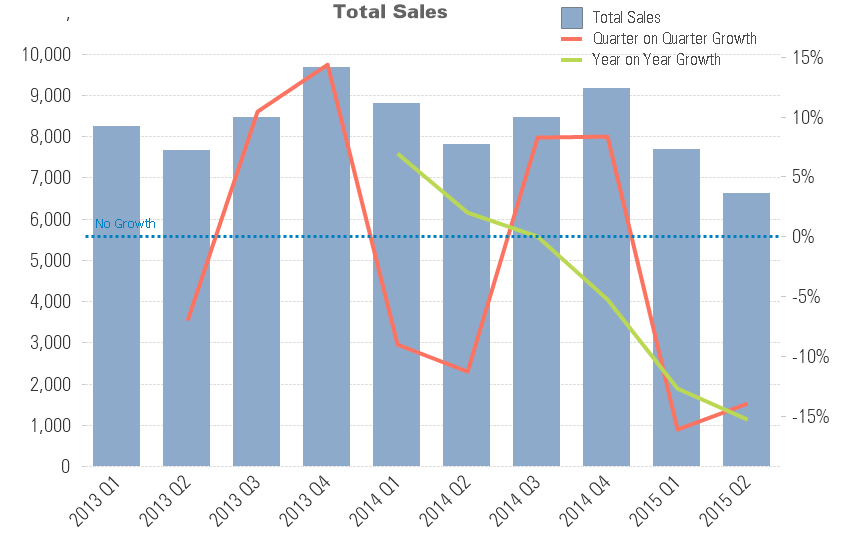

The Desktop Monitor market in Europe was down in Q2 with sales down 14% on last year as the market in Russia failed to recover after a terrible Q1. Germany was also down and as a result, Meko reported the lowest sales for the first half of the year since it started tracking the market in 2000. Sales were 6.6 million in Q2 – very close to the lowest every recorded over the period. For the first half, sales were 14.3 million – less than half the peak sales of 31.7 million in 2006.

“Russia has often had bad quarters and has always been a volatile market, but usually a very bad quarter is followed by some recovery. However, the economic situation in Russia is so bad that sales have seen record low levels for two consecutive quarters”, said Bob Raikes, principal analyst at Meko. “Sales were just over three quarters of a million units in the first half of 2015 – the lowest we’ve recorded before that in the last 13 years was almost 1.5 million”.

“The market was not helped by difficult sales in Western Europe. German buyers are very disciplined and reacted badly to the price increases that vendors have been forced to introduce to deal with the Euro depreciation”, Raikes continued. “Buyers have deferred their purchase plans and that has hit the market”.

As a result of the Euro problems, the market in Western Europe was down by 16% from Q1. There was no help from the Middle East Africa region which saw sales down 24% compared to the first half of 2014 as low oil prices and political problems hit demand.

Those that were buying wanted good products and L24H became the highest selling segment for the first time. Samsung remains the brand with the top share, but only just ahead of Dell and HP.