Apple recently released its iPhone SE (2020) on its official website for RMB3,299-RMB4,599 (around USD465.82-USD649.38), offering the lowest starting price for the budget model since 2016. IDC believes that the new iPhone SE has a clear target audience and is mainly pitched against Android models in the same price range to keep existing users in the iOS fold.

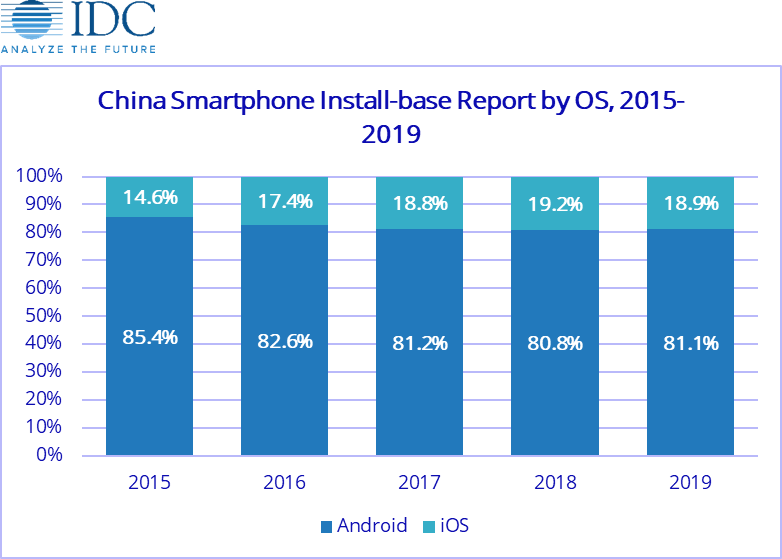

According to the IDC China Smartphone Install-base Report, Apple has always had a significant share of smartphones in use in China because iOS-based iPhones have a longer replacement cycle than Android phones. In 2019, Apple continued to have the largest user base among smartphone vendors in China, with iPhones in use accounting for 18.9%—representing a slightly lower percentage than in 2018—of all smartphones in use in China.

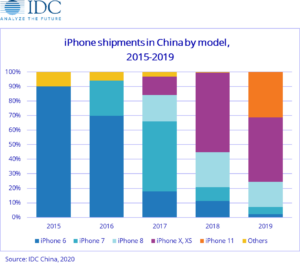

From the perspective of historical shipments, iPhone 6 and 7, with ultra-long replacement cycles, have contributed a large share of iPhone shipments over the past five years and accumulated a large user base. For those users, the latest iPhone SE is more similar to the previous generation and more familiar to them, in addition to boasting upgraded chip and system performance that encourages replacement. Moreover, budget-friendly prices and trade-in programs offered on e-commerce platforms add to the appeal of the new iPhone SE as a transitional model before users make new purchases subsequently. On the other hand, the likelihood is low for existing users of Android phones in the same price range to switch to the iPhone SE for their next phone because they have been accustomed to typical Android features such as large screen and multi-camera.

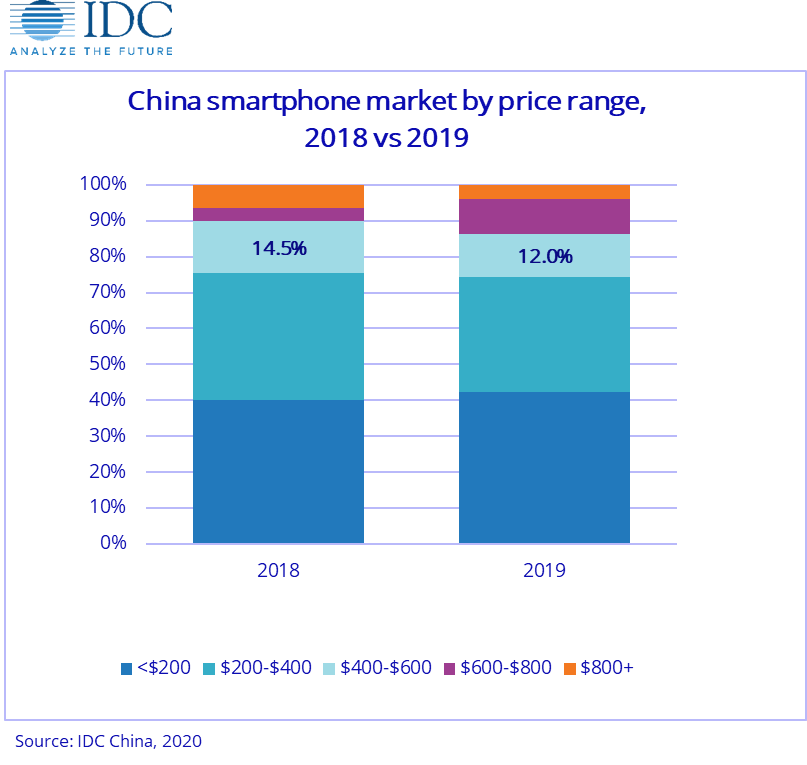

The mid-range smartphone segment in which the new iPhone SE falls ($400-$600 exclusive of tax) experienced a contraction in China throughout 2019 as vendors gradually shifted away from the segment to the mainstream price range emphasizing performance to price and to the high end.

