According to IDC, the Asia/Pacific excluding Japan (APeJ) region’s spending on augmented reality and virtual reality is forecast to reach $11.1 billion in 2018, an increase of more than 100% from $4.6 billion the previous year. AR/VR products and services have gained exceptional market momentum in 2018 and are expected to achieve a five-year CAGR of 68.5% throughout the forecast period (2017-22). IDC’s Avinav Trigunait commented:

“The availability of new standalone VR headsets such as Oculus Go from Facebook and Mirage Solo from Lenovo is expected to drive adoption as well as content spending in 2018 and beyond, as these headsets eradicate the need for pairing with PCs or consoles that used to drive costs higher for AR/VR experiences”.

Being the largest source of spending, the consumer sector will continue to drive growth for AR/VR products and services, holding a 51.3% share of overall spending in 2018. The growth will be primarily driven by the availability of new headsets for VR which will lead to VR consumer spending.

While AR spending will be dominated by the purchase of services, the launch of AR SDK platforms from both Google and Apple is also expected to drive spending on application development and games for mobile platforms. In line with this trend, AR games in the consumer sector look very promising and are projected to hit a five-year CAGR of 90.9%, while VR games will register a five-year CAGR of 54.7%. As expected, gaming is one of the most prominent use cases of AR/VR for consumers.

While consumer growth is anticipated to grow steadily, the commercial sectors or enterprise spending — which represents more than 48% of AR/VR spending in 2018 — is expected to overtake the consumer sector in the next five years, with a 58% share by the end of the forecast period. Each of the five commercial sectors is forecast to register solid growth in spending, led by the distribution and services, and public sectors.

Distribution and services ($2 billion) will be the largest amongst the five commercial sectors in 2018, led by the personal and consumer services, retail, and professional services industries. The second-largest sector will be manufacturing and resources ($1.7 billion), with balanced spending across the process manufacturing, construction, and discrete manufacturing industries.

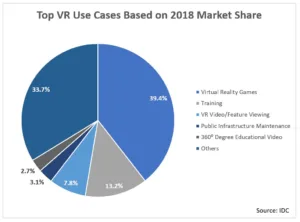

VR gaming has the highest share among all the sectors, garnering a 39.4% share of overall spending in 2018. Likewise, with the rising hype in the market for AR, there is an expected increment in the market for use cases in different sectors.

In the distribution and services sector, training and retail showcases will be the two largest use cases, with combined spending of more than $329 million in 2018. Training, industrial maintenance and project management will be the largest use cases in the manufacturing and resource sector. In the public sector, infrastructure maintenance and government training will be the two largest use cases in 2018. Trigunait continued:

“The use cases for both AR and VR are proliferating in the enterprise segment as companies are developing new IT and business applications. Many enterprises in the region have already developed solutions utilising AR and VR, such as design and visualisation, corporate training, field maintenance, and customer experience and marketing applications”.

Senior market analyst Swati Chaturvedi also said:

“AR/VR technologies are quickly crossing the chasm, with several real-world applications emerging every day in both enterprise and consumer segments. Although, adoption in the Asia Pacific (excluding China and Japan) region is slower when compared with the US or even China markets, the growth trajectory is very promising, with enterprises utilising AR/VR technologies to accelerate their digital transformation strategies.

In terms of spending, the education industry is expected to top the charts from 2019 until the end of the forecast period. Other key industries driving growth for AR/VR include retail, manufacturing and healthcare”.

On a geographic basis, China will be the region with the largest AR/VR spend, with 91.3% share of overall spending ($10.2 billion) in the APeJ region in 2018. This trend is likely to rise over the forecast period (2017-22) with a five-year CAGR of 70.5%. AR/VR technology in other countries in the region are slowly gaining trend and experimenting with how AR/VR can be used in retail and other industries.

Analyst Comment

“The growth will be primarily driven by the availability of new headsets for VR which will lead to VR consumer spending.” is an interesting comment. ‘Build it and they will come’ is not really a great strategy for most businesses! (BR)