Global sales of smartphones to end users totalled 383 million units in the third quarter of 2017, a 3% increase over the same period in 2016, according to Gartner. All of the top five smartphone vendors achieved double-digit growth apart from Apple, which achieved a 5.7% increase. Anshul Gupta, research director at Gartner, said:

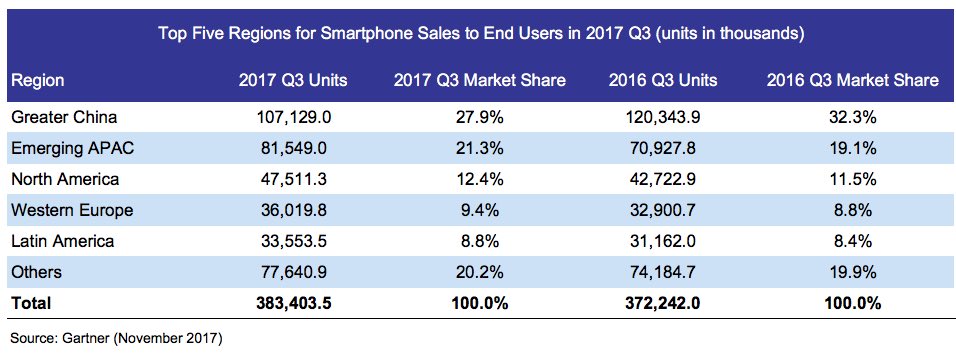

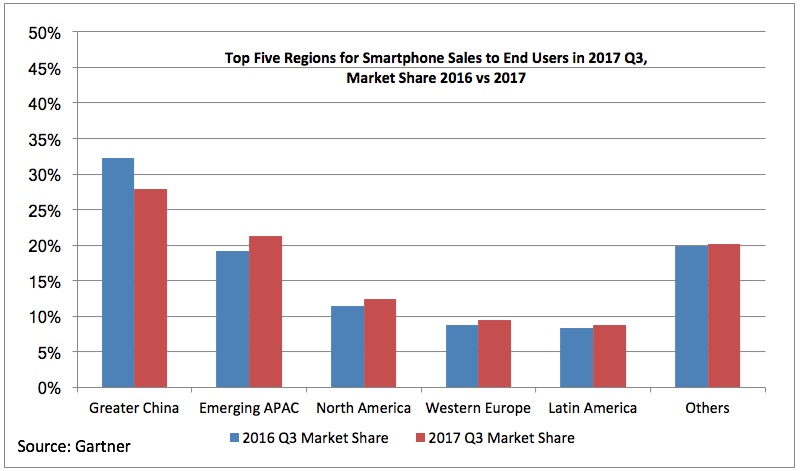

“Despite market weakness in China, sales of smartphones rose in the third quarter of 2017. Emerging Asia/Pacific and North America drove the smartphone growth in the quarter.

In emerging Asia Pacific, both Samsung and Huawei saw healthy demand as along with Xiaomi and Vivo, which were able to grow their footprint outside their home markets In North America, Samsung was the driving force in the quarter due to its new flagship products”.

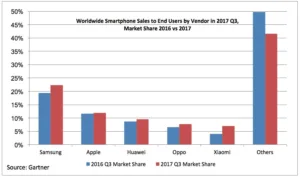

Samsung’s smartphone sales recorded a double-digit increase in the third quarter of 2017.

“Renewed pushes of the newly designed Galaxy S8, S8+ and Note 8 smartphones have brought back growing demand for Samsung smartphones, which helped it compete against Chinese manufacturers and deliver a solid performance in the quarter. The last time Samsung achieved a double-digit growth was in the fourth quarter of 2015.”

Apple’s sales grew 5.7% year-on-year. Apple returned to growth in China and also saw strong sales in many of the emerging markets, including India. This is due to the continued sales of legacy iPhones, including the iPhone 5S which retails at around $240 street price in most markets.

Xiaomi achieved the strongest growth, exhibiting an 80% increase in the third quarter of 2017. Xiaomi’s growth came more from international markets than from China, where it faces strong competition from Huawei, Oppo and Vivo. India continues to be the biggest and highest-growth market for Xiaomi outside China, but growing sales from Latin America and Russia are also boosting its sales.

Greater China exhibited a decline of 11% in the third quarter due to consolidation around local and lesser-known brands (see Table 2). Buyers are preferring known and high-priced smartphones, which is cannibalizing demand of budget smartphones from local brands. In Western Europe and North America, demand for premium smartphones from top brands led to smartphone sales growth in the third quarter.

Leading Chinese manufacturers Oppo, Huawei, Vivo and Xiaomi continued to drive sales across emerging markets, led by their mid-price and budget smartphones, with a focus on 4G connectivity and better cameras. Gupta concluded:

“The arrival of Apple’s new flagship iPhones at the end of the third quarter of 2017 has delayed smartphone purchases into the fourth quarter of 2017. Following compelling offers on Black Friday and Cyber Monday, the holiday season will likely boost sales of smartphones before the end of the year.

We estimate the fourth quarter’s smartphone sales will boost total sales for the full year. We expect smartphone sales will reach 1.57 billion units in 2017″.