||

|---|---|---|---|---|---|

| Vendor | Q4’14 Units | Q4’13 Units | Q4’14 Market Share (%) | Q4’13 Market Share (%) | YoY Change (%) |

| Samsung | 318.2 | 316.4 | 24.5 | 31 | 0.6 |

| Apple | 192.7 | 153.4 | 14.8 | 15.1 | 25.5 |

| Huawei | 73.6 | 49 | 5.7 | 4.8 | 50.4 |

| Lenovo | 70 | 45.5 | 5.4 | 4.5 | 54.1 |

| LG | 59.2 | 47.8 | 4.6 | 4.7 | 24 |

| Others | 587.3 | 407.4 | 45.1 | 40 | 44.2 |

| Total | 1,301.1 | 1,019.400 | 100 | 100 | 27.6 |

| Source: IHS | |||||

Comments

Juniper Research released its own results at almost the same time as IDC, and for the most part they agreed, with similar shipments numbers for both Q4 and 2014 overall. Juniper was slightly more optimistic about Samsung’s Q4 shipments, causing the gap between the leaders to be larger in Juniper’s results.

A change between Juniper and IDC was the mention of Microsoft, which IDC ignored. According to Juniper, Microsoft’s Windows Phone shipments rose, driven by low-cost models. (TA)