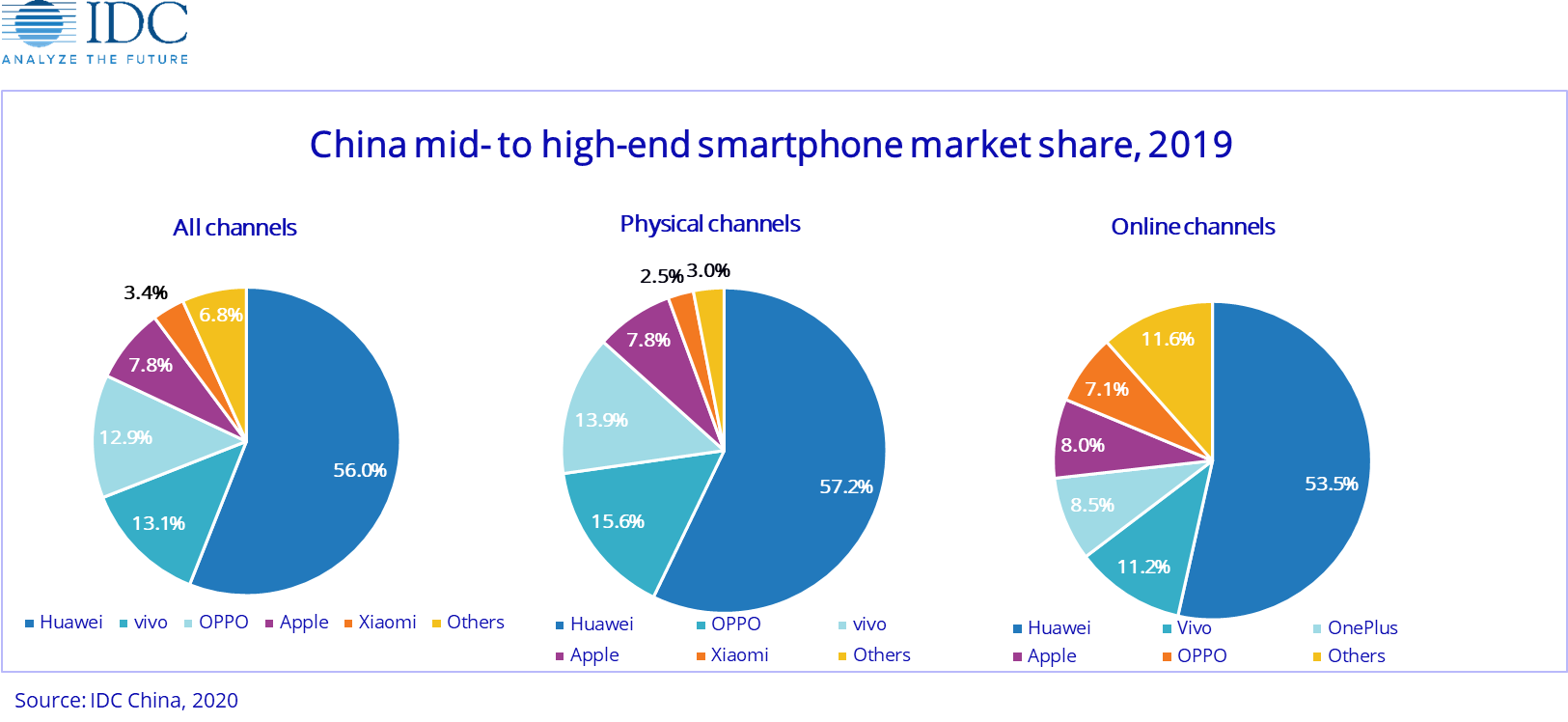

In the midrange segment of China’s smartphone market in 2019, Huawei continued to lead with a big margin, followed by vivo and OPPO in second and third places. In terms of channel, Huawei widened its lead in physical channels by leveraging its solid physical presence, and OPPO ranked second, receiving a boost from its Reno series. In the online space, OnePlus which focuses on e-commerce for the segment made into the top three.

“With rising costs of 5G, camera and other hardware components, and the continuing upgrading of domestic brands, the average price in China’s smartphone market will further increase and competition in the mid-range segment will become more intense as well,” said Xi Wang, research manager at IDC China. “However, the new iPhone SE has a clear target audience, i.e. users of older iPhone models. It is therefore not so much an attack as a defense amid increasingly intense competition for users in the domestic market as Apple attempts to keep existing iPhone users in the iOS fold.”