According to the latest figures published by IDC, the overall tablet market for Western Europe declined 13.1% year-on-year, shipping 10.6 million units in the fourth quarter of 2017, indicating a continued weakening of the market. Slate tablets continue to be the primary driver of this market erosion, declining by 15.4% year-on-year, as their productive use cases pale in comparison to newer form factors, and they increasingly become relegated to simple media consumption devices. Detachable tablets have slowed down but continue to see traction in certain areas. They posted a minor 2% year-on-year decline, but thanks to increasing interest in premium devices, coupled with a very strong commercial performance of 8.5% year-on-year growth, the value of their sales rose by 3.2%.

Overall, the commercial segment performed slightly negatively with a 1.4% decline year-on-year. Despite this, detachable tablets experienced growth of 8.5%, driven by increased adoption into enterprise, where they are poised to address the increasing portable needs of the mobile workforce.

On the consumer side, seasonal promotions were sufficient to grow the market quarter-on-quarter but the market continued to weaken year-on-year, with a decline of 15.5%. Slate tablets’ value proposition for consumers continues to diminish. Certain vendors pushed a considerable volume of this form factor as a gateway into their larger ecosystems, but this did not make up for the growing consumer disinterest, leading to a 16.8% decline year-on-year. Detachable tablets also contracted in this segment, declining 7.1% year-on-year, as the rapid adoption of convertibles cannibalises their sales. Senior research analyst, Daniel Goncalves, said:

“Profitability is increasingly becoming the focus among the most important tablet manufacturers. The performance of Apple and Samsung, the two main players in the Western European market, together representing over 40% of all tablet shipments, reflects the increasing concern for value over volume. Both posted double-digit growth in revenue year-on-year, despite the single-digit declines year-on-year in units”.

Goncalves said Apple’s results were driven by the good traction of the newer iPad Pro detachables, particularly among professionals and prosumers, through notebook replacement. Additionally, this device is appealing to tablet users upgrading to a premium device with keyboard capabilities and enhanced specs. Goncalves continued:

“This is a trend we observe across the whole device spectrum, where consumers are increasingly willing to invest more to obtain better user experiences, and to be able to enhance their device’s longevity”.

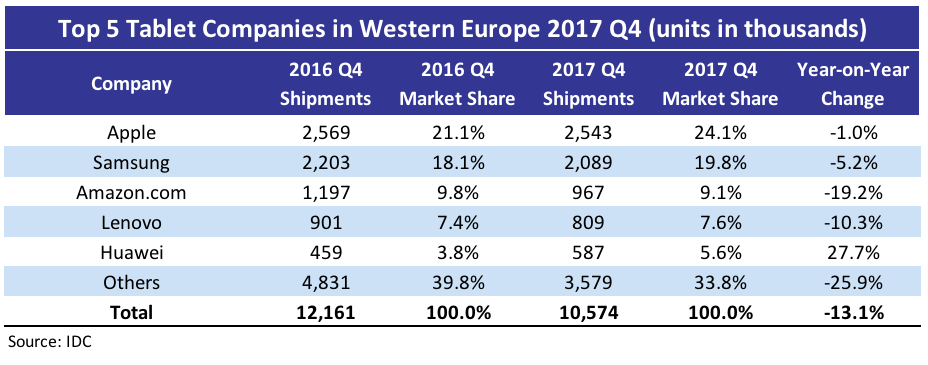

Apple ranked first with 24.1% market share, but decreased 1% year-on-year. Its solid lead was upheld by good traction of the newer iPad detachables in the commercial and prosumer space.

Samsung ranked second, recording a market share of 19.8%, but decreasing 5.2% year-on-year. Despite the decline in units, a solid performance from its premium Android range enabled Samsung to grow in value by 8.2% year-on-year.

Amazon ranked third with a market share of 9.1%, despite a large year-on-year decline of 19.2%. Steep discounts around the holiday period, and the inclusion of the Alexa voice assistant, led to very strong sales this quarter.

Lenovo ranked fourth after growing 0.2% year-on-year in market share to 7.6%. This was driven by a robust commercial performance for its detachable range.

Huawei was the only top-five vendor that grew year-on-year, by 27.7%, maintaining its fifth-place spot with 5.6% market share. This growth has been leveraged from an increased presence in distribution.