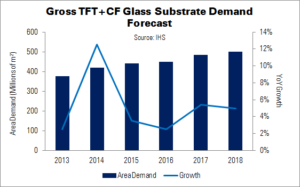

Unit demand for large-area LCD glass – i.e., that used for TVs, desktop monitors and similar applications – will fall this year, says IHS. However, area demand will continue to rise, due to increasing average screen sizes. Total LCD glass capacity is now matching area glass demand.

IHS forecasts area demand for glass to rise at a CAGR of 13% between 2015 and 2018. This year, average LCD TV screen size is expected to rise from 39.3″ to 40.8″.

“Because manufacturing LCD glass requires special tanks for the LCD substrates used in processing, the manufacturing cost of LCD glass is higher than for other materials, and tank investment can be a risky proposition for glass makers”, said IHS’ Tadashi Uno. “For these reasons, LCD glass manufacturers are looking to increase the capacity of existing tanks, rather than making additional investments in new tanks.”

Module price reductions are affecting LCD panel makers as competition intensifies, leading to falling profits. As this happens, major large panel makers are putting pressure on vendors to lower the costs of materials and other components. In addition, they are trying to save on glass costs by producing thinner glass.

Between 2012 and 2014, major panel makers transitioned from a 0.7mm-thick substrate to 0.5mm, and are now aiming to reach 0.4mm. Samsung was the first to start these efforts, but other vendors are expected to follow.