We joined the Investor Conference, run like the Business Conference by DSCC, for a panel discussion, but the early part of the event was a presentation by Bob O’Brien of DSCC who tallked about the markets for different display materials, while Ross Young, the other co-founder of DSCC covered equipment and overall displays.

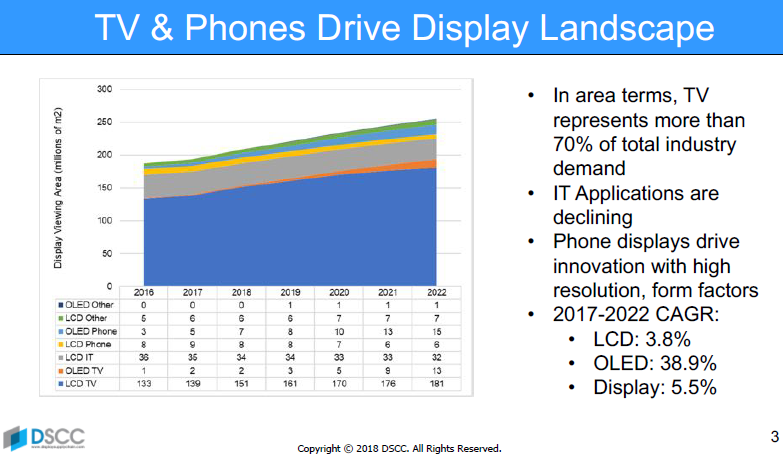

O’Brien made the point that TV represents 70% of the market and the combination of TV & smartphones are dominating the market as IT applications are not growing. He also made the point that material use tends to scale with input capacity, not with output – if there are a lot of low yielding G10.5 fabs, they will still buy a lot of glass and other materials, even if they don’t sell finished panels.

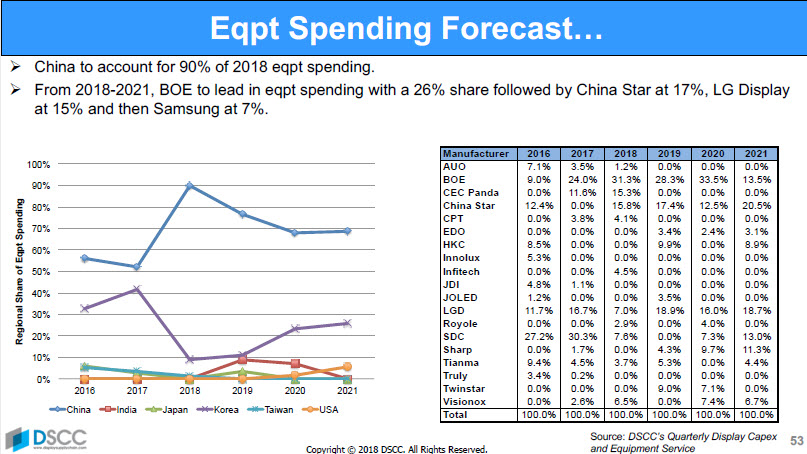

The overall market information from Young was a repeat of that shown at the business conference. In Equipment, the companies that are doing best are those that supply equipment for both OLEDs and LCDs (e.g. Nikon, Applied Materials). He then covered material on smartphones and flexible opportunities from the previous day.

The first question discussed was “Why are stock values around three times higher for Chinese companies?” and the answer was that it is difficult to compare stocks in Shenzen. BOE, for example, is very big in medical equipment and the display business is a new area, so it’s hard to judge the firm on just the displays.

“When is a good time to talk to companies about IPOs?”, moderator Ross Young asked. “When you have a good story” was the first reply. There is a real shortage of IPOs and investment opportunities at the moment and many fewer than ten or fifteen years ago. You need a sound plan and business concept if you want to have an IPO. It can take anything from four to six months for due diligence for an IPO, but often there are windows of opportunities. Investors want and need to invest.

Display is not a particularly different market, in the panel’s view, but if you have a good business model and a sustainable business, like UDC, you can raise money OK.

Applied Materials was the first presentation but we covered the firm in the business conference and there was no real difference in the content. In questions at the end of the session, the firm said that roll to roll display manufacturing is a potential future market opportunity, but may always be a future technology because of the challenges in resolution and performance these days. The company is looking at it, but not yet convinced that it is feasible.

In response to a question about the lack of improvements in TACT time in display making in recent years, the speaker said that the reality is that it is harder to move and process larger substrates (for example to load a machine can take longer), so the challenge is not to speed up, but just to avoid slowing down as substrate size grows and processes get more sophisticated.

Buy Side & Equity Panel Session

The panel was

- Pierpoint Capital: Jarret Fass, Managing Partner

- M Ventures: Sven Harmsen, Ph. D, Investment Director

- Intel Capital: Stephen Saltzman, Investment Director

- Applied Ventures: Tony Chao, Senior Investment Director and General Manager

Intel has a number of display investments including Nanosys and was driven for a while by the technology needed for AR and VR. The question for Intel is where can the company add value. Intel has invested in 1,500 companies since it started and works with many VCs.

M Ventures has interests in semiconductors and display technologies and has investments in ClearInk and in a mixed reality company. It also has investments in Peratech which has QTC force touch technology.

Applied Ventures looks for disruptive technologies.

Pierpoint said that it is aware that there are significant barriers to entry in displays, so is looking for companies that can get into the market.

The companies see themselves as strategic investors that are looking for longer term opportunities compared to general VCs. The companies vary in the size of their investments and Pierpoint is looking for $5 million to $10 million, while M Ventures has done a deal from $200K. Intel has also funded ‘two men and a dog’ operations and has also invested in $ billions so has no rules on scale. Applied Ventures also covers a wide range of deal sizes.

Timing for the companies can also vary a lot. A couple of months may be possible for some, but if there is an opportunity, Applied said it can work very quickly. Intel can also work very quickly. All companies have some deals that may take a year or more as syndicates may need to come together or deals may depend on IP. Pierpoint said that it tends to take stakes in companies that don’t need them, so it can take a long time!

In terms of how to appeal, the firms said that usually if they have got to the stage of talking to a company, they are aware of the market opportunity, but what they need to really understand is a powerpoint of ten or fifteen slides – not the 50 or 60 that they sometimes see. They are also very interested in the quality of the team that is in the firm, rather than the technology so much.

Intel said that the people need to be ‘non-toxic’ – the kind of people that can bring in partners and supporters as well as building alliances with other industry players. It’s rare for a company to make an impact without the support of suppliers, partners and customers