India’s traditional PC market shipments posted a 28.1% growth year-on-year, with shipments totalling 2.25 million units in the second quarter of 2018, according to IDC. The high growth can be partially attributed to the fact that the second quarter of 2017 was heavily impacted by the then-upcoming GST implementation. (India Increases Duty on TVs, Panels and Phones)

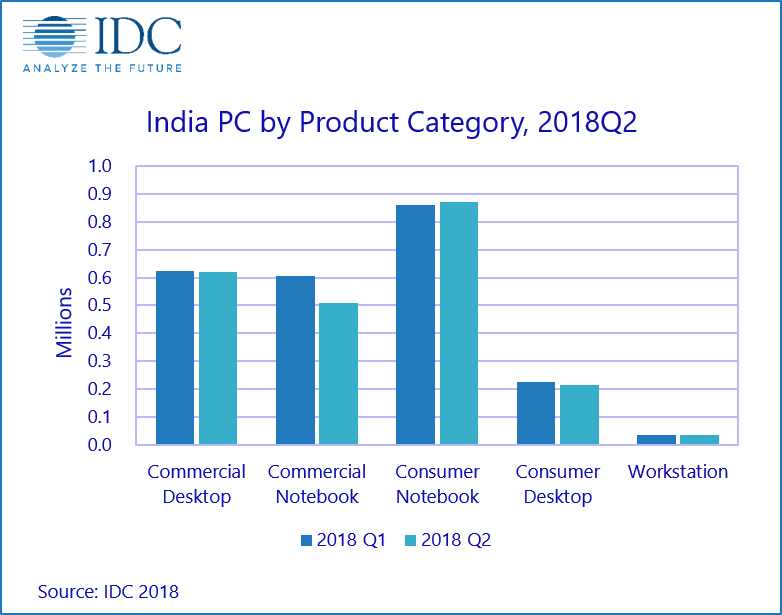

Notebooks contributed to 61% of the overall India traditional PC market with a 45.2% year-on-year growth, as demand continued across both the consumer and commercial segments. This was mainly driven by ultraslim notebooks, which now account for 20% of overall notebooks, compared to 11% a year ago.

Consumer PCs grew 33.7% to 1.09 million units, mainly because of promotions and new product offerings with updated specifications and aesthetically pleasing designs. Vendors targeted different use cases and provided schemes such as back-to-school offers with extended warranties, cashback offers and no-cost monthly payment options. Vendors launched exclusive models for both online and offline channels too.

The commercial PC market grew 23.3% to reach 1.17 million units. This was driven by both new and replacement demand from enterprises and SMBs. Public sector demand was driven by the execution of several projects in education and government sector. Research manager Nishant Bansal commented:

“Spendin

g on convertibles and ultraslim notebooks is increasing due to the popularity of lighter form factors that facilitate mobility. Business sentiment has been improving over the settling of reforms, leading to increased demand from medium and small enterprises across verticals like manufacturing, BFSI and pharmaceuticals, as they look to expand their businesses and technology capabilities”.

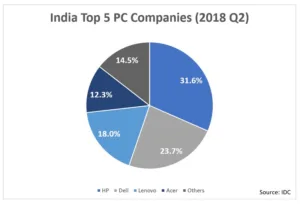

HP maintained its leadership with a market share of 31.6% in the second quarter, with a growth of 6.1% quarter-on-quarter and 19.8% year-on-year growth. The company’s convertibles and ultraslim notebooks performed well in large-format retail and exclusive stores, due to a high-decibel marketing campaign during the annual Indian Premier League cricket season. The commercial business for HP posted a 6.7% quarter-on-quarter growth on the back of a few key wins in the education sector, as well as refresh demand across key enterprise accounts from the IT/ITES and BFSI verticals.

Dell retained the second position with a 23.7% market share in the second quarter, a year-on-year growth of 71.3%, but a quarter-on-quarter decline of 2.2%. Although the company declined 6.3% over the last quarter in the consumer business, its ultraslim notebooks registered a double-digit growth, as the company continued its focus on high-end devices. Dell’s commercial business grew 1.2% quarter-on-quarter due to its increased focus on a solution-centric approach, selling both hardware and services as a bundle for medium and large businesses in the BFSI, PSU and IT/ITeS sectors.

Lenovo remained in the third position with a market share of 18%, a 36% growth year-on-year but a decline of 20.6% quarter-on-quarter. On the back of brand pull and aggressive pricing, Lenovo managed to remain largely flat in the consumer PC market in the second quarter. On the commercial side, incremental demand from global accounts and small-to-medium enterprises contributed to Lenovo’s commercial volumes. However, the company declined by 33.2% quarter-on-quarter due to the lack of execution of manifesto projects.

IDC anticipates the overall traditional India PC market will grow sequentially in the third quarter of 2018 due to seasonality and aggressive efforts from ecosystem players to meet the demand. Associate research director Navkendar Singh remarked:

“The consumer market is expected to take off in the coming quarter, as consumer confidence on discretionary spending should remain positive during the upcoming festival season”.

Commercial spending due to both new and refresh demand by large and medium enterprises is expected to continue, led by the education, BFSI and IT/ITeS sectors. The public sector is also expected to use allocated budgets for the new financial year, continuing with the execution of state manifesto projects.