According to the April update of the IDC Worldwide Black Book Live Edition, Asia/Pacific excluding Japan (APeJ) IT Spending will decline by -1.3% in 2020 compared to -0.8% decline projected back in March. Majority of countries have also revised their GDP estimate to either flat or negative growth for 2020 due to lesser economic activities across all industries.

To provide relief for impacted businesses, governments across the region have announced stimulus packages.

|

Asia Pacific ex Japan % Year Over Year Growth Value (Constant Annual) |

2019 |

2020 |

2021 |

|

IT Spending |

3.6% |

-1.3% |

11.3% |

|

Telecom Spending |

-1.7% |

-0.3% |

0.3% |

|

ICT Spending |

1.6% |

-0.6% |

6.7% |

|

Source: IDC Worldwide Black Book Live Edition, April 2020 |

|||

“The ICT Spending forecasts will remain a moving goal post in the next few months due to the uncertainties around the epidemic, inconsistent lockdown measures by country, varying stimulus packages by various governments, and the different economic resiliency by country in the region. Cloud will be a major differentiator as CAPEX maybe under pressure for some time, forcing enterprises to move faster on the Cloud,” says Avneesh Saxena, Group Vice President for Domain Research at IDC Asia/Pacific.

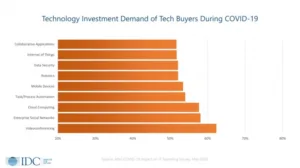

Based on IDC’s latest COVID-19 Impact on IT Spending survey of technology leaders in the region, it is not all doom and gloom as technology buyers highlight technologies that will benefit from COVID-19. The solutions will be driven by work from home (WFH), increased demand for cloud for business continuity, automation to deal with reduced workforce, to name a few.

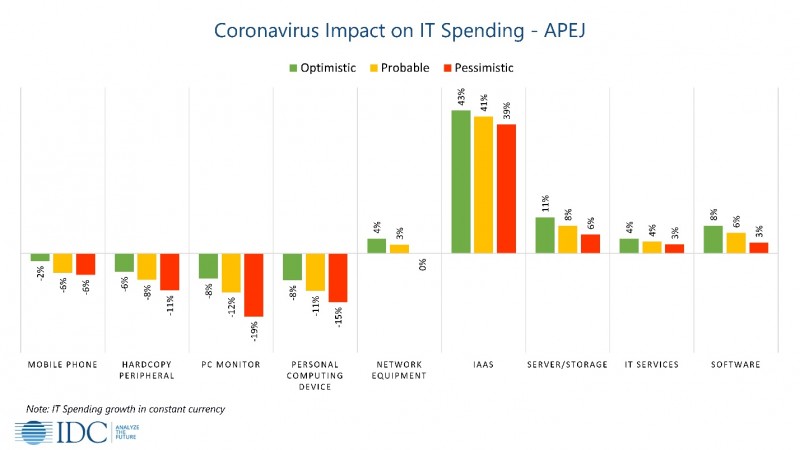

Consumer technology spending has witnessed the highest decline, as demand and supply remains far from a return to optimal levels; various restricting factors imposed by all governing authorities across the region impact day-to-day life. Global supply from APeJ region has also been delayed due to the same factors which has been causing a ripple effect worldwide as majority of the goods and raw materials are produced in APeJ for global consumption. Despite all measures of containment, the alarming growth of infection has led to majority of the production units to be shut down. As social distancing becomes the new norm, enterprises are grappling with the challenge of resetting their business to the new normal. However, many of the countries have been rapidly growing their infrastructure, especially in healthcare and governing bodies to improve quality of care, speed of recovery, and to protect individuals from further spread of infections.

“Not all organizations were equipped to handle business disruptions due to COVID-19. IDC’s latest COVID-19 Impact on IT Spending Survey indicates increasing challenges across enterprises due to expected decrease in employee productivity, difficulty in addressing business issues, cybersecurity and privacy. This has nudged enterprises sitting on fringes to rethink their digital strategy as they try to adapt to the new normal of social/physical distancing,” says Vinay Gupta, Research Director for IT Spending Guides, Customer Insights & Analysis at IDC Asia/Pacific.

Gupta adds, “This rethink will lead organizations to explore technologies which were not evaluated before. For example, in previous economic crashes, spend on IT hardware would overshoot the economic cycle – be it during slow down or during recovery. However, with Cloud, spend has moved from CAPEX to OPEX. This could in turn mean that spending could be more resilient in this economic downturn than in any previous one.”

Hardware

Devices continue to be the highest impacted market within the IT market. Furthermore, the revised forecast during the April release estimates that devices will witness a decline of about -5.5% for 2020 according to the pessimistic scenario. Production is partially recovering, but uncertainty looms around the demand side of the equation, as lockdowns impact the economy and in turn spending this year.

Software

Most enterprises have continued to delay activities within sectors such as transportation, manufacturing, personal and consumer services, as well as banking (lending), mostly to curb down infection rates. This has resulted in a negative impact on their revenues leading to a drop of discretionary spends on non-essential projects. However, spends related to ensure work continuity such as remote working, collaboration, and security is expected to be resilient.

IT Services

IT services remain to have least impact due to an increase in remote location operations. Businesses are likely to put on hold new projects till market is stable, and focus is expected to shift towards initiatives leading to cost optimization, efficiency, and resiliency in operations. As focus would be on controlling cost, it is expected that service contracts would be extended to get maximum value out of IT assets and defer any new purchases. As the number of businesses executing austerity measures increases, this same underlying theme will dominate managed services contract renewals. While there is a certain level of resiliency driven by multiyear engagements and the level of entrenchment due to the assimilation of the service provider capabilities that are core to the day to day running of the business, our optimistic outlook assumes most contracts are renewed.

IDC Asia/Pacific has recently organized the webinar, IDC Tech Talk: The Impact of COVID-19 on APeJC IT Spending which provided the latest updates on the IT Spending forecast for the region, COVID-19 impact on economy and key industries, and outlook post-COVID-19 on major AP markets. To view the webinar OnDemand, visit https://bit.ly/35ebkjn.

The IDC ICT Market Spending data presented here is based on the Worldwide Black Book Live Edition, updated monthly with the latest IT spending forecasts for annual growth across 100 countries. It will continue to evolve and capture the escalating impact of COVID-19 in the ICT market. For more information on IDC Worldwide Black Book Live, please contact Vinay Gupta at [email protected]. For media inquiries, please contact Tessa Rago at [email protected] or Alvin Afuang at [email protected].

IDC is the definitive source of Tech Insight on COVID-19. To help organizations plan their next moves in response to the pandemic, IDC is offering a range of resources including updated market forecasts with multiple outcome scenarios that address future uncertainties, research designed to keep digital transformation efforts on track, and insights into the workplace changes brought on by the virus. For more information, visit www.idc.com/covid19

About IDC Spending Guides

IDC’s Spending Guides provide a granular view of key technology markets from a regional, vertical industry, use case, buyer, and technology perspective. The spending guides are delivered via pivot table format or custom query tool, allowing the user to easily extract meaningful information about each market by viewing data trends and relationships.