The battle between OLED and LCD rages on in the premium TV space and ultimately, the winners will be companies that can manage to get the highest prices and the lowest costs possible, according to DSCC. The company’s latest Quarterly Advanced TV Cost Report describes in detail the cost battle in the premium TV market, covering current and future scenarios for both OLED and LCD products.

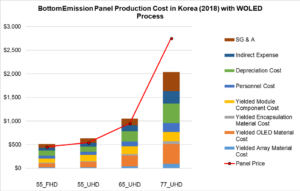

Most of the costs of TV panels are determined by the screen size, product architecture, substrate size and cut efficiency, and the location of production.

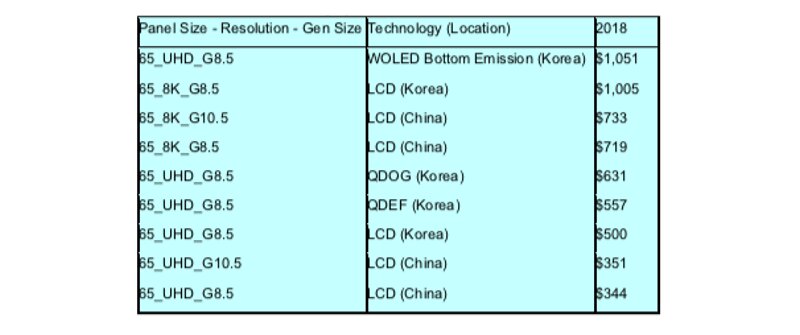

Product Ranking by Total Cost for 65” Panels in 2018. Source: DSCC

Product Ranking by Total Cost for 65” Panels in 2018. Source: DSCC

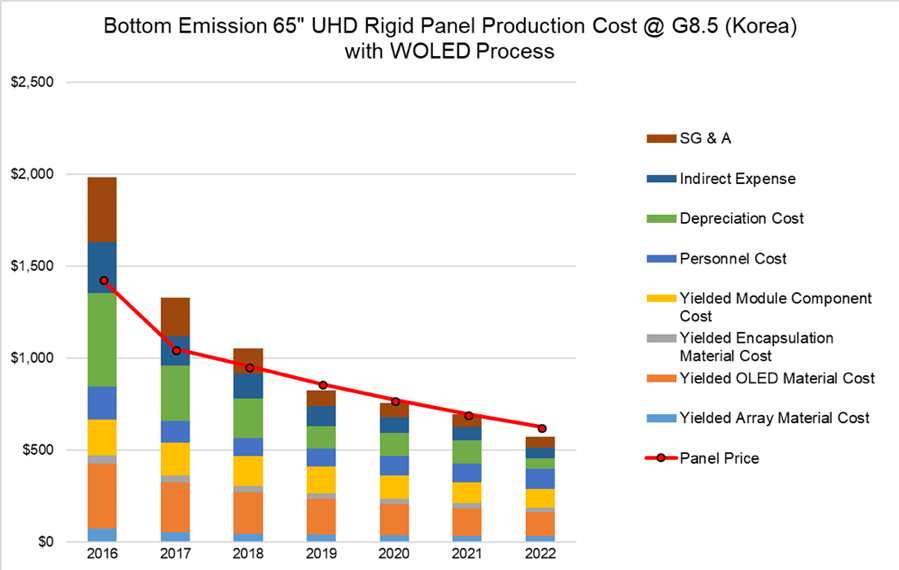

With the current product and manufacturing architecture, LG’s WOLED is the most expensive 65” panel, with a higher cost than even “8K” LCD panels and three times the cost of conventional LCD panels made in China. While cost reductions via material price drops and yield and efficiency improvements will bring the panel’s cost down to $695 by 2021, OLED panels will continue to cost substantially more than LCD.

Source: DSCC

The chart below shows that LCDs made in China have the lowest costs in the industry, indicating the significant advantages of manufacturing in China. These advantages include huge government subsidies that reduce the capital investment for a display fab by 50% and lower costs for personnel and indirect costs.

China manufacturers also benefit from a longer equipment depreciation duration of seven years, compared to five years in Korea, which results in a smaller depreciation expense each year — although the Korean fabs’ depreciation expense ends earlier.

