The Europe, Middle East, and Africa (EMEA) traditional PC market remained stable in the third quarter of 2018, with the market turning positive (0.5% growth year-on-year) and totalling 18.1 million units, according to IDC.

The commercial space grew 4.9% year-on-year as ongoing device renewals continued and the adoption of Windows 10 picked up, while the consumer space remained negative (-4.1% year-on-year), recording a decrease in both desktops and notebooks. Desktops declined for the first time this year (-2.4% year-on-year) but continued to grow in the commercial space. A stable notebook performance (1.4% growth year-on-year) kept the market in positive territory, as mobility adoption and renewals continued to drive demand in the commercial space.

The Western European traditional PC market registered overall growth of 2% year-on-year, with the commercial segment continuing to show strong growth (8.3% year-on-year), offsetting the impact of the consumer decline (-5.5% year-on-year). The overall consumer decline can be attributed primarily to desktops, where erosion persisted, while notebooks also continued to decline, albeit at a softer rate.

On the commercial side, ongoing device renewals in the mid-market space, as well as growing Windows 10 adoption, continued to drive growth in this segment. Being a back-to-school quarter, education undoubtedly contributed to this growth. From a sub-regional perspective, the Nordics, DACH and UKI were strong performers this quarter, but Benelux recorded the strongest results, boosted by strong double-digit growth in the commercial space.

Research analyst Laura Llames commented:

“In Western

Europe, renewals continued to affect the commercial space positively, despite the impact of the component shortage, especially on the CPU side. All the sub-regions performed well in this space, with Benelux and DACH leading the rally”.

Despite the negative performance in the consumer PC market in Western Europe, ultramobile, thin-and-light and 2-in-1 devices continue to elicit consumer interest, softening the overall notebook decline as the holiday season approaches. Gaming, while not substantial in volume, persists in providing a strong pocket of growth in this segment. Associate VP for the CEMA region Stefania Lorenz added:

“The third quarter of the year reported surprising results given the different dynamics in the CEE and MEA regions. The traditional PC market in the CEMA region reported a contraction of 2.4% year-on-year. The MEA dragged the overall region to negative results due to the worst decline recorded in Turkey as the market dropped by nearly 60% year-on-year. The country is facing major challenges with currency fluctuation as well as economic uncertainty affecting all commercial sectors.”

Product manager for the CEMA region Nikolina Jurisic also commented:

“Contrary to the strong decline in MEA, the CEE region reported better than expected results, increasing 7.1% year-on-year. Behind the overall success is Russia reporting double-digit growth. Despite all the uncertainty about sanctions and fluctuation of the ruble, the country’s economy remained stable with low inflation during the quarter. Demand continued to be strong thanks to few large deals in the corporate and public sector and with retailers already purchasing for the Christmas season”.

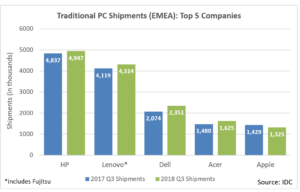

Traditional PC market consolidation persisted and the top-three vendors’ share continued to grow in the third quarter of 2018. The top-three accounted for 64.2% of total market volume, compared with 61.3% the year before.

- HP held on to the number-one position in EMEA, gaining 0.5% year-on-year to reach 28.4% market share. Solid results across both segments helped maintain the company’s leadership position.

- Lenovo (including Fujitsu) once again secured the second spot, reporting 23.9% market share, an increase of 1% year-on-year. Particularly strong notebook performance in the commercial space supported its overall results.

- Dell retained third place with a market share of 13%, up 1.5% year-on-year. Dell had an exceptional quarter, with double-digit growth across both segments attributing to their strong growth in market share.

- Acer came fourth with 9% market share, up 0.8% year-on-year. A solid performance in the shrinking consumer market and an exceptional commercial performance aided by back-to-school buying drove this growth.

- Apple crept into fifth with 7.3% market share, down 0.6% year-on-year. Despite a decline, Apple outperformed Asus, which continued to erode in the EMEA market.