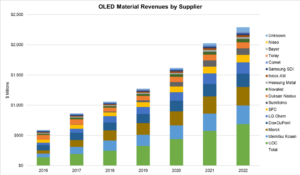

Sales for OLED stack materials are expected to grow at a 22% annual CAGR from $864 million in 2017 to $2.29 billion in 2022, according to DSCC.

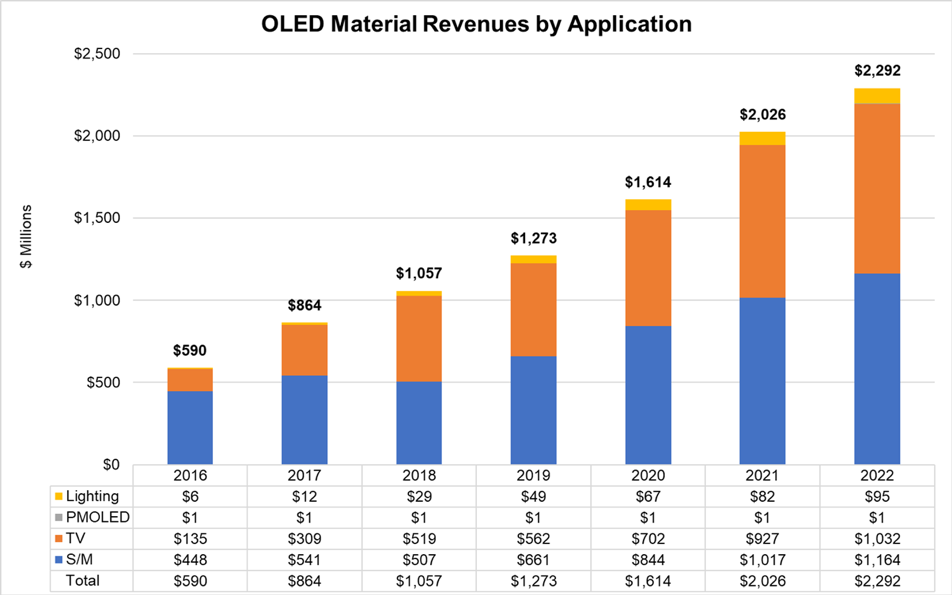

The company’s latest report includes a revised outlook of OLED input area, based on reductions in small and medium smartphone OLED manufacturing and offset by increases in investment plans by LG for larger-size OLED manufacturing.

