Worldwide smartphone sales reached new record levels at the end of 2015, thanks to multiple product offerings at all price points, in both mature and emerging markets. Preliminary IDC data shows that 399.5 million total units were shipped in Q4’15: 5.7% YoY growth, from 377.8 million in Q4’14. Over the course of the year, more than 1.4 billion units were shipped, up 10.1% from 1.3 billion in 2014.

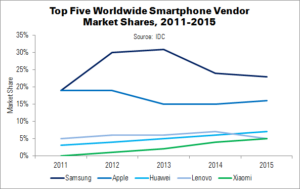

IDC’s Melissa Chau highlighted Huawei, rather than major vendors Samsung and Apple, as having performed particularly well in 2015. It is one of the few Chinese brands that has successfully diversified worldwide, with almost half of its shipments outside of China. The company is currently the world’s third-largest smartphone vendor, and is in a good position to retain that place.

Apple, of course, continued to dominate headlines. Q4’15 was the company’s most successful ever, shipping 74.8 million units (1% YoY rise). Although unit growth was minimal, the company’s market share rose to 16.2% from 14.8% last year. Growth in key markets, such as China, was up 18%, and half of buyers in these countries were said to be first-time iPhone owners. This was despite the company’s ASP increase, now up to $691, from $687 in 2014.

“Features such as a more widely accepted Apple Pay, increased performance, and the innovative Force Touch technology, continue to set the iPhone apart from the competition”, said IDC’s Anthony Scarsella. He added, “To combat Apple at the high-end, competing vendors will need to bring value to consumers to stay relevant in the market.” With mature markets largely saturated, many vendors are focusing on premium-looking mid-range devices, as a new value proposition to customers in both developed and emerging countries. For example, Samsung’s Alpha series and Huawei’s Honor brand.

| Top 5 Vendors’ Worldwide Smartphone Shipments, Q4’15 (Preliminary) (Millions) | |||||

|---|---|---|---|---|---|

| Vendor | Q4’15 Unit Shipments | Q4’14 Unit Shipments | Q4’15 Share | Q4’14 Share | YoY Change |

| Samsung | 85.6 | 75.1 | 21.4% | 19.9% | 14.0% |

| Apple | 74.8 | 74.5 | 18.7% | 19.7% | 0.4% |

| Huawei | 32.4 | 23.6 | 8.1% | 6.3% | 37.0% |

| Lenovo | 20.2 | 14.1 | 5.1% | 3.7% | 43.6% |

| Xiaomi | 18.2 | 16.5 | 4.6% | 4.4% | 10.0% |

| Others | 168.3 | 174.0 | 42.1% | 46.1% | -3.3% |

| Total | 399.5 | 377.8 | 100.0% | 100.0% | 5.7% |

| Source: IDC | |||||

Samsung remained the leader of the worldwide smartphone market, shipping 85.6 million units in Q4’15 (up 14% YoY). Over the year, Samsung shipped 324.8 million units (up 2.1%). The company faces a battle on multiple fronts, challenged by Apple at the high-end and at the low-end and midrange by Chinese vendors, such as ZTE, Xiaomi and Huawei.

Second place Apple shipped 74.8 million units in the quarter, and 231.5 million units in the year. Growth for the year was more impressive than for the quarter, rising 20.2%, from 192.7 million units. New features, a new phone colour, better performance and increased speed helped to drive upgrades and attract Android switchers.

Huawei was the biggest winner in the quarter, with high YoY growth of 37%. The company also became the fourth mobile phone vendor in history to ship more than 100 million smartphones in a year, after Nokia, Samsung and Apple.

Just over a year after its acquisition of Motorola, Lenovo still suffered from uncertainties caused by organisational changes, as well as greater competition in its home market of China. The Motorola brand, which performed well in 2014, produced fewer ground-breaking new models in 2015. In the future, the Motorola name will be shortened to ‘Moto’ and used in high-end models; the ‘Vibe’ brand will represent the low end.

Xiaomi was in fifth place, relying heavily on China for growth. Volumes were still 90% domestic, although the company did ramp up its operations in India and Brazil. Xiaomi spent 2015 trying to transition away from the low-end to midrange models, although the low-end still represents the bulk of its shipments. On the basis of this, the company was able to widen the gap with sixth-place LG.

| Top 5 Vendors’ Worldwide Smartphone Shipments, 2015 (Preliminary) (Millions) | |||||

|---|---|---|---|---|---|

| Vendor | 2015 Unit Shipments | 2014 Unit Shipments | 2015 Share | 2014 Share | YoY Change |

| Samsung | 324.8 | 318.2 | 22.7% | 24.4% | 2.1% |

| Apple | 231.5 | 192.7 | 16.2% | 14.8% | 20.2% |

| Huawei | 106.6 | 73.8 | 7.4% | 5.7% | 44.3% |

| Lenovo | 74.0 | 59.4 | 5.2% | 4.6% | 24.5% |

| Xiaomi | 70.8 | 57.7 | 4.9% | 4.4% | 22.8% |

| Others | 625.2 | 599.9 | 43.6% | 46.1% | 4.2% |

| Total | 1,432.9 | 1,301.7 | 100.0% | 100.0% | 10.1% |

| Source: IDC | |||||