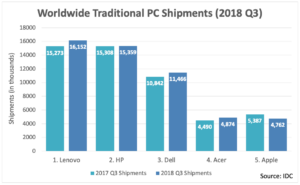

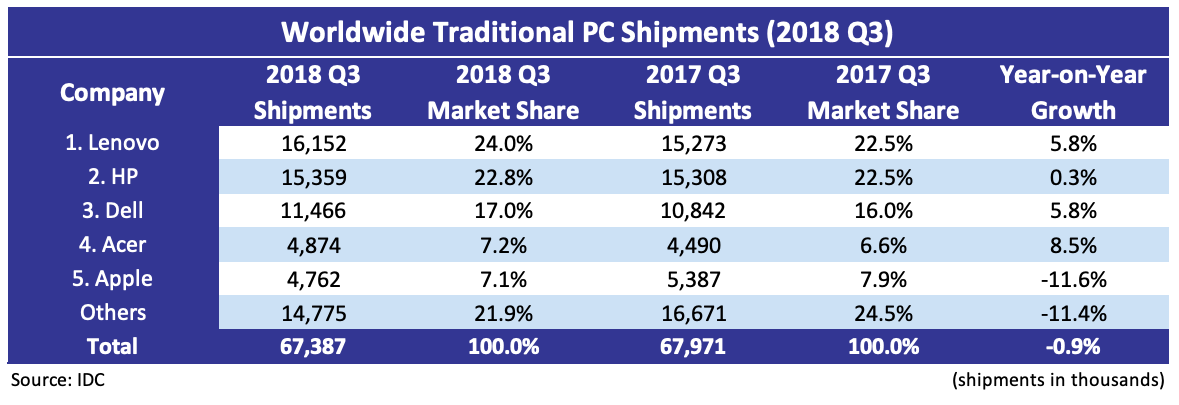

According to IDC, preliminary results for the third quarter of 2018 show that shipments of traditional PCs (desktop, notebook, and workstation) totalled nearly 67.4 million units, marking a decline of 0.9% year-on-year, unlike the second quarter, which saw growth. The third-quarter results nonetheless outperformed IDC’s forecast, which indicated a decline of 3% due to several factors.

The traditional PC market has trended toward stabilisation since 2017 and even flirted with solid growth in the second quarter of 2018. While demand from mature regions remained key to the market, many emerging markets had to contend with unfavourable currency headwinds and other politico-economic factors that cramped demand.

In addition, heading into the third quarter, there were some concerns about processor shortages. Despite this, most of the top OEMs were able to fulfil a sizeable portion of their demand and outperform the market. All in all, the quarter appears to have been driven by pockets of strong demand, as well as a focus on increasing inventory ahead of further supply issues and expected price hikes.

From a geographic perspective, all regions exceeded the forecast, though Latin America and Asia/Pacific saw year-on-year declines. Research manager Jay Chou remarked:

“The third quarter came in better than expected, but the outlook remains uncertain as we head into the holiday season, when volume will be boosted by many consumer-oriented promotions in entry-level SKUs. AMD supply could help with processor demand somewhat, but it will also take time for OEMs to spec in more models”.

Senior research analyst Neha Mahajan added:

“Despite looming concerns around CPU shortages, the US PC market turned in a good quarter, backed by strong results in the notebook segment. Healthy business volume, steady Chromebook shipments to the K-12 education sector and a growing gaming consumer base have been key reasons for optimism around the market”.

USA: The US PC market had yet another growth quarter, with a total of 17.2 million units shipped. The boost in PC volume was a result of growing demand for notebook PCs in the enterprise segment and increasing popularity of gaming systems that supported the consumer segment.

USA: The US PC market had yet another growth quarter, with a total of 17.2 million units shipped. The boost in PC volume was a result of growing demand for notebook PCs in the enterprise segment and increasing popularity of gaming systems that supported the consumer segment.

Europe, the Middle East and Africa: The traditional PC market recorded flat results, with ongoing mobility demand leading to a slightly stronger notebook performance compared to desktops. Despite higher demand from the commercial space, component shortages slightly dampened the overall growth.

Asia/Pacific excluding Japan (APeJ): The traditional PC market in APeJ posted a single-digit decline, but results were above expectations. Vendors and channel partners increased shipments in the third quarter of 2018 to hedge against expected price increases and CPU shortages. India saw a significant sequential increase in sell-in due to preparations for the festive Diwali season. In China, ultraslim demand fuelled consumer and SMB shipments, while the government segment benefited from Windows 10 renewals.

Japan: Strong commercial activity likely helped beat expectations for the third quarter of 2018. Two factors – the replacement of PCs that were bought at the time of Windows end of service and migration to Windows 10 – have been accelerating in the commercial space and are expected to carry into 2019.

Lenovo continued the second quarter of its joint venture with Fujitsu. The company saw a marked improvement in its North American business in the wake of a revamped channel strategy and more stable management. The addition of Fujitsu volume helped to push the vendor to the top spot, with 24% of the global market share.

HP grew a modest 0.3% year-on-year but still reached its tenth consecutive quarter of year-on-year growth and slightly outgrew its market share from a year ago. It faced a tough quarter in the US, as well as Latin America.

Dell tied with Lenovo in terms of year-on-year growth at 5.8% and further expanded its market share versus a year ago. A strong showing in desktop volume overall and a great EMEA quarter were the driving forces behind its results.

Acer climbed to fourth place with strong performances in education and gaming. The company has continued to focus on building out a comprehensive Chrome OS portfolio and its gaming notebooks have also garnered significant uptake.

Apple finished the quarter in fifth place, declined over 11%, and was the only top-five company to underperform the overall market.

Analyst Comment

Separately, Gartner’s preliminary data found that global traditional PC shipments actually experienced flat growth of 0.1% during the third quarter of 2018. In terms of company performance, Gartner’s ranking features the same top-three as IDC’s, though Gartner puts Apple in fourth place and Acer in fifth. (AF)