Jon Peddie Research has published its results for Q2’17 GPU shipments world-wide.

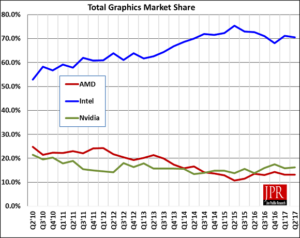

Up to now, the GPU and PC market had been showing a return to what has been normal seasonality. The typical pattern is flat to down in Q1, a significant drop in Q2 as OEMs and the channel deplete inventory before the summer months. A restocking with the latest products in Q3 in anticipation of the holiday season usually happens and with a mild increase to flat change in Q4. All, of that is subject to an overall decline in the PC market since the great recession of ’07 and the influx of tablets and smartphones. However, this year, Q2 dGPU shipments were completely out of synch, and remarkably high, as shown in the following chart.

Figure 1: Quarter-to-quarter shipments of discrete GPUs

Figure 1: Quarter-to-quarter shipments of discrete GPUs

As the chart shows, this is the first time in over 20 years that Q2 has seen an increase in shipments, and never one this dramatic.

The big difference is the impact Bitcoin, Ethereum and other coin miners are having on the market.

Why Ethereum? There was a similar uptick in GPU sales for Bitcoin and Litcoin mining 2013. It drove up sales of GPUs and especially AMD GPUs because AMD’s GCN architecture favored mining. Low cost Figure 1: Quarter-to-quarter shipments of discrete GPUs ASICs were then employed to do the job and that boom went bust, much to the relief of gamers looking for better deals on GPUs. Bitcoin miners who had built large GPU structures for mining, dumped their AIBs on eBay, cannibalizing the GPU market for a couple of quarters. Due to the architecture of Ethereum, that won’t happen this time.,

Ethereum uses a different hashing algorithm to Bitcoin, which makes it incompatible with the special hashing hardware, ASICs, developed for Bitcoin mining. Ethereum’s algorithm is known as Ethash. It’s a memory-hard algorithm; meaning it’s designed to resist the development of Ethereum-mining ASICs. Instead, Ethash is deliberately best-suited to GPU-mining.

As long as Bitcoin process keep going up, new people will be attracted to the mining market. It will eventually flatten out because the ROI just won’t be there. At that point AIB sales for mining will roll off, and we may even see some dumping by the marginal players/miners. And there still is the social issue of what kinds of transactions the miners are verifying.

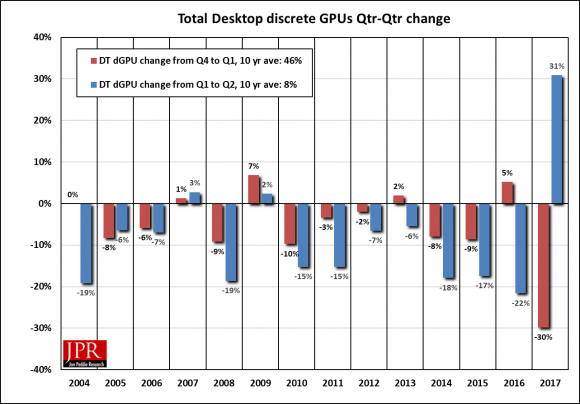

Overall GPU shipments increased 7.2% from last quarter: AMD increased 8%, Nvidia increased by 10% and Intel increased by 6%.

Year-to-year total GPU shipments increased 6.4%, desktop graphics increased 5% and notebooks increased 7%.

After years of incursion into the discrete GPU market, it appears the discrete GPUs (dGPU) are gaining market share over iGPUs. The long-term CAGR has been positive, while iGPUs have been negative.

However, some of the increase in dGPU sales has to be attributed to the blockchain mining demand for GPUs. The continued decline in the overall PC market shows up in the integrated GPU shipment numbers.

Quick highlights

- AMD’s overall unit shipments increased 7.81% quarter-to-quarter, Intel’s total shipments increased 6.31% from last quarter, and Nvidia’s increased 10.42%.

- The attach rate of GPUs (includes integrated and discrete GPUs) to PCs for the quarter was 146% which was up 9.57% from last quarter.

- Discrete GPUs were in 35.38% of PCs, which is up 4.02%.

- The overall PC market saw an increase of 0.12% quarter-to-quarter, and a decrease of -3.98% year-to-year.

- Desktop graphics add-in boards (AIBs) that use discrete GPUs increased 30.88% from last quarter.

- Q2’17 saw a decrease in tablet shipments from last quarter.

GPUs are traditionally a leading indicator of the market, since a GPU goes into every system before it is shipped, and most of the PC vendors are guiding cautiously for Q4’14. The Gaming PC segment, where higher-end GPUs are used, was a bright spot in the market in the quarter.

The quarter in general

- AMD’s shipments of desktop heterogeneous GPU/CPUs, i.e., APUs, for desktops decreased -22.2% from the previous quarter. AMD’s APU shipments were down -18.8% in notebooks. Desktop discrete GPUs decreased -34.6% from last quarter, and notebook discrete shipments decreased -16.0%. AMD’s total PC graphics shipments decreased -24.8% from the previous quarter.

- Intel’s desktop processor embedded graphics (EPGs) shipments decreased from last quarter by -10.5% and notebook processors decreased by -8.0%, and total PC graphics shipments decreased -13.9% from last quarter.

- Nvidia’s desktop discrete GPU shipments were down -27.8% from last quarter; and the company’s notebook discrete GPU shipments decreased -23.0%, and total PC graphics shipments decreased -25.6% from last quarter.

Total discrete GPUs (desktop and notebook) shipments for the industry decreased -25.5% from the last quarter, and decreased -6.0% from last year. Sales of discrete GPUs fluctuate due to a variety of factors (timing, memory pricing, etc.), new product introductions, and the influence of integrated graphics. Overall, the CAGR from 2014 to 2017 is now -9%.

Ninety nine percent of Intel’s non-server processors have graphics, and over 66% of AMD’s non-server processors contain integrated graphics; AMD still ships integrated graphics chipsets (IGPs).