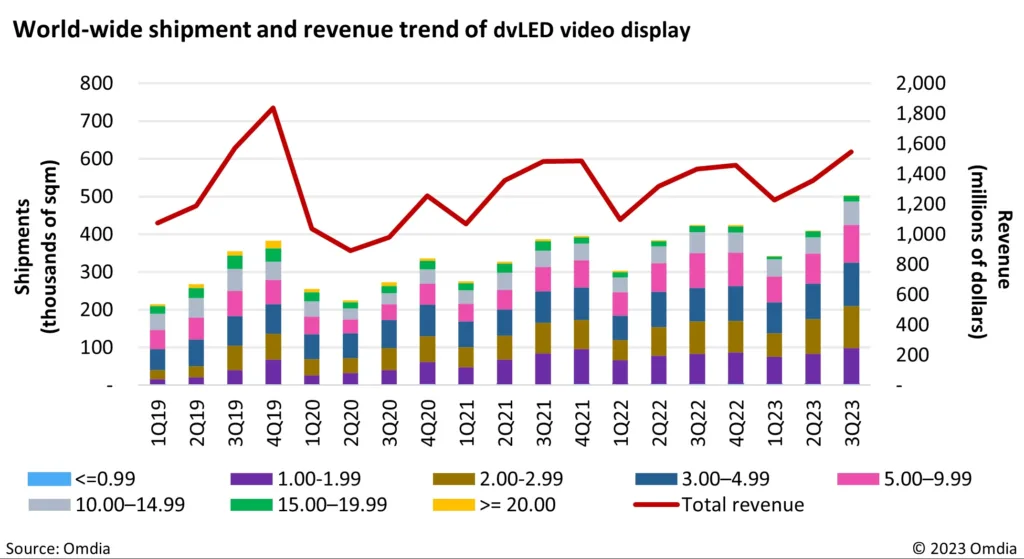

The direct view LED (dvLED) display market continues to expand globally, according to new data from market research firm Omdia. In the third quarter of 2023, global shipments grew 23.1% from the previous quarter and 18.5% year-over-year. However, inflationary pressures have impacted revenue growth, which was up just 13.9% quarterly and 7.7% annually.

“End-users and system integrators affected by inflationary pressures downgraded their choices to cheaper products in their class, or chose wider pixel pitch products at a lower price, while compromising on achieving higher resolution,” explained Tay Kim, Senior Principal Analyst at Omdia.

Growth trends varied by region. China rebounded strongly this year after negative growth in late 2022 amid zero-COVID policies, with Q3 shipments up 23.4% quarterly and 23.6% annually. Europe saw a 2.1% annual decline due to high inflation levels and low price competitiveness against LCDs. North America was more resilient with 15.7% annual growth thanks to currency advantages. The Asia Pacific market was boosted by rising demand in India, resulting in 20.5% yearly growth.

Sales of LED video displays using COB (chip-on-board) technology are accelerating as Chinese OEM brands have improved COB production capacity and major brands now offer COB products. COB quality exceeds SMD displays in uniformity, durability, heat, and power use. Prices are also becoming more competitive with SMD. In Q3, COB shipments rose 31.2% annually versus 17.9% growth for SMD.

Shipments of all-in-one direct view LEDs grew 57.4% YoY as they offer larger sizes than LCDs for conference rooms and other settings. As LED display pricing becomes more competitive overall, analysts expect strong continued expansion versus LCDs.