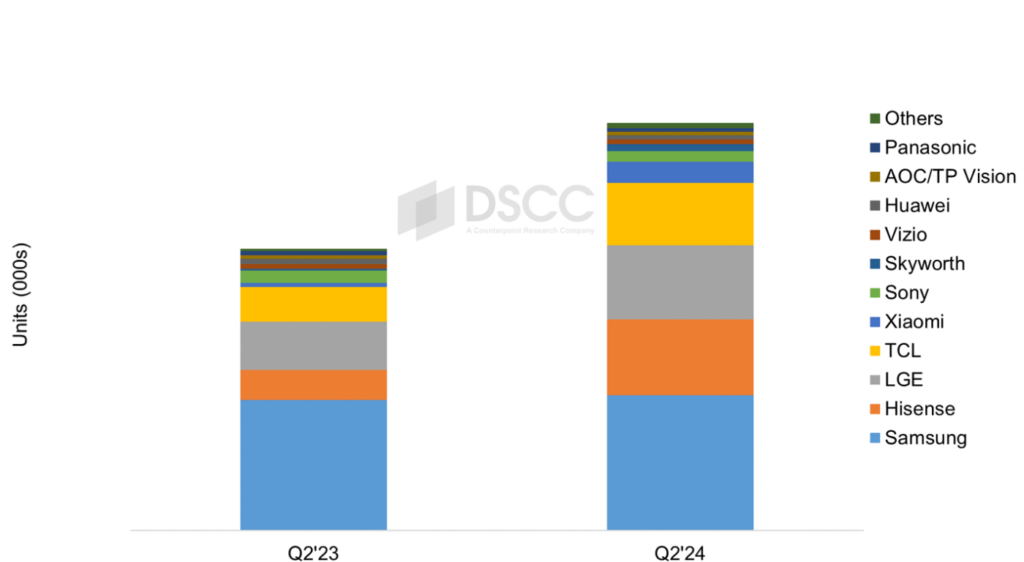

A lot of new data just came out on the state of the TV market. After three straight quarters of decline, the global TV market made a comeback in Q2 2024, with shipments up 3% YoY. That’s according to new data out of DSCC. The analysts say this boost was largely based on strong demand in the more monied economical regions gearing up for major sporting events like the Olympics, although the Chinese market, the world’s third largest, continued to struggle.

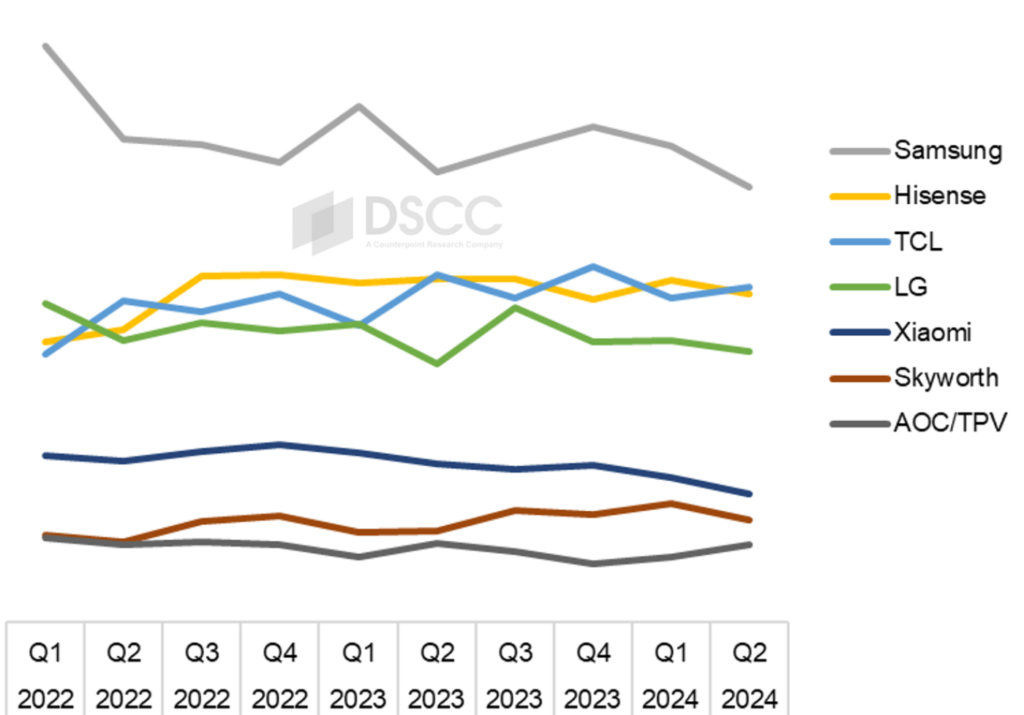

Samsung held onto to top spot but its market share dip to its lowest level since at least 2021. Samsung’s shipments were flat YoY at 8.2 million units but the overall growth in the market meant its share dropped from 15.1% in Q2 2023 to 14.6% in Q2 2024.

