The EMEA traditional PC market recorded a slight growth of 0.6% in the first quarter of 2018, with the market totalling 17.5 million units, according to IDC. The commercial space grew 6.2% due to enterprise renewals, while the consumer space declined 5.2% as market saturation in Western Europe led to heavy declines across the region.

Notebooks posted a slight decline of 0.5% for EMEA as continued demand for mobility and security drove strong commercial growth, offsetting the weak consumer performance in Western Europe. Desktops were the real drivers this quarter, posting an overall growth in EMEA of 2.9% year-on-year, as ongoing traction in the gaming market aided overall consumer performance, while enterprise renewals contributed to the strong commercial outlook.

In Western Europe, the overall traditional PC market contracted by 4.3% year-on-year. Desktops made a resurgence and showed clear signs toward stabilisation, very nearly breaking flat. Commercial traditional PC shipments in Western Europe increased by 6.3% year-on-year. Solid growth was registered transversely across both product categories but the strongest results came from desktops, which posted their first annual growth in 14 quarters. Research analyst Laura Llames commented:

“In Western Europe the commercial segment had an outstanding quarter, with certain subregions such as UKI and Benelux posting double-digit growth. As recent data breaches and the looming influence of the GDPR compliance mandate have caused growing security concerns, both the public and private sectors are ramping up to renew their devices”.

The consumer PC market in Western Europe declined by 16.7% year-on-year. Gaming is still maintaining healthy traction in the market, with casual gaming at the forefront, but its low base volume rendered it insufficient to shift the market trend. Associate VP for the CEMA region, Stefania Lorenz, also said:

“In the first quarter of 2018, the PC market recorded excellent year-on-year results in CEMA, boosted by stronger demand in the CEE region. The overall PC market in CEE reported a year-on-year increase of 14.3%. This unexpected growth was driven by both the consumer and commercial segments. Most countries across the CEE region recorded sound growth, with Russia reporting the strongest performances in both desktops and notebooks.

Despite all the imposed sanctions on Russia since last year, PC demand in the first quarter of 2018 has seen the best year-on-year growth for a long time, reaching total volumes of 1.2 million. The foreseen economic stability and the ruble improvement at the end of 2017 have influenced the top vendors to push PC products to the channel, possibly creating inventory for the upcoming quarters”.

Product manager for the CEMA region, Nikolina Jurisic, commented that the MEA region also performed above expectations, reporting year-on-year growth of 6.2%, thanks to good results from the largest countries:

“The central part of the region also saw notable growth in key countries with Hungary, Czech Republic and Poland reporting better results than forecast. The notebook market, in the mentioned countries, reported strong increases thanks to the improved consumer confidence on the back of stabile economic growth, which remains mostly driven by private consumption and boosted by foreign and domestic investments.

The commercial PC market was driven by small-scale and medium projects in the public and corporate sectors, Turkey and Saudi Arabia have both applied aggressive retail promotions and in Saudi Arabia, after the VAT tax implementation at the beginning of 2018, a few vendors have offered a VAT discount campaign to boost consumer demand”.

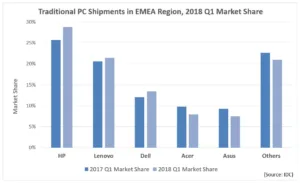

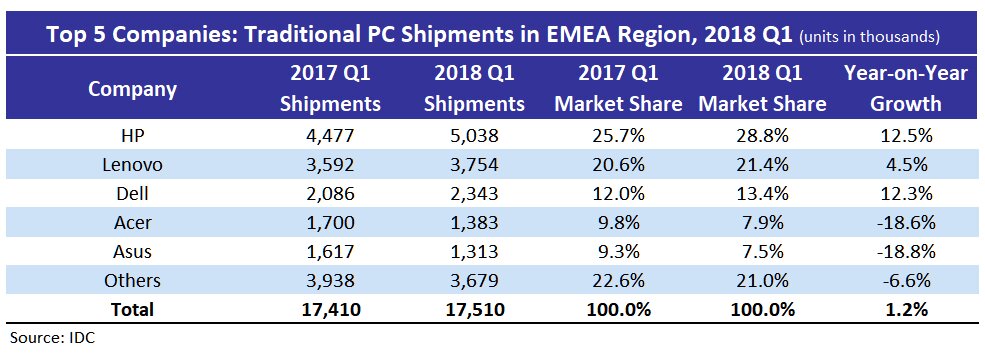

Traditional PC market consolidation has continued, and the top three vendors’ share continued to grow in the first quarter of 2018. The top three players accounted for 63.6% of total market volume, compared with 58.3% in the first quarter of 2017.

HP held on to the top spot in EMEA, gaining 3.1% market share year-on-year to reach 28.8%. Strong performance both in notebooks and desktops boosted its results.

Lenovo retained its second spot, reporting 21.4% market share, up by 0.8% year-on-year. Solid performance in the commercial space, both desktops and notebooks, drove its overall results.

Dell secured the third position with a market share of 13.4%, up 1.4% year-on-year. A strong notebook performance combined with even stronger desktop results, both in the consumer and commercial space, contributed to its overall growth in the region.

Acer was fourth in the overall ranking with 7.9% market share, dropping 1.9% year-on-year, primarily due to poor performance in Western Europe. However, it maintained its strong foothold in CEMA, reporting positive year-on-year growth.

Asus finished fifth with 7.5% market share, down 1.8% year-on-year. The vendor had another challenging quarter, except in CEMA, where it maintained positive year-on-year growth in the notebook space.

Analyst Comment

We have heard that IDC has a very negative forecast for Q2 in Europe int he monitor market, which doesn’t match what we have been hearing. If your experience chimes with the IDC view, I’d be happy to hear about it. [email protected]. (BR)