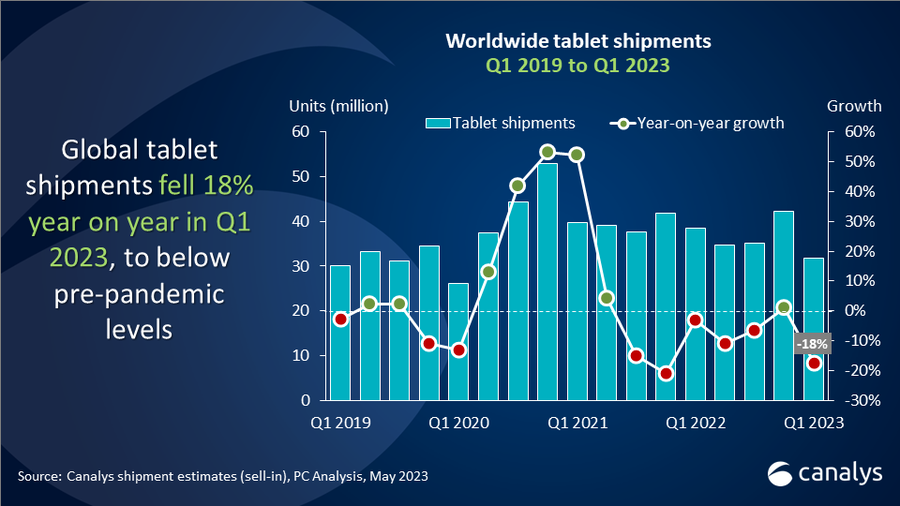

Global tablet shipments experienced an 18% year-on-year decline in Q1’23, reaching only 31.7 million units, according to the latest Canalys data. This marks the lowest number of shipments since the COVID-19 pandemic began in Q1’20 when supply and distribution were heavily disrupted. Despite this, vendors are expected to benefit from opportunities in the premium consumer segment and increased deployments in commercial and education sectors.

Q1’23 saw a significant drop in shipments, following a quarter with 1% growth due to strong promotional activity. Himani Mukka, Research Manager at Canalys, attributes the decline to reduced consumer spending amidst high inflation and a structural correction as the pandemic-driven demand drivers subside. Tablet vendors and retailers are now focusing on managing high inventory levels and recalibrating their expectations for more modest demand.

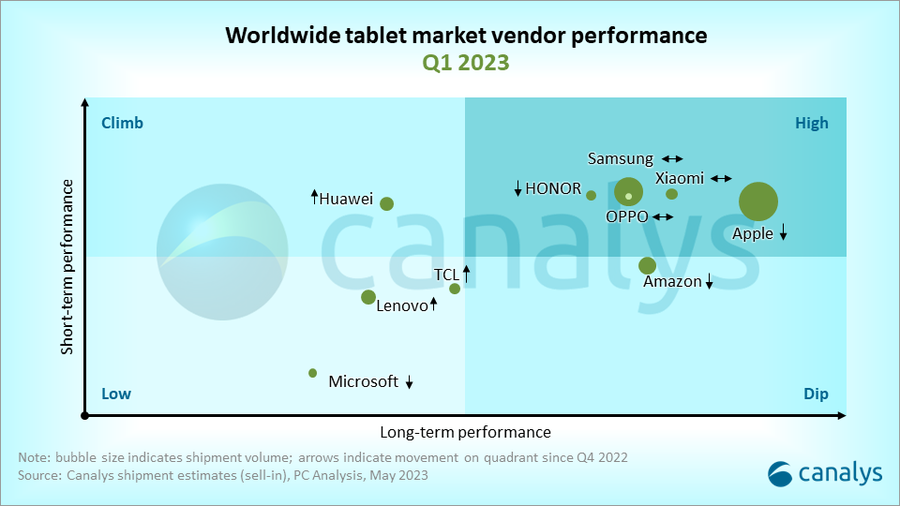

Mukka emphasizes the importance of premium user experiences, chipset innovation, better displays, and improved productivity functions in future tablet upgrades. She also highlights the success of Huawei, Oppo, and Xiaomi in pursuing a strategy that reinforces the significance of tablets within a device ecosystem, particularly in the context of hybrid work styles.

In addition to the consumer segment, tablet vendors are expected to find growth opportunities in commercial and education deployments. Although procurement from businesses and the public sector has stagnated due to economic challenges, budgets are anticipated to recover. The demand for tablets in Asian education markets and the digitalization of industries like healthcare and manufacturing are also expected to boost demand.

Tablet shipments are projected to gradually recover in the second half of 2023 and accelerate in 2024, maintaining numbers above pre-pandemic levels. In Q1’23, Apple led the worldwide tablet market with 12.4 million units shipped, albeit a 17% YoY decline. Samsung ranked second with 6.7 million units, marking a 14% decline. Amazon secured third place with 2.5 million units, a 30% YoY drop. Lenovo and Huawei took fourth and fifth places, shipping 1.9 million and 1.5 million units, respectively. Lenovo saw the largest decline among the top five vendors, with tablet shipments down 37%, while Huawei experienced a modest 4% decline, driven by strong demand in China.