North America, Western Europe, and Eastern Europe all saw double-digit YoY growth. North America and Western Europe posted 14% gains, while Eastern Europe jumped 15% YoY. China saw a steep 21% YoY drop in shipments, marking its fourth straight quarter of decline and the third with double-digit losses.

Competition for the number 2 spot in the global TV market remains tight, with Hisense, TCL, and LG all in the mix. Over the past year, LG has fallen behind its Chinese rivals, Hisense and TCL, who have traded places in the rankings over the last five quarters. In Q2 2024, TCL took the number 2 spot, with Hisense close behind at number 3.

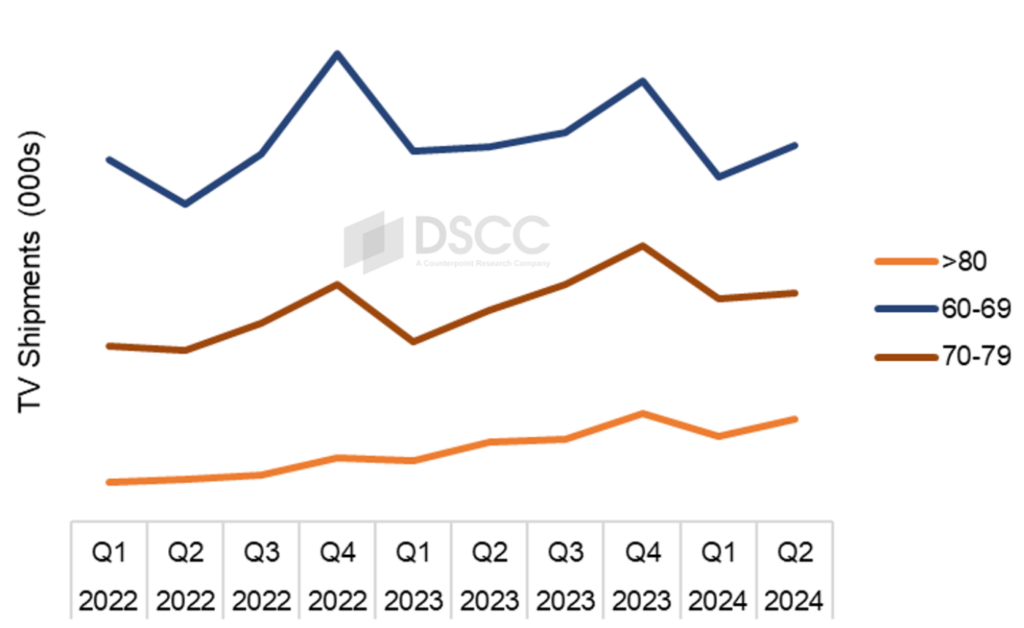

The data also points to a growing preference for larger TVs. While shipments of TVs under 40 inches dropped 7% YoY, bigger screens are on the rise. The 60-69 inch category saw a small 1% increase YoY, but the 70-79 inch range grew by 8%, and TVs 80 inches and up surged 29% YoY.

Looking at the advanced TV market, DSCC offers up some more detail on trends that suggest we are likely to see even more shifts in the balance of power at the top of the rankings. This segment saw a significant surge in Q2 2024, outpacing the broader rebound in the global TV market. Shipments skyrocketed by 44% compared to last year, with revenue climbing 28% YoY. The changes in this market, and the impact being made by Chinese manufacturers suggest that we may see even more fluctuations in market share over the coming year.

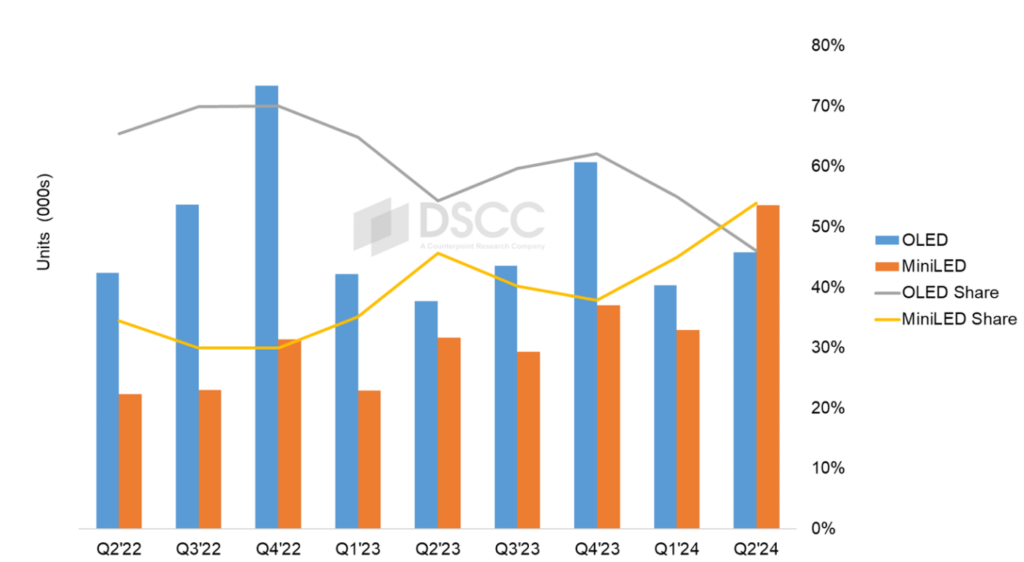

For the first time MiniLED TVs outpaced OLED TVs in both shipment volume and revenue, grabbing more than half of the market share in the high-end segment. This was thanks to Chinese brands TCL and Hisense making impressive gains in market share. Xiaomi also shook things up by overtaking Sony to snag the fifth spot in the rankings.

TCL and Hisense’s did with it aggressive pricing and effective promotion of MiniLED LCD TVs. TCL, which pioneered the MiniLED category back in 2019, reclaimed its leadership position. Samsung, however, which had been the dominant force in this sector, saw its MiniLED TV shipments drop by 19% YoY, leading to a dip in its market share.

As a result, advanced LCD TV shipments surged by 52% YoY, easily outpacing the 21% growth in OLED TV shipments. The revenue boost for advanced TVs marked the second straight quarter of growth, following a rough patch in 2022 and 2023. While OLED revenues inched up by 5%, advanced LCD TVs saw a big 41% jump in revenue with higher unit sales and a richer product mix, even as prices fell.

Samsung managed to stay on top in both units and revenue, but it wasn’t without challenges. The company’s overall revenue took a hit, dropping 13%, with its MiniLED segment dragging it down. On the flip side, Hisense had stellar performance, with shipments soaring 157% and revenue up 128%, netting the company the second spot in the rankings.

TCL continued its rise, holding onto the fourth position but closing the gap with Samsung in MiniLEDs. TCL’s shipments shot up by 78%, with revenue jumping 81%, and there’s probably more growth there for company as it builds on its momentum. Xiaomi made a dramatic entrance into the top five, with an eye-popping 433% increase in shipments and a 713% surge in revenue. For Sony the intense competition meant that it had the toughest quarter of all the major brands with declining shipments and revenue causing it to drop out of the top five.

It seems like the Chinese manufacturers are fueling the growth of larger format TVs with aggressive pricing and product tactics that leverage the distinct price advantage that MinLED TVs have over OLED which is good news for consumers. If you are going to spend your money on a TV then a size for buck strategy seems to be working better than a bang for buck strategy which may be why we may continue to see further erosion of OLED market share. Although it has to be said that OLED TVs are probably benefiting by showing some growth riding in the wake of MiniLED’s momentum.

Samsung still dominates, and LG is holding its own, but seeing Sony drop out of the top five should be a concern for both because TCL and Hisense seem to be negating the long-term brand value of their competitors and finding their footing globally. The Chinese manufacturers appear to be in the driving seat and it is hard to see how they are going to be stopped if they continue at this pace. It’s pretty astonishing to see their growth rates as compared to the overall growth of the global TV market, and that of the established Korean players.