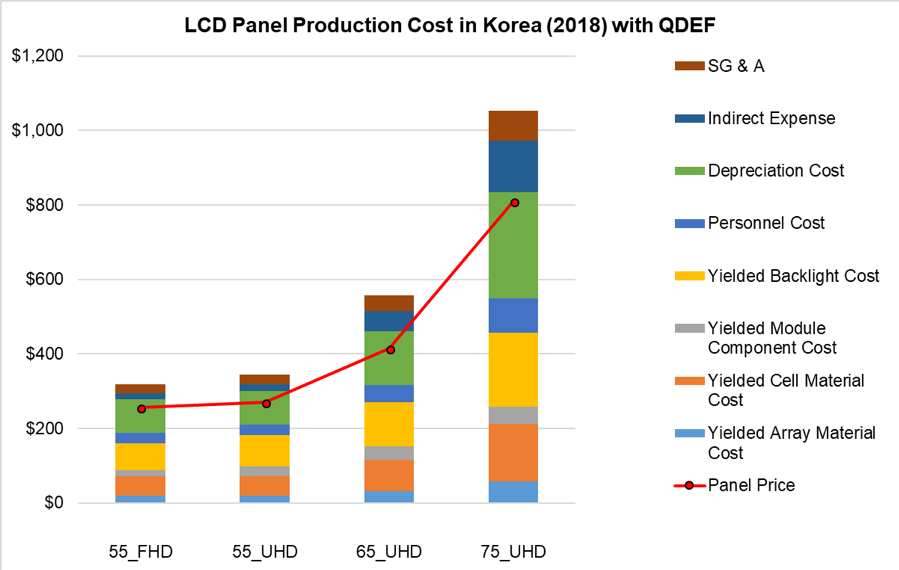

The charts below show the current battle between OLED and QLED, and between LG and Samsung. The latter uses QLED as the sub-brand for their quantum dot technology, based on a quantum dot enhancement film (QDEF).

The costs for a QDEF LCD TV panel run between 37% and 52% lower than the costs of an OLED panel of the same size and resolution. Despite this huge cost advantage, Samsung has chosen to price QLED TVs at roughly the same as LG’s OLED TVs.

Source: DSCC

Source: DSCC

Source: DSCC

Source: DSCC

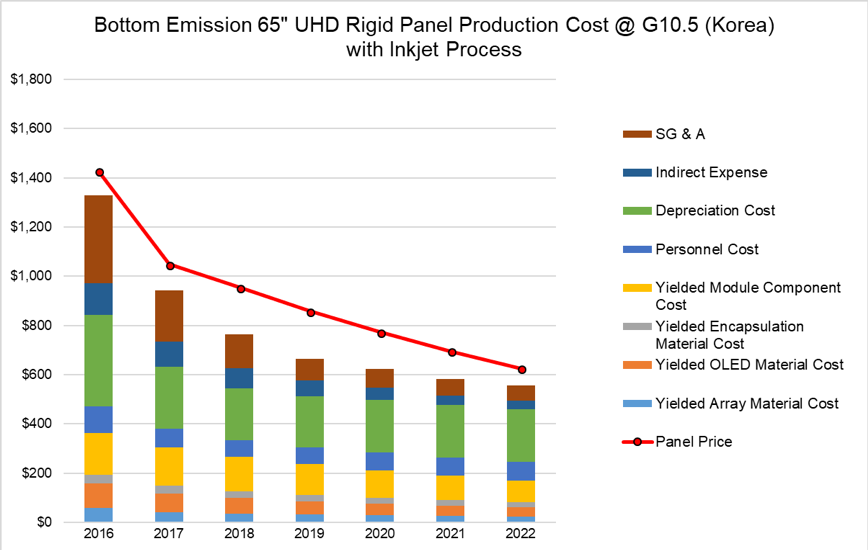

One of the most critical developments to reduce the cost of OLED TV is shifting from the current WOLED product architecture to an RGB OLED using inkjet printing. DSCC’s report quantifies the cost benefits of shifting to inkjet printing primarily through lower OLED material costs, as shown in the chart below.

Source: DSCC

Source: DSCC

The report also shows why it will be challenging for OLED TV to grow beyond being a niche at the top-end of the TV market. Although the performance of OLED TV allows it to capture an increasing portion of the premium TV space, the costs of making these panels, and especially the large cost delta with high-end LCD products, will make it very challenging to turn a profit on the OLED TV panel business.