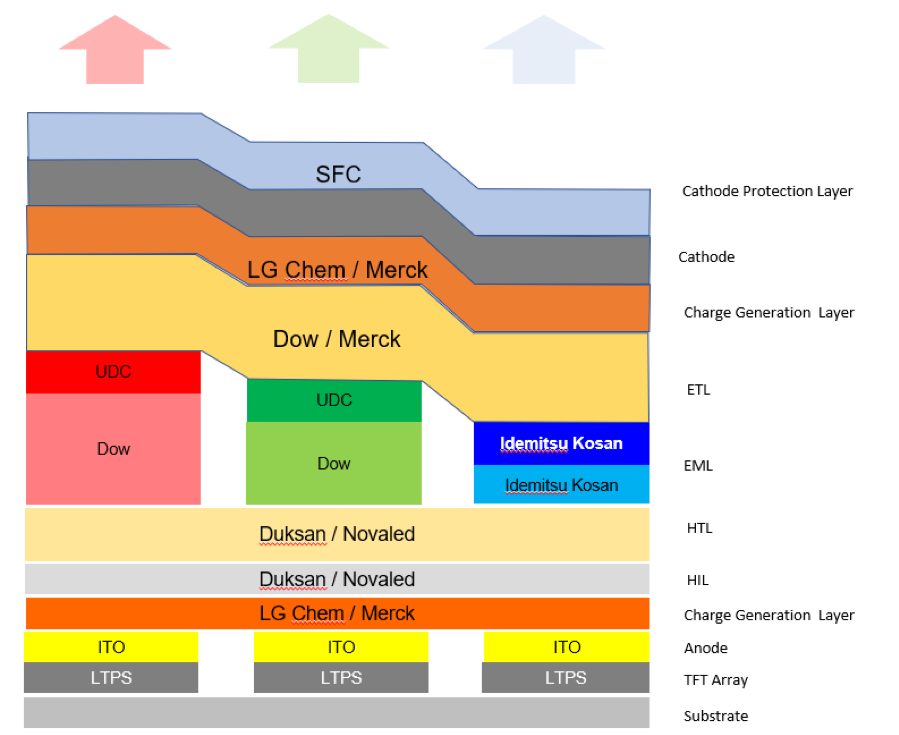

The update also includes a revised stack profile for small and medium OLEDs, revising layer thickness based on the newest profile used in the Galaxy S9 series, as Samsung has worked to reduce the amount of material used. The stack profile and report now include the use of a cathode protection layer (CPL) on most product architectures.

Source: DSCC

Source: DSCC

Sales of OLED materials for TV and other large-screen applications will exceed sales for small and medium applications (primarily mobile smartphones) in 2018, as TV input area has increased rapidly while small and medium input area has dialed back growth in 2018. With the reduced stack profile used by Samsung, combined with only 16% growth in input area and combined with material price declines, material sales for small and medium applications will decline by 7% in 2018, before resuming growth in 2019.

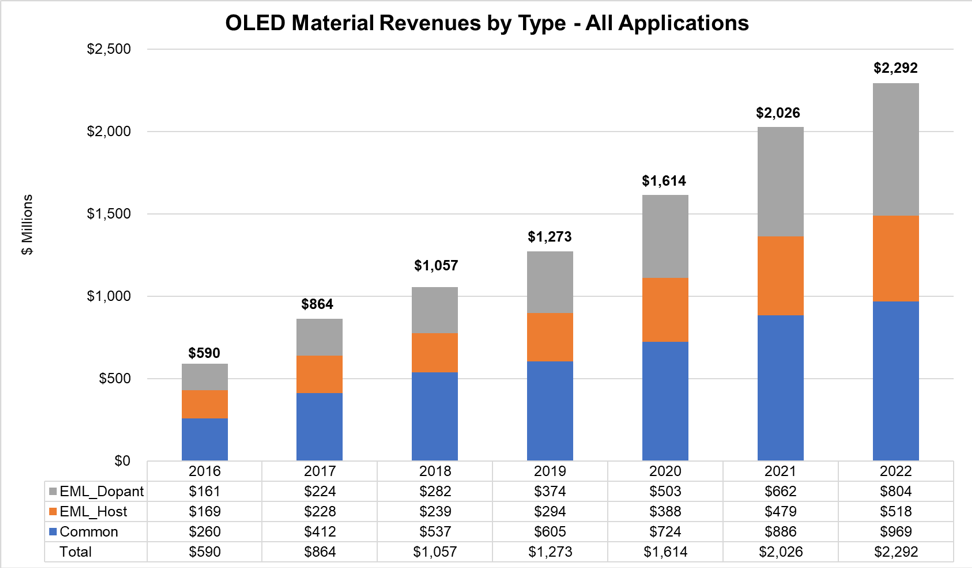

Red and green phosphorescent dopant materials from UDC saw 16% growth in 2018, matching input area growth. In 2019, DSCC predicts 39% growth. While common materials (which include electron/hole injection and transport layer materials) represent the largest category of sales in 2017, the growth of emitting layer dopants will increase the fastest over the next five years, growing at 29% annually from $224 million to $804 million.

Source: DSCC

Source: DSCC

Among material suppliers, Universal Display is expected to remain the largest supplier of OLED materials on a revenue basis, as they maintain their dominant position selling red and green dopant materials for the emitting layer. The report doesn’t assume that UDC captures the market with a phosphorescent blue emitter.

This would represent a substantial upside to the forecast, not only for UDC because of additional sales, but for the whole industry as an efficient blue emitter would enable higher-performance and lower-cost OLED. Merck, Dow Dupont and Idemitsu Kosan will continue to hold second, third and fourth positions among OLED material suppliers through 2022.

Source: DSCC

Source: DSCC

In the display industry, materials sales have often been the most profitable segment, as they are typically associated with high barriers to entry from intellectual property and technological prowess, analysts said. The OLED materials industry can expect robust growth as OLED displays continue to penetrate more applications.

Source: